Sallie Mae 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

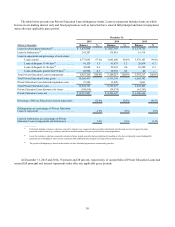

Regulatory Capital

The Bank is subject to various regulatory capital requirements administered by federal and state banking authorities.

Failure to meet minimum capital requirements can initiate certain mandatory and possibly additional discretionary actions by

regulators that, if undertaken, could have a direct material adverse effect on our business, results of operations and financial

condition. Under U.S. Basel III and the regulatory framework for prompt corrective action, the Bank must meet specific capital

standards that involve quantitative measures of its assets, liabilities and certain off-balance sheet items as calculated under

regulatory accounting practices. The Bank’s capital amounts and its classification under the prompt corrective action framework

are also subject to qualitative judgments by the regulators about components of capital, risk weightings and other factors.

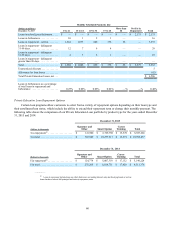

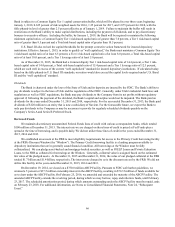

“Well capitalized” regulatory requirements are the quantitative measures established by regulation to ensure capital

adequacy. To qualify as “well capitalized,” the Bank must maintain minimum amounts and ratios (set forth in the table below)

of Common Equity Tier 1, Tier 1 and Total capital to risk-weighted assets and of Tier 1 capital to average assets. The following

capital amounts and ratios are based upon the Bank's assets.

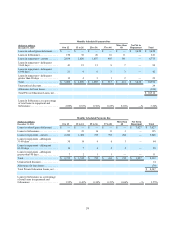

Actual "Well Capitalized"

Regulatory Requirements

(Dollars in thousands) Amount Ratio Amount Ratio

As of December 31, 2015:

Common Equity Tier 1 Capital (to Risk-Weighted

Assets) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,734,315 14.4% $ 781,638 > 6.5%

Tier 1 Capital (to Risk-Weighted Assets). . . . . . . . . . $ 1,734,315 14.4% $ 962,017 > 8.0%

Total Capital (to Risk-Weighted Assets). . . . . . . . . . $ 1,848,528 15.4% $ 1,202,521 > 10.0%

Tier 1 Capital (to Average Assets). . . . . . . . . . . . . . . $ 1,734,315 12.3% $ 704,979 > 5.0%

As of December 31, 2014:

Tier 1 Capital (to Risk-Weighted Assets). . . . . . . . . . $ 1,413,988 15.0% $ 565,148 > 6.0%

Total Capital (to Risk-Weighted Assets). . . . . . . . . . $ 1,497,830 15.9% $ 941,913 > 10.0%

Tier 1 Capital (to Average Assets). . . . . . . . . . . . . . . $ 1,413,988 11.5% $ 614,709 > 5.0%

Capital Management

The Bank seeks to remain “well capitalized” at all times with sufficient capital to support asset growth, operating needs,

unexpected credit risks and to protect the interests of depositors and the DIF. The Bank is required by its regulators, the UDFI

and the FDIC, to comply with mandated capital ratios. We intend to maintain levels of capital at the Bank that significantly

exceed the levels of capital necessary to be considered “well capitalized” by the FDIC. The Company is a source of strength

for the Bank and will provide additional capital if necessary. The Board of Directors and management periodically evaluate the

quality of assets, the stability of earnings, and the adequacy of the allowance for loan losses for the Bank. We currently believe

that current and projected capital levels are appropriate for 2016. As our balance sheet continues to grow in 2016, these ratios

will decline but will remain significantly in excess of the capital levels required to be considered “well capitalized” by our

regulators. We do not plan to pay dividends on our common stock. We do not intend to initiate share repurchase programs as a

means to return capital to shareholders. We only expect to repurchase common stock acquired in connection with taxes

withheld in connection with award exercises and vesting under our employee stock-based compensation plans. Our Board of

Directors will periodically reconsider these matters.

As of January 1, 2015, the Bank was required to comply with U.S. Basel III, which is aimed at increasing both the

quantity and quality of regulatory capital and, among other things, establishes Common Equity Tier 1 as a new tier of capital

and modifies methods for calculating risk-weighted assets. Certain aspects of U.S. Basel III, including new deductions from

and adjustments to regulatory capital and a new capital conservation buffer, are being phased in over several years. The Bank’s

Capital Policy requires management to monitor the new capital standards. The Bank is subject to the following minimum

capital ratios under U.S. Basel III: a Common Equity Tier 1 risk-based capital ratio of 4.5 percent, a Tier 1 risk-based capital

ratio of 6.0 percent, a Total risk-based capital ratio of 8.0 percent, and a Tier 1 leverage ratio of 4.0 percent. In addition, the