Sallie Mae 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the fiscal year ended December 31, 2015

or

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from to

Commission file numbers 001-13251

SLM Corporation

(Exact Name of Registrant as Specified in Its Charter)

Delaware 52-2013874

(State of Other Jurisdiction of

Incorporation or Organization) (I.R.S. Employer

Identification No.)

300 Continental Drive, Newark, Delaware 19713

(Address of Principal Executive Offices) (Zip Code)

(302) 451-0200

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act

Common Stock, par value $.20 per share.

Name of Exchange on which Listed:

The NASDAQ Global Select Market

6.97% Cumulative Redeemable Preferred Stock, Series A, par value $.20 per share

Name of Exchange on which Listed:

The NASDAQ Global Select Market

Floating Rate Non-Cumulative Preferred Stock, Series B, par value $.20 per share

Name of Exchange on which Listed:

The NASDAQ Global Select Market

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the

past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and

post such files). Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of

registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the

definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer Accelerated filer

Non-accelerated filer Smaller reporting company

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No

The aggregate market value of voting common stock held by non-affiliates of the registrant as of June 30, 2015 was $4.2 billion (based on closing sale price of $9.87 per

share as reported for the NASDAQ Global Select Market).

As of January 31, 2016, there were 426,316,005 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement relating to the Registrant’s 2016 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on

Form 10-K.

Table of contents

-

Page 1

... file numbers 001-13251 SLM Corporation (Exact Name of Registrant as Specified in Its Charter) Delaware (State of Other Jurisdiction of Incorporation or Organization) 52-2013874 (I.R.S. Employer Identification No.) 300 Continental Drive, Newark, Delaware (Address of Principal Executive Offices... -

Page 2

...on Accounting and Financial Disclosure ...Item 9A. Controls and Procedures...Item 9B. Other Information...PART III. Item 10. Directors, Executive Officers and Corporate Governance...Item 11. Executive Compensation ...Item 12. Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 3

...to the student lending business and financial institutions generally; changes in banking rules and regulations, including increased capital requirements; increased competition from banks and other consumer lenders; the creditworthiness of the Company's customers; changes in the general interest rate... -

Page 4

..., Code of Business Conduct (which includes the code of ethics applicable to our Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer) and the governing charters for each committee of our Board of Directors are available free of charge on our website, as well as... -

Page 5

...three Smart Option repayment types at the time of loan origination. The first two, Interest Only and Fixed Payment options, require monthly payments while the student is in school and for six months thereafter, and accounted for approximately 56 percent of the Private Education Loans Sallie Mae Bank... -

Page 6

... or the interest rates we charge other than those restrictions generally applicable to all FDIC-insured banks of similar size. We diversify our funding base by raising term funding in the long-term asset-backed securities ("ABS") market collateralized by pools of Private Education Loans. We plan to... -

Page 7

... by Sallie Mae is a save-for-college rewards program helping Americans save for higher education. Membership is free and each year approximately 400,000 consumers enroll to use the service. Members earn money for college by receiving cash back rewards when shopping at participating on-line or... -

Page 8

... for those experiencing extreme long term hardship. Sallie Mae has long supported bankruptcy reform that (i) would permit the discharge of education loans, both private and federal, after a required period of good faith attempts to repay and (ii) is prospective in application, so as not to... -

Page 9

... of our 2015 Private Education Loan originations were for students attending for-profit institutions. The for-profit institutions where we continue to do business are focused on career training. We expect students who attend and complete programs at for-profit schools to support the same repayment... -

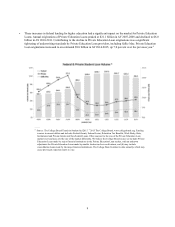

Page 10

... in College Pricing 2015. © 2015 The College Board. www.collegeboard.org. The College Board restates its data annually, which may cause previously reported results to vary. Sources of Funding • Borrowing through federal education loan programs increased at a compound annual growth rate of 10... -

Page 11

...Education Loan providers, including Sallie Mae. Private Education Loan originations increased to an estimated $9.0 billion in AY 2014-2015, up 7.0 percent over the previous year.6 _____ 6 Source: The College Board-Trends in Student Aid 2015. © 2015 The College Board. www.collegeboard.org. Funding... -

Page 12

...Student Aid 2015. © 2015 The College Board. www.collegeboard.org, College Board -Trends in Student Pricing 2015. © 2015 The College Board. www.collegeboard.org, National Student Clearinghouse - Term Enrollment Estimates, and Company analysis. Other sources for these data points also exist publicly... -

Page 13

... of active military service (including education loans) and limits the amount of interest, including fees, that may be charged; the Truth in Savings Act and Regulation DD issued by the CFPB, which mandate certain disclosures related to consumer deposit accounts; the Expedited Funds Availability Act... -

