Sallie Mae 2015 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

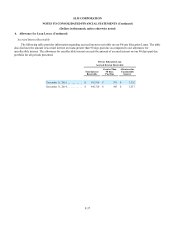

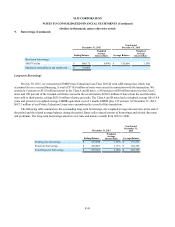

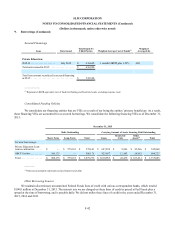

9. Borrowings (Continued)

F-43

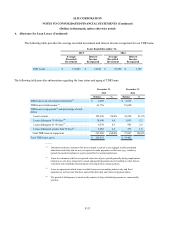

We established an account at the FRB to meet eligibility requirements for access to the Primary Credit borrowing facility

at the FRB’s Discount Window (the “Window”). The Primary Credit borrowing facility is a lending program available to

depository institutions that are in generally sound financial condition. All borrowings at the Window must be fully

collateralized. We can pledge asset-backed and mortgage-backed securities, as well as FFELP Loans and Private Education

Loans, to the FRB as collateral for borrowings at the Window. Generally, collateral value is assigned based on the estimated

fair value of the pledged assets. At December 31, 2015 and December 31, 2014, the value of our pledged collateral at the FRB

totaled $1.7 billion and $1.4 billion, respectively. The interest rate charged to us is the discount rate set by the FRB. We did not

utilize this facility in the years ended December 31, 2015, 2014 and 2013.

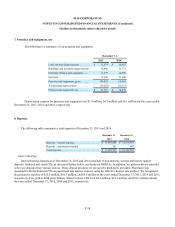

10. Private Education Loan Term Securitizations

We securitize Private Education Loan assets by selling these assets to securitization trusts. If a transfer of loans

qualifies as a sale, we derecognize the loan and recognize a gain or loss as the difference between compensation received and

the carrying basis of the loans sold and liabilities retained. We recognize the results of a transfer of loans based upon the

settlement date of the transaction. If we have a variable interest in a VIE (e.g., a securitization trust) and have determined that

we are the primary beneficiary, then we will consolidate the VIE and the transfer is accounted for as a financing as opposed to a

sale.

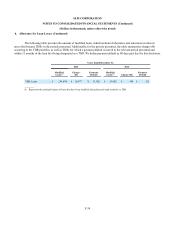

On October 27, 2015, we executed a $701.0 million Private Education Loan term ABS transaction that qualified for

sale treatment and removed the principal balance of the loans backing the securitization trust from our balance sheet on the

settlement date. We continue to service the loans in the trust. In the fourth quarter of 2015, we recorded a pre-tax gain of $58.0

million on the sale, net of closing adjustments and transaction costs, a 7.8 percent premium.

On July 30, 2015, we executed a $714.0 million Private Education Loan term ABS transaction that was accounted for

as a secured financing. We retained a 5 percent interest in the Class A and B notes, a 100 percent interest in the Class C notes

and 100 percent of the residual certificates issued in the securitization. $630.8 million of notes were sold to third-parties, raising

$623.0 million of gross proceeds. At December 31, 2015, $687.3 million of our Private Education Loans were encumbered as a

result of this transaction.

On April 23, 2015, we executed a $738 million Private Education Loan term ABS transaction that qualified for sale

treatment and removed the principal balance of the loans backing the securitization trust from our balance sheet on the

settlement date. We continue to service the loans in the trust. In the second quarter of 2015, we recorded a pre-tax gain of $77.0

million on the sale, net of closing adjustments and transaction costs, a 10.4 percent premium.

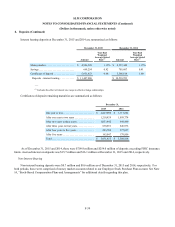

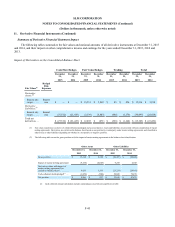

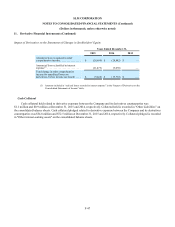

11. Derivative Financial Instruments

Risk Management Strategy

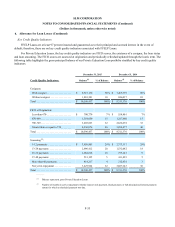

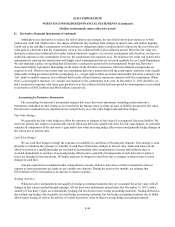

We maintain an overall interest rate risk management strategy that incorporates the use of derivative instruments to

reduce the economic effect of interest rate changes. Our goal is to manage interest rate sensitivity by modifying the repricing

frequency and underlying index characteristics of certain balance sheet liabilities so any adverse impacts related to movements

in interest rates are managed within low to moderate limits. As a result of interest rate fluctuations, hedged liabilities will

appreciate or depreciate in market value or create variability in cash flows. Income or loss on the derivative instruments that are

linked to the hedged item will generally offset the effect of this unrealized appreciation or depreciation or volatility in cash

flows for the period the item is being hedged. We view this strategy as a prudent management of interest rate risk.