Sallie Mae 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19

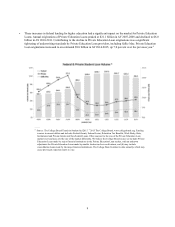

Access to alternative means of financing the costs of education and other factors may reduce demand for Private Education

Loans, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

The demand for Private Education Loans could weaken if families and student borrowers use other vehicles to bridge the

gap between available funds and costs of post-secondary education. These vehicles include, among others:

• Home equity loans or other borrowings available to families to finance their education costs;

• Pre-paid tuition plans, which allow students to pay tuition at today’s rates to cover tuition costs in the future;

• Section 529 plans, which include both pre-paid tuition plans and college savings plans that allow a family to save

funds on a tax-advantaged basis;

• Education IRAs, now known as Coverdell Education Savings Accounts, under which a holder can make annual

contributions for education savings;

• Government education loan programs such as the DSLP; and

• Direct loans from colleges and universities.

In addition, our ability to grow Private Education Loan originations could be negatively affected if

• demographic trends in the United States result in a decrease in college-age individuals,

• demand for higher education decreases,

• the cost of attendance of higher education decreases, or

• public resistance to increasing higher education costs strengthens.

We are dependent on key personnel and the loss of one or more of those key personnel could harm our business.

Our future success depends significantly on the continued services and performance of our management team. We believe

our management team’s depth and breadth of experience in our industry is integral to executing our business plan. We also will

need to continue to attract, motivate and retain other key personnel. The loss of the services of members of our management

team or other key personnel to our competitors or other companies or the inability to attract additional qualified personnel as

needed could have a material adverse effect on our business, financial position, results of operations and cash flows.

Regulatory

Failure to comply with consumer protection laws could subject us to civil and criminal penalties or litigation, including

class actions, and have a material adverse effect on our business.

We are subject to a broad range of federal and state consumer protection laws applicable to our Private Education Loan

lending and retail banking activities, including laws governing fair lending, unfair, deceptive and abusive acts and practices,

service member protections, interest rates and loan fees, disclosures of loan terms, marketing, servicing and collections.

Violations of, or changes in, federal or state consumer protection laws or related regulations, or in the prevailing

interpretations thereof, may expose us to litigation, administrative fines, penalties and restitution, result in greater compliance

costs, constrain the marketing of Private Education Loans, adversely affect the collection of balances due on the loan assets

held by us or by securitization trusts or otherwise adversely affect our business. We could incur substantial additional expense

complying with these requirements and may be required to create new processes and information systems. Moreover, changes

in federal or state consumer protection laws and related regulations, or in the prevailing interpretations thereof, could invalidate

or call into question the legality of certain of our services and business practices.

For example, the Bank is currently subject to the FDIC Consent Order and the DOJ Consent Order. Specifically, on May

13, 2014, the Bank reached settlements with the FDIC and the DOJ regarding disclosures and assessments of certain late fees,

as well as compliance with the SCRA.

Effective January 1, 2015, the CFPB became the Bank’s primary consumer compliance supervisor, with consumer

compliance examination authority and primary consumer compliance enforcement authority. CFPB jurisdiction could result in

additional regulation and supervision, which could increase our costs and limit our ability to pursue business opportunities.