Sallie Mae 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

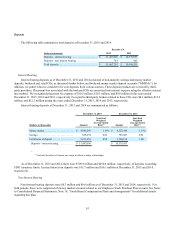

Use of Forbearance as a Private Education Loan Collection Tool

Forbearance involves granting the customer a temporary cessation of payments (or temporary acceptance of smaller than

scheduled payments) for a specified period of time. Using forbearance extends the original term of the loan. Forbearance does

not grant any reduction in the total repayment obligation (principal or interest). While in forbearance status, interest continues

to accrue and is capitalized to principal when the loan re-enters repayment status. Our forbearance policies include limits on the

number of forbearance months granted consecutively and the total number of forbearance months granted over the life of the

loan. In some instances, we require good-faith payments before granting forbearance. Exceptions to forbearance policies are

permitted when such exceptions are judged to increase the likelihood of collection of the loan. Forbearance as a collection tool

is used most effectively when applied based on a customer’s unique situation, including historical information and judgments.

We leverage updated customer information and other decision support tools to best determine who will be granted forbearance

based on our expectations as to a customer’s ability and willingness to repay their obligation. This strategy is aimed at

mitigating the overall risk of the portfolio as well as encouraging cash resolution of delinquent loans.

Forbearance may be granted to customers who are exiting their grace period to provide additional time to obtain

employment and income to support their obligations, or to current customers who are faced with a hardship and request

forbearance time to provide temporary payment relief. In these circumstances, a customer’s loan is placed into a forbearance

status in limited monthly increments and is reflected in the forbearance status at month-end during this time. At the end of their

granted forbearance period, the customer will enter repayment status as current and is expected to begin making their scheduled

monthly payments on a go-forward basis.

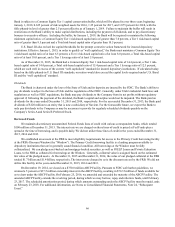

Forbearance may also be granted to customers who are delinquent in their payments. If specific requirements are met, the

forbearance can cure the delinquency and the customer is returned to a current repayment status. In more limited instances,

delinquent customers will also be granted additional forbearance time.

Prior to the Spin-Off, the Bank sold Private Education Loans that were delinquent more than 90 days or were granted a

hardship forbearance to an entity that is now a subsidiary of Navient. Because of this past business practice, we do not yet have

meaningful comparative historic forbearance data with respect to our Private Education Loan portfolio. However, subsequent to

the Spin-Off, we began using forbearance as part of our loss mitigation efforts. Nonetheless, the historic default experience on

loans put into forbearance that Navient (pre-Spin-Off SLM) experienced prior to the Spin-Off is still considered in the

determination of our allowance for loan losses.

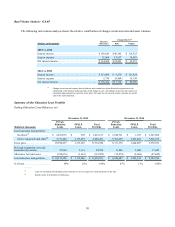

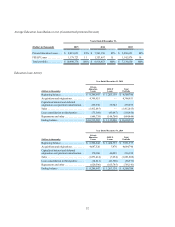

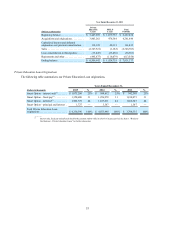

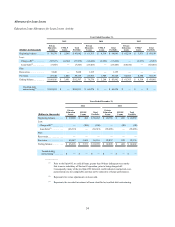

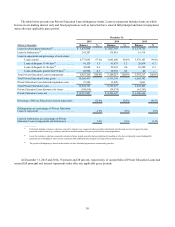

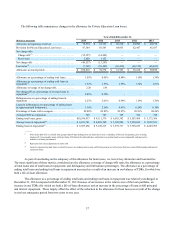

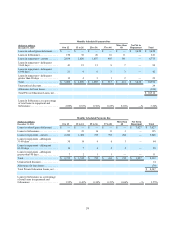

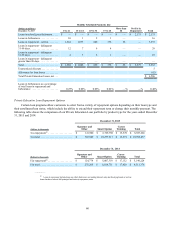

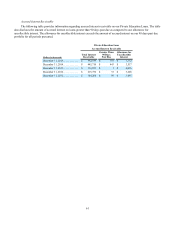

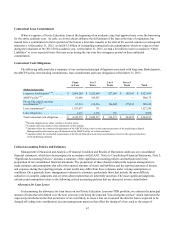

The tables below show the composition and status of the Private Education Loan portfolio aged by number of months in

active repayment status (months for which a scheduled monthly payment was due). Active repayment status includes loans on

which borrowers are making interest only and fixed payments as well as loans that have entered full principal and interest

repayment status after any applicable grace period. Our experience shows that the percentage of loans in forbearance status

decreases the longer the loans have been in active repayment status. At December 31, 2015, loans in forbearance status as a

percentage of loans in repayment and forbearance were 4 percent for loans that have been in active repayment status for less

than 25 months. Approximately 78 percent of our Private Education Loans in forbearance status have been in active repayment

status less than 25 months.