Sallie Mae 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

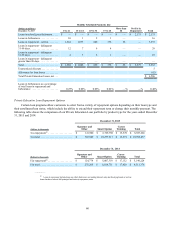

Contractual Loan Commitments

When we approve a Private Education Loan at the beginning of an academic year, that approval may cover the borrowing

for the entire academic year. As such, we do not always disburse the full amount of the loan at the time of origination, but

instead have a commitment to fund a portion of the loan at a later date (usually at the start of the second semester or subsequent

trimesters). At December 31, 2015, we had $1.5 billion of outstanding contractual loan commitments which we expect to fund

during the remainder of the 2015/2016 academic year. At December 31, 2015, we had a $2 million reserve recorded in “Other

Liabilities” to cover expected losses that may occur during the one-year loss emergence period on these unfunded

commitments.

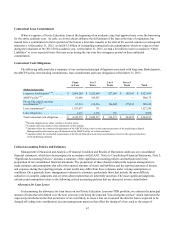

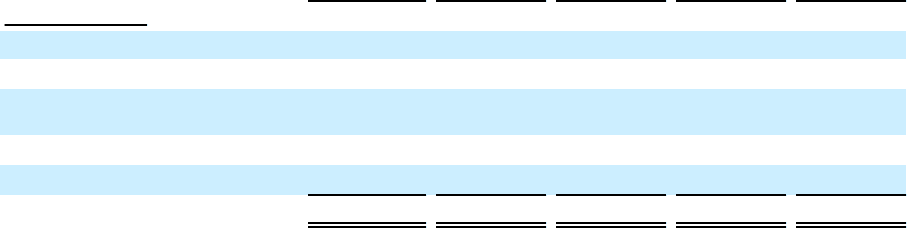

Contractual Cash Obligations

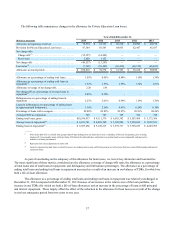

The following table provides a summary of our contractual principal obligations associated with long-term Bank deposits,

the ABCP Facility, term funding commitments, loan commitments and lease obligations at December 31, 2015.

1 Year

or Less 1 to 3

Years 3 to 5

Years Over 5

Years Total

(Dollars in thousands)

Long-term bank deposits(1)(2) . . . . . . . . . $ 2,668,240 $ 2,262,669 827,063 $ 165,047 $ 5,923,019

ABCP Facility(1)(3) . . . . . . . . . . . . . . . . . 81,608 418,567 — — 500,175

Private Education Loan term

securitizations(1)(4) . . . . . . . . . . . . . . . . . 67,214 136,236 106,442 279,032 588,924

Loan commitments(1) . . . . . . . . . . . . . . . 1,527,077 171 — — 1,527,248

Lease obligations . . . . . . . . . . . . . . . . . . 1,433 2,630 766 — 4,829

Total contractual cash obligations . . . . . $ 4,345,572 $ 2,820,273 $ 934,271 $ 444,079 $ 8,544,195

____

(1) Interest obligations are either variable or fixed in nature.

(2) Excludes derivative market value adjustments of $8.4 million.

(3) Amounts reflect the contractual requirements of the ABCP Facility, based on the expected paydown of the underlying collateral.

Management has the intent to pay off advances on the ABCP Facility on a short term basis.

(4) Amounts reflect the contractual requirements of the Private Education Loan term securitizations, based on the expected paydown

of the underlying collateral.

Critical Accounting Policies and Estimates

Management’s Discussion and Analysis of Financial Condition and Results of Operations addresses our consolidated

financial statements, which have been prepared in accordance with GAAP. Notes to Consolidated Financial Statements, Note 2,

“Significant Accounting Policies” includes a summary of the significant accounting policies and methods used in the

preparation of our consolidated financial statements. The preparation of these financial statements requires management to

make estimates and assumptions that affect the reported amounts of assets and liabilities and the reported amounts of income

and expenses during the reporting periods. Actual results may differ from these estimates under varying assumptions or

conditions. On a quarterly basis, management evaluates its estimates, particularly those that include the most difficult,

subjective or complex judgments and are often about matters that are inherently uncertain. The most significant judgments,

estimates and assumptions relate to the following critical accounting policies that are discussed in more detail below.

Allowance for Loan Losses

In determining the allowance for loan losses on our Private Education Loan non-TDR portfolio, we estimate the principal

amount of loans that will default over the next year (one year being the expected "loss emergence period," which represents the

expected period between the first occurrence of an event likely to cause a loss on a loan and the date the loan is expected to be

charged off, taking into consideration account management practices that affect the timing of a loss, such as the usage of