Sallie Mae 2015 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257

|

|

8

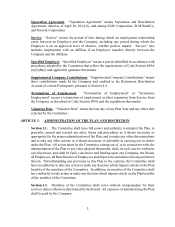

14. MISCELLANEOUS

14.1. Facility of Payment. If it will be found that (a) a person entitled to receive any

payment under the Plan is physically or mentally incompetent to receive such payment and to give

a valid release therefore, and (b) another person or an institution is then maintaining or has custody

of such person, and no guardian, administrator, or other representative of the estate of such person

has been duly appointed by a court of competent jurisdiction, the payment may be made to such

other person or institution referred to in (b) above, and the release of such other person or institution

will be a valid and complete discharge for the payment.

14.2. Notice of Address. Each person entitled to benefits under the Plan must file with

the Administrator, in writing, his mailing address and each change of mailing address. Any

communication, statement, or notice addressed to such person at such address will be deemed

sufficient for all purposes of the Plan, and there will be no obligation on the part of the Corporation

or the Administrator to search for or to ascertain the location of such person.

14.3. Data. Each person entitled to benefits under the Plan must furnish to the

Administrator such documents, evidence, or other information as the Administrator considers

necessary or desirable for the purposes of administering the Plan or to protect the Plan. The

Administrator will be entitled to rely on representations made by Participants, spouses and

beneficiaries with respect to age, marital status and other personal facts, unless it knows said

representations are false.

14.4. Tax Determinations. Notwithstanding any other provision to the contrary herein, in

the event of a determination, as defined in section 1313(a) of the Internal Revenue Code, that any

Participant is subject to Federal income taxation on amounts deferred under this Plan, the amounts

that are includable in the Participant’s federal gross income will be distributed to such Participant

upon the receipt by the Corporation of notice of such determination. Subject to the requirements

of Code Section 409A and any guidance issued thereunder, the Corporation may make such

provisions and take such action as it may deem necessary or appropriate for the withholding of any

taxes which the Corporation is required by any law or regulation of any governmental authority,

whether Federal, state or local, to withhold in connection with any benefits under the Supplemental

Savings Plan, including, but not limited to, the withholding of appropriate sums from any amount

otherwise payable to the Participant (or his beneficiary). Each Participant, however, shall be

responsible for the payment of all individual tax liabilities relating to any such benefits.

IN WITNESS WHEREOF, SLM Corporation has caused this Plan to be duly executed in

its name and on its behalf.

SLM Corporation

By:____________________________________