Sallie Mae 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257

|

|

31

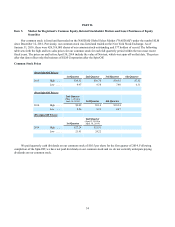

The holders of our preferred stock have rights that are senior to those of our common shareholders.

At December 31, 2015, we had issued and outstanding 3.3 million shares of our 6.97 percent Cumulative Redeemable

Preferred Stock, Series A and 4.0 million shares of our Floating-Rate Non-Cumulative Preferred Stock, Series B.

Our preferred stock is senior to our shares of common stock in right of payment of dividends and other distributions. We

must be current on dividends payable to holders of preferred stock before any dividends can be paid on our common stock. In

the event of our bankruptcy, dissolution or liquidation, the holders of our preferred stock must be satisfied before any

distributions can be made to our common shareholders.

Our ability to pay dividends on our common stock can be subject to regulatory restrictions.

We have not paid dividends on our common stock since the Spin-Off and we do not expect to do so for the foreseeable

future. However, should we choose to do so, we are dependent on funds obtained from the Bank to fund dividend payments.

Regulatory and other legal restrictions may limit our ability to transfer funds freely, either to or from our subsidiaries. In

particular, the Bank is subject to laws and regulations that authorize regulatory bodies to block or reduce the flow of funds to

us, or that prohibit such transfers altogether in certain circumstances. These laws, regulations and rules may hinder our ability

to access funds that we may need to make payments on our obligations. The FDIC has the authority to prohibit or to limit the

payment of dividends by the banking organizations they supervise, including us and our bank subsidiaries.

Restrictions on Ownership

The ability of a third-party to acquire us is limited under applicable U.S. and state banking laws and regulations.

Under the Change in Bank Control Act of 1978, as amended (“CIBC Act”), the FDIC’s regulations thereunder, and

similar Utah banking laws, any person, either individually or acting through or in concert with one or more other persons, must

provide notice to, and effectively receive prior approval from, the FDIC and UDFI before acquiring “control” of us. In practice,

the process for obtaining such approval is complicated and time-consuming, often taking longer than six months, and a

proposed acquisition may be disapproved for a variety of factors, including, but not limited to, antitrust concerns, financial

condition and managerial competence of the applicant, and failure of the applicant to furnish all required information. Under

the FDIC’s CIBC Act regulations, control is rebuttably presumed to exist, and notice is required, where a person owns, controls

or holds with the power to vote 10 percent or more of any class of our voting shares and no other person owns, controls or holds

with the power to vote a greater percentage of that class of voting shares.

Item 1B. Unresolved Staff Comments

None.