Sallie Mae 2015 Annual Report Download - page 234

Download and view the complete annual report

Please find page 234 of the 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257

|

|

1

Exhibit 10.11

SLM CORPORATION

DEFERRED COMPENSATION PLAN FOR DIRECTORS

(As Established Effective May 1, 2014 and Amended June 25, 2015)

INTRODUCTION

The SLM Corporation Deferred Compensation Plan for Directors (the “Plan”) is hereby

established by SLM Corporation (the “Corporation”) effective as of May 1, 2014 (the “Effective

Date”). Section 9 was amended on June 25, 2015.

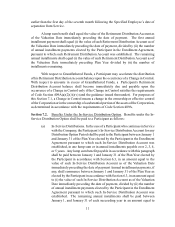

The Plan represents an assumption and continuation of a portion of the former SLM

Corporation Deferred Compensation Plan for Directors, as originally adopted on February 21, 1995,

and thereafter amended (the “Predecessor Plan”). The liabilities for the Predecessor Plan participants

set forth on Appendix A have been transferred to and assumed by this Plan as of the Effective Date.

This Plan includes certain Grandfathered Accounts (defined below), which shall continue

to be subject to, and governed by, the terms of the Predecessor Plan as in effect on December 31,

2004. “Grandfathered Account” means the separate memorandum account maintained by the

Corporation for a Predecessor Plan participant listed on Appendix A to which amounts that were

deferred and vested prior to January 1, 2005, and any earnings attributable thereto, are credited.

This Plan document applies to amounts deferred under the Predecessor Plan that were earned

or vested after December 31, 2004, and any earnings attributable thereto, as well as any amounts

deferred and vested under this Plan after the Effective Date. With respect to deferrals after December

31, 2004, the Plan is to be interpreted as necessary to comply with section 409A of the Internal

Revenue Code of 1986 and Treasury Regulations section 1.409A-1 et seq., as they both may be

amended from time to time, and other guidance issued by the Treasury Department and Internal

Revenue Service thereunder (“Section 409A”). If an amount credited to a Grandfathered Account

becomes subject to Section 409A, such amount shall be deemed governed by the Plan and shall be

paid in accordance with Section 3(E).

1. DEFERRAL OPPORTUNITY

Each year during the annual enrollment period (“Annual Enrollment Period’’) any non-

employee director (“Director”) of the Corporation may, in accordance with rules, procedures and

forms specified from time to time by the Corporation, elect to defer receipt of either all or a specified

part of his Director’s fees for the following calendar year (the “Deferral Election”). Any amount

so deferred (the “Deferred Amount”), shall be credited to a memorandum account maintained by

the Corporation on behalf of the Director (the “Deferred Account”) and paid out as hereinafter

provided. In addition, an individual may make an election prior to commencing his initial term as

a member of the Board and such election shall be effective as of the date he commences such term