Sallie Mae 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

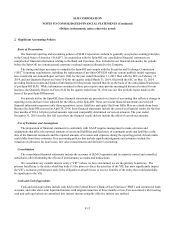

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

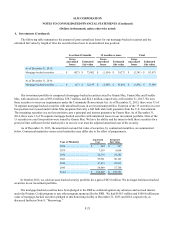

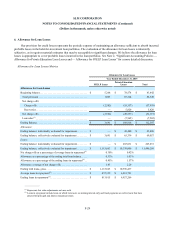

2. Significant Accounting Policies (Continued)

F-19

• Level 3 — Pricing inputs significant to the valuation are unobservable. Inputs are developed based on the best

information available. However, significant judgment is required by us in developing the inputs.

Loan Interest Income

For loans classified as held for investment, we recognize interest income as earned, adjusted for the amortization of

deferred direct origination costs. This adjustment is recognized based upon the expected yield of the loan over its life after

giving effect to prepayments and extensions. The estimate of the prepayment speed includes the effect of voluntary

prepayments, student loan defaults, and consolidation (if the loan is consolidated to a third-party), all of which shorten the life-

of-loan. Prepayment speed estimates also consider the utilization of deferment, forbearance, and extended repayment plans,

which lengthen the life-of-loan. We regularly evaluate the assumptions used to estimate the prepayment speeds. In instances

where there are changes to the assumptions, amortization is adjusted on a cumulative basis to reflect the change since the

origination of the loan. We also pay to the U.S. Department of Education (“ED”) an annual 105 basis point consolidation loan

rebate fee on FFELP consolidation loans, which is netted against loan interest income. Additionally, interest earned on

education loans reflects potential non-payment adjustments in accordance with our uncollectible interest recognition policy as

discussed further in “Allowance for Loan Losses” of this Note 2. We do not amortize any adjustments to the basis of education

loans when they are classified as held-for-sale.

We recognize certain fee income (primarily late fees) on education loans when earned according to the contractual

provisions of the promissory notes, as well as our expectation of collectability. Fee income is recorded when earned in “other

non-interest income” in the accompanying consolidated statements of income.

Interest Expense

Interest expense is based upon contractual interest rates adjusted for the amortization of issuance costs. We incur interest

expense on interest bearing deposits comprised of non-maturity savings deposits, brokered and retail CDs, brokered MMDAs

and secured financings. Interest expense is recognized when amounts are contractually due to deposit and debt holders and is

adjusted for net payments/receipts related to interest rate swap agreements that qualify and are designated hedges of interest

bearing liabilities. Interest expense also includes the amortization of deferred gains and losses on closed hedge transactions that

qualified as hedges. Amortization of debt issuance costs, premiums, discounts and terminated hedge-basis adjustments are

recognized using the effective interest rate method. We incur certain fees related to our Private Education Loan asset-backed

commercial paper facility (the “ABCP Facility”), including an unused ABCP Facility fee, and also incur fees related to our term

asset-backed securities ("ABS"). These fees are included in interest expense. Refer to Note 8, “Deposits,” and Note 9,

“Borrowings” for further details of our interest bearing liabilities.

Gains on Sale of Loans, Net

We participate and sell loans to third-parties and affiliates, including entities that were related parties prior to the Spin-

Off. These sales may occur through whole loan sales or securitization transactions that qualify for sales treatment. If a transfer

of loans qualifies as a sale, we derecognize the loan and recognize a gain or loss as the difference between the carry basis of the

loan sold and liabilities retained and the compensation received. We recognize the results of a transfer of loans based upon the

settlement date of the transaction. These loans were initially recorded as held for investment, and were transferred to held-for-

sale immediately prior to sale or securitization.

Prior to the Spin-Off, the Bank sold loans to an entity that is now a subsidiary of Navient when loans became 90 days

delinquent and to facilitate securitization transactions. Prior to the Spin-Off, the Bank sold $805 million and $2.4 billion of

loans resulting in a net gain on sale of loans of $36 million and $197 million for the years ended December 31, 2014 and 2013,

respectively. Subsequent to the Spin-Off, we sold loans through loan sales and securitization transactions with third-parties