Sallie Mae 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

6. Allowance for Loan Losses (Continued)

F-32

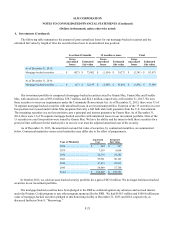

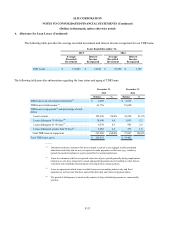

Troubled Debt Restructurings

All of our loans are collectively assessed for impairment, except for loans classified as TDRs (where we conduct

individual assessments of impairment). We modify the terms of loans for certain borrowers when we believe such modifications

may increase the ability and willingness of a borrower to make payments and thus increase the ultimate overall amount

collected on a loan. These modifications generally take the form of a forbearance, a temporary interest rate reduction or an

extended repayment plan. In the first nine months after a loan enters full principal and interest repayment, the loan may be in

forbearance for up to six months without it being classified as a TDR. Once the initial nine-month period described above is

over, however, any loan that receives more than three months of forbearance in a twenty-four month period is classified as a

TDR. Also, a loan becomes a TDR when it is modified to reduce the interest rate on the loan (regardless of when such

modification occurs and/or whether such interest rate reduction is temporary). The majority of our loans that are considered

TDRs involve a temporary forbearance of payments and do not change the contractual interest rate of the loan. Once a loan

qualifies for TDR status, it remains a TDR for allowance purposes for the remainder of its life. Approximately 23 percent and

10 percent of the loans granted forbearance as of December 31, 2015 and 2014, respectively, have been classified as TDRs due

to their forbearance status.

Prior to the Spin-Off, we did not have TDR loans because the loans generally were sold to a now unrelated affiliate in the

same month that the terms were restructured. Subsequent to May 1, 2014, we have individually assessed $307.2 million of

Private Education Loans as TDRs. When these TDR loans are determined to be impaired, we provide for an allowance for

losses sufficient to cover life-of-loan expected losses through an impairment calculation based on the difference between the

loan's basis and the present value of expected future cash flows (which would include life-of-loan default and recovery

assumptions) discounted at the loan's original effective interest rate.

Within the Private Education Loan portfolio, loans greater than 90 days past due are considered to be nonperforming.

FFELP Loans are at least 97 percent guaranteed as to their principal and accrued interest by the federal government in the event

of default and, therefore, we do not deem FFELP Loans as nonperforming from a credit risk standpoint at any point in their life

cycle prior to claim payment, and continue to accrue interest through the date of claim.

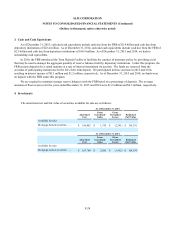

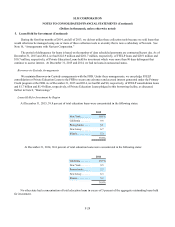

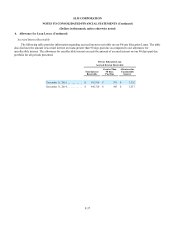

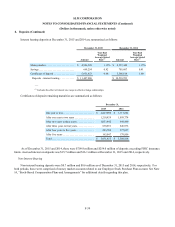

At December 31, 2015 and 2014, all of our TDR loans had a related allowance recorded. The following table provides

the recorded investment, unpaid principal balance and related allowance for our TDR loans.

Recorded

Investment

Unpaid

Principal

Balance Allowance

December 31, 2015

TDR Loans. . . . . . . . . . . . $ 269,628 $ 265,831 $ 43,480

December 31, 2014

TDR Loans. . . . . . . . . . . . $ 60,278 $ 59,402 $ 9,815