Sallie Mae 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

4. Investments (Continued)

F-25

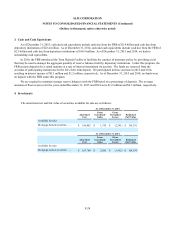

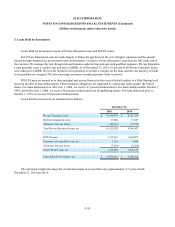

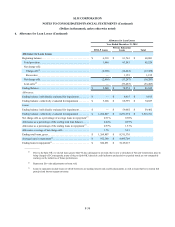

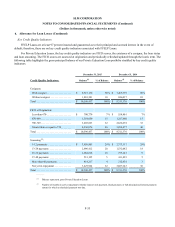

The following table summarizes the amount of gross unrealized losses for our mortgage-backed securities and the

estimated fair value by length of time the securities have been in an unrealized loss position:

Less than 12 months 12 months or more Total

Gross

unrealized

losses Estimated

fair value

Gross

unrealized

losses Estimated

fair value

Gross

unrealized

losses Estimated

fair value

As of December 31, 2015:

Mortgage-backed securities . . . . . . . $ (827) $ 73,802 $ (1,554) $ 39,271 $ (2,381) $ 113,073

As of December 31, 2014:

Mortgage-backed securities . . . . . . . $ (27) $ 12,147 $ (1,465) $ 41,462 $ (1,492) $ 53,609

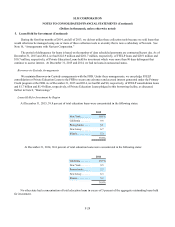

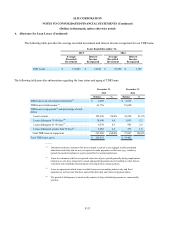

Our investment portfolio is comprised of mortgage-backed securities issued by Ginnie Mae, Fannie Mae and Freddie

Mac, with amortized costs of $93.6 million, $78.7 million, and $24.1 million, respectively, at December 31, 2015. We own

these securities to meet our requirements under the Community Reinvestment Act. As of December 31, 2015, there were 35 of

74 separate mortgage-backed securities with unrealized losses in our investment portfolio. Fourteen of the 35 securities in a net

loss position were issued under Ginnie Mae programs that carry a full faith and credit guarantee from the U.S. Government.

The remaining securities in a net loss position carry a principal and interest guarantee by Fannie Mae. As of December 31,

2014, there were 13 of 56 separate mortgage-backed securities with unrealized losses in our investment portfolio. Nine of the

13 securities in a net loss position were issued by Ginnie Mae. We have the ability and the intent to hold these securities for a

period of time sufficient for the market price to recover to at least the adjusted amortized cost of the security.

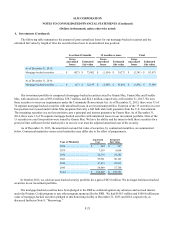

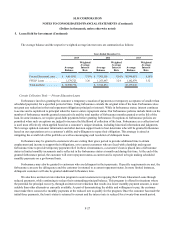

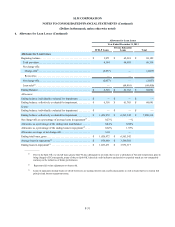

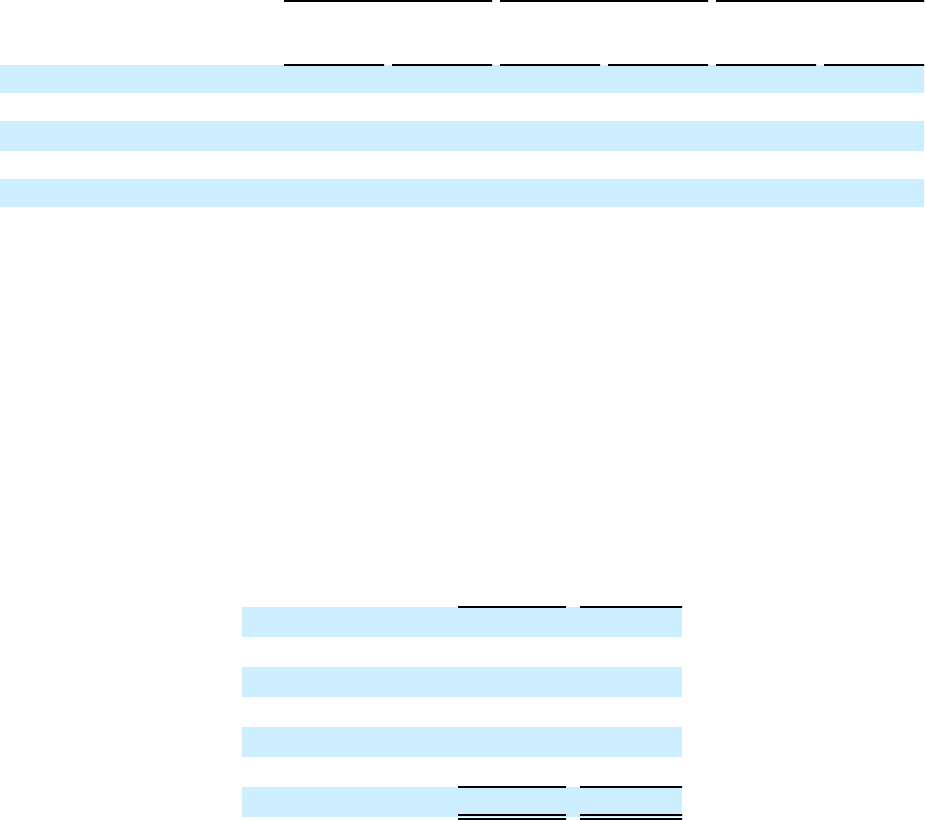

As of December 31, 2015, the amortized cost and fair value of securities, by contractual maturities, are summarized

below. Contractual maturities versus actual maturities may differ due to the effect of prepayments.

Year of Maturity Amortized

Cost Estimated

Fair Value

2038. . . . . . . . . . . . . . . . . . $ 284 $ 307

2039. . . . . . . . . . . . . . . . . . 7,539 8,054

2042. . . . . . . . . . . . . . . . . . 22,336 21,282

2043. . . . . . . . . . . . . . . . . . 59,961 60,165

2044. . . . . . . . . . . . . . . . . . 47,833 47,815

2045. . . . . . . . . . . . . . . . . . 58,449 57,768

Total. . . . . . . . . . . . . . . . . . $ 196,402 $ 195,391

In October 2013, we sold our asset-backed security portfolio for a gain of $63.8 million. We no longer hold asset-backed

securities in our investment portfolio.

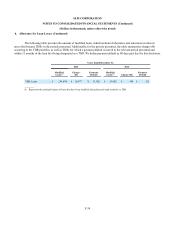

The mortgage-backed securities have been pledged to the FRB as collateral against any advances and accrued interest

under the Primary Credit program or any other program sponsored by the FRB. We had $188.3 million and $160.9 million par

value of mortgage-backed securities pledged to this borrowing facility at December 31, 2015 and 2014, respectively, as

discussed further in Note 9, “Borrowings.”