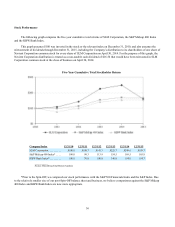

Sallie Mae 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

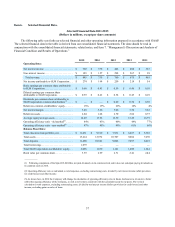

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with our consolidated financial statements and

related notes included elsewhere in this Annual Report on Form 10-K. This discussion and analysis also contains forward-

looking statements and should also be read in conjunction with the disclosures and information contained in “Forward-

Looking and Cautionary Statements” and Item 1A. “Risk Factors” in this Annual Report on Form 10-K.

Through this discussion and analysis, we intend to provide the reader with some narrative context for how our

management views our consolidated financial statements, additional context within which to assess our operating results, and

information on the quality and variability of our earnings, liquidity and cash flows.

Overview

The following discussion and analysis presents a review of our business and operations as of and for the year ended

December 31, 2015.

On April 30, 2014, we completed the Spin-Off and separated pre-Spin-Off SLM into two distinct publicly traded entities:

Navient and SLM.

For periods before the Spin-Off, the financial information contained herein and in the accompanying consolidated balance

sheets, statements of income, changes in equity, and cash flows is presented on a basis of accounting that reflects a change in

reporting entity and has been adjusted for the effects of the Spin-Off. These carved-out financial statements and selected

financial information represent only those operations, assets, liabilities and equity that form SLM on a stand-alone basis.

Because the Spin-Off occurred on April 30, 2014, these financial statements include the carved-out financial results for the first

four months of 2014. All prior period amounts represent comparably determined carved-out amounts. The year ended

December 31, 2015 was the first full year where the financial results did not include the effect of carved-out amounts.

For more information regarding the basis of presentation of these statements, see Notes to Consolidated Financial

Statements, Note 2, “Significant Accounting Policies — Basis of Presentation.” Since the Spin-Off, we have completed the

operational separation of our servicing platforms and personnel from Navient, established our own new loan originations

platform, and made changes to policies to further conform to the applicable regulations and procedures of our prudential and

consumer protection regulators. While we still have certain ongoing business arrangements with Navient, as well as a transition

services agreement in effect through at least 2016, we now consider our operational separation from Navient to be complete.

The following discussion and analysis provides more detail regarding the steps taken and costs incurred to complete this

operational separation in 2015. For a more detailed description of ongoing arrangements among the Company and Navient, see

Notes to Consolidated Financial Statements, Note 16, “Arrangements with Navient Corporation.”

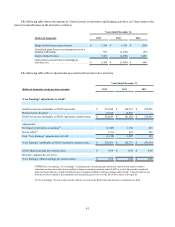

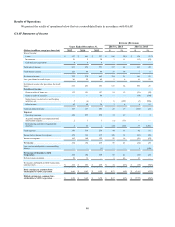

Key Financial Measures

Set forth below are brief summaries of our key financial measures. Our operating results are primarily driven by net

interest income from our Private Education Loan portfolio, gains and losses on loan sales, provision expense for credit losses,

and operating expenses. The growth of our business and the strength of our financial condition are primarily driven by our

ability to achieve our annual Private Education Loan origination goals while sustaining credit quality and maintaining cost-

efficient funding sources to support our originations.

Net Interest Income

Most of our earnings are generated from the interest income earned on assets in our education loan portfolios, net of the

interest expense we pay on funds used to originate these loans. We report these earnings as net interest income. We also often

refer to the net interest margin, which is the net interest yield earned on a portfolio less the rate paid on our related interest

bearing liabilities. The majority of our interest income comes from our Private Education Loan portfolio. FFELP Loans have a

lower net interest yield and carry lower risk than Private Education Loans, as a result of the federal government guarantee

supporting FFELP Loans. We do not expect to acquire more FFELP Loans and the balance of our FFELP Loan portfolio is

expected to decline due to normal amortization.