Page 14

... reports to Congress annually on the trends and issues identified through this process. The CFPB continues to take an active interest in the student loan industry, undertaking a number of initiatives related to the Private Education Loan market and student loan servicing. On October 16, 2015... -

Page 15

... relating to customer complaints, fees and charges assessed in connection with the servicing of student loans and related collection practices of pre-Spin-Off SLM by entities now subsidiaries of Navient during a time period prior to the SpinOff. Two state attorney generals have provided the Bank... -

Page 16

... Utah and its deposits are insured by the FDIC. The Bank's ability to pay dividends is subject to the laws of Utah and the regulations of the FDIC. Generally, under Utah's industrial bank laws and regulations as well as FDIC regulations, the Bank may pay dividends to the Company from its net profits... -

Page 17

... Financial institutions generally may not disclose certain consumer or account information to any nonaffiliated third-party for use in telemarketing, direct mail marketing or other marketing. The privacy regulations also restrict information sharing among affiliates for marketing purposes and govern... -

Page 18

... backed by residential and commercial mortgages and automobile, commercial, credit card, and student loans, except for certain transactions with limited connections to the United States and U.S. investors. The regulations generally require securitizers of asset-backed securities, such as Sallie Mae... -

Page 19

...banking entities to trade for risk mitigating hedging and liquidity management, subject to certain conditions and restrictions. A conformance period ended on July 21, 2015... businesses prohibited by the Volcker Rule. We may incur costs in connection with implementing the compliance program required ... -

Page 20

.... It reached a high of 13.3 percent in 2011 and declined to 3.8 percent in December 2015. Likewise, high unemployment and decreased savings rates may impede Private Education Loan originations growth as loan applicants and their cosigners may experience trouble repaying credit obligations or may not... -

Page 21

... protection laws applicable to our Private Education Loan lending and retail banking activities, including laws governing fair lending, unfair, deceptive and abusive acts and practices, service member protections, interest rates and loan fees, disclosures of loan terms, marketing, servicing and... -

Page 22

...imposed limitations. As our business, capital and balance sheet continue to grow, we expect to be able to achieve our annual Private Education Loan origination targets for 2016 without the need to sell loans to third-parties. We may reconsider loan sales from time to time, however, based on a number... -

Page 23

... to fund new Private Education Loan originations, our business, financial condition, results of operations and cash flows could be materially adversely affected. We fund Private Education Loan originations through term and liquid brokered and retail deposits raised by the Bank. Assets funded in... -

Page 24

... of funds is primarily related to deposit rates. Certain of our Private Education Loans bear fixed interest rates. These loans are not specifically match funded with fixed-rate deposits or fixed rate funding obtained through asset-backed securitization. Likewise, the average term of our deposits is... -

Page 25

... Education Loan default aversion strategies were focused on the final stages of delinquency, from 150 days to 212 days. As a result of changing our corporate charge-off policy to charging off at 120 days delinquent and greatly reducing the number of potentially delinquent loans we sell to Navient... -

Page 26

... status (in-school, grace, forbearance, repayment and delinquency), loan seasoning (number of months in active repayment), underwriting criteria (e.g., credit scores), presence of a cosigner and the current economic environment. General economic and employment conditions, including employment rates... -

Page 27

... loan originations and the servicing, financial, accounting, data processing or other operating systems and facilities that support them may fail to operate properly, become disabled as a result of events beyond our control or be unable to be rapidly configured to timely address regulatory changes... -

Page 28

... parties also may fraudulently induce employees, customers and other users of our systems to gain access to our and our customers' data. As a result, we continue to evolve our security controls to effectively prevent, detect, and respond to the continually changing threats and we may be required... -

Page 29

...-related services in connection with our business. If a service provider fails to provide the services we require or expect, or fails to meet applicable regulatory or contractual requirements, such as service levels, protection of our customers' personal and confidential information, or compliance... -

Page 30

... balance risk and return. We have established processes and procedures intended to identify, measure, monitor, control and report the types of risk to which we are subject. We seek to monitor and control our risk exposure through a framework of policies, procedures, limits and reporting requirements... -

Page 31

... action related to the servicing, operations and collections activities of pre-Spin-Off SLM and its subsidiaries with respect to Private Education Loans and FFELP Loans that were assets of the Bank or Navient at the time of the Spin-Off; provided that written notice is provided to Navient prior... -

Page 32

... Our smaller market capitalization as compared to pre-Spin-Off SLM; Changes in earnings estimated by securities analysts or our ability to meet those estimates; Our policy of paying no common stock dividends; The operating and stock price performance of comparable companies; News reports relating to... -

Page 33

... The ability of a third-party to acquire us is limited under applicable U.S. and state banking laws and regulations. Under the Change in Bank Control Act of 1978, as amended ("CIBC Act"), the FDIC's regulations thereunder, and similar Utah banking laws, any person, either individually or acting... -

Page 34

...mortgage. We believe that our headquarters, loan servicing centers, data center, back-up facility and data management and collection centers are generally adequate to meet our long-term lending and business goals. Our headquarters are currently located in owned space at 300 Continental Drive, Newark... -

Page 35

... relating to customer complaints, fees and charges assessed in connection with the servicing of student loans and related collection practices of preSpin-Off SLM by entities now subsidiaries of Navient during a time period prior to the Spin-Off. Two state attorney generals have provided the Bank... -

Page 36

... 30, 2014 include the value of Navient, which was spun off on that date. The prices after that date reflect only the business of SLM Corporation after the Spin-Off. Common Stock Prices (Post-Spin-Off Prices) 1st Quarter 2015 High ...Low ...(Post-Spin-Off Prices) 2nd Quarter (May 1, 2014 to June 30... -

Page 37

... per share data) Total Number of Shares Purchased(1) Average Price Paid per Share Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs Period: October 1 - October 31, 2015 ...November 1 - November 30, 2015 ...December 1 - December 31, 2015 ...Total fourth-quarter 2015... -

Page 38

... graph, the Navient Corporation distribution is treated as a non-taxable cash dividend of $16.56 that would have been reinvested in SLM Corporation common stock at the close of business on April 30, 2014. Five-Year Cumulative Total Stockholder Return Company/Index SLM Corporation ...S&P Midcap 400... -

Page 39

...Net interest margin...Return on assets ...Average equity/average assets ...Operating efficiency ratio - old method(2) ...Operating efficiency ratio - new method(3) ...Balance Sheet Data: Total education loan portfolio, net...Total assets...Total deposits ...Total borrowings ...Total SLM Corporation... -

Page 40

... Financial Statements, Note 2, "Significant Accounting Policies - Basis of Presentation." Since the Spin-Off, we have completed the operational separation of our servicing platforms and personnel from Navient, established our own new loan originations platform, and made changes to policies... -

Page 41

... on our Private Education Loans are affected by risk characteristics such as loan status (in-school, grace, forbearance, repayment and delinquency), loan seasoning (number of months in active repayment), underwriting criteria (e.g., credit scores), presence of a cosigner and the current economic... -

Page 42

... "Gains (losses) on derivative and hedging activities, net," are primarily caused by interest rate volatility and changing credit spreads during the period as well as the volume and term of derivatives not receiving hedge accounting treatment. Cash flows on derivative instruments that do not qualify... -

Page 43

...5,300 $ (3,996) $ The following table reflects adjustments associated with our derivative activities. Years Ended December 31, (Dollars in thousands, except per share amounts) 2015 2014 2013 "Core Earnings" adjustments to GAAP: GAAP net income attributable to SLM Corporation ...Preferred stock... -

Page 44

... our balance sheet, and the amount of new Private Education Loan originations we generate each year is a key indicator of the trajectory of our business, including our future earnings and asset growth. Funding Sources Deposits We utilize brokered, retail and other core deposits to meet funding needs... -

Page 45

...support our capital levels, in part, through active participation in the capital markets during 2015, our first full year since the Spin-Off. Complete Necessary Steps to Permit the Bank to Independently Originate and Service Private Education Loans In 2015, we implemented the final phase of the Bank... -

Page 46

... credit quality and cosigner rates in our Smart Option Student Loan originations. In 2016, we expect to introduce a Private Education Loan product permitting parents to borrow and fund their children's education without a student co-borrower ("Parent Loans"). As our business, capital and balance... -

Page 47

...and Services The Spin-Off provided us the opportunity to redesign our processes, procedures and customer experiences exclusively around our Private Education Loan products, rather than accommodating the servicing of those products as well as FFELP and Direct Student Loans serviced under direction of... -

Page 48

... interest ...Net income attributable to SLM Corporation ...Preferred stock dividends ...Net income attributable to SLM Corporation common stock ...Basic earnings per common share attributable to SLM Corporation ...Diluted earnings per common share attributable to SLM Corporation ...$ $ $ 349... -

Page 49

... provision expense was a $14 million benefit from the change in our charge-off policy. Gains on sales of loans, net, increased $14 million. In 2015, we sold $1.5 billion of loans through Private Education Loan sales and a securitization transaction with third-parties. As a result, we recorded gains... -

Page 50

...benefit from the net effect of a change in our loss emergence period from two years to one year and a change in our charge-off policy that was recorded in the second quarter of 2014. Gains on sales of loans, net, decreased $76 million. In 2014, we sold $1.9 billion of loans through Private Education... -

Page 51

... net interest margin on a consolidated basis. Years Ended December 31, 2015 (Dollars in thousands) Balance Rate Balance 2014 Rate Balance 2013 Rate Average Assets Private Education Loans ...FFELP Loans ...Taxable securities ...Cash and other short-term investments ...Total interest-earning assets... -

Page 52

...The changes in income and expense are calculated independently for each line in the table. The totals for the rate and volume columns are not the sum of the individual lines. Summary of Our Education Loan Portfolