Sallie Mae 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

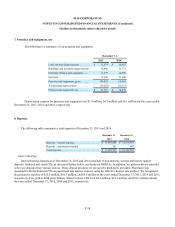

11. Derivative Financial Instruments (Continued)

F-44

Although we use derivatives to reduce the risk of interest rate changes, the use of derivatives does expose us to both

market and credit risk. Market risk is the chance of financial loss resulting from changes in interest rates and market liquidity.

Credit risk is the risk that a counterparty will not perform its obligations under a contract and it is limited to the loss of the fair

value gain in a derivative that the counterparty owes us less collateral held or plus collateral posted. When the fair value of a

derivative contract less collateral held or plus collateral posted is negative, we owe the counterparty and, therefore, we have no

credit risk exposure to the counterparty; however, the counterparty has exposure to us. We minimize the credit risk in derivative

instruments by entering into transactions with highly rated counterparties that are reviewed regularly by our Credit Department.

We also maintain a policy of requiring that all derivative contracts be governed by an International Swaps and Derivative

Association Master Agreement. Depending on the nature of the derivative transaction, bilateral collateral arrangements are

required as well. When we have more than one outstanding derivative transaction with the counterparty, and there exists legally

enforceable netting provisions with the counterparty (i.e., a legal right to offset receivable and payable derivative contracts), the

“net” mark-to-market exposure, less collateral held or plus collateral posted, represents exposure with the counterparty. When

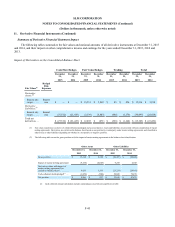

there is a net negative exposure, we consider our exposure to the counterparty to be zero. At December 31, 2015 and 2014, we

had a net positive exposure (derivative gain positions to us less collateral which has been posted by counterparties to us) related

to derivatives of $50.1 million and $60.8 million, respectively.

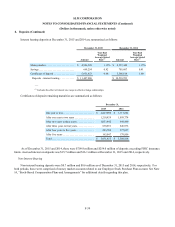

Accounting for Derivative Instruments

The accounting for derivative instruments requires that every derivative instrument, including certain derivative

instruments embedded in other contracts, be recorded on the balance sheet as either an asset or liability measured at fair value.

Our derivative instruments are classified and accounted for by us as fair value hedges and cash flow hedges.

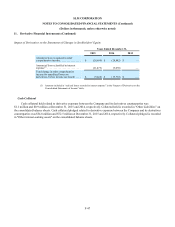

Fair Value Hedges

We generally use fair value hedges to offset the exposure to changes in fair value of a recognized fixed-rate liability. We

enter into interest rate swaps to economically convert fixed-rate debt into variable rate debt. For fair value hedges, we generally

consider all components of the derivative’s gain and/or loss when assessing hedge effectiveness and generally hedge changes in

fair values due to interest rates.

Cash Flow Hedges

We use cash flow hedges to hedge the exposure to variability in cash flows of floating rate deposits. This strategy is used

primarily to minimize the exposure to volatility in cash flows from future changes in interest rates. Gains and losses on the

effective portion of a qualifying hedge are recorded in accumulated other comprehensive income and ineffectiveness is

recorded immediately to earnings. In assessing hedge effectiveness, generally all components of each derivative’s gains or

losses are included in the assessment. We hedge exposure to changes in cash flows due to changes in interest rates or total

changes in cash flow.

Amounts reported in accumulated other comprehensive income related to derivatives will be reclassified to interest

expense as interest payments are made on our variable rate deposits. During the next twelve months, we estimate that

$15.0 million will be reclassified as an increase to interest expense.

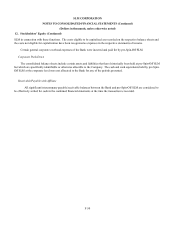

Trading Activities

When derivative instruments do not qualify for hedge accounting treatment, they are accounted for at fair value with all

changes in fair value recorded through earnings. All our derivative instruments entered into after December 31, 2013, with a

maturity of less than 3 years, are economically hedging risk but do not receive hedge accounting treatment. Trading derivatives

also include any hedges that originally received hedge accounting treatment, but lost hedge accounting treatment due to failed

effectiveness testing, as well as the activity of certain derivatives prior to them receiving hedge accounting treatment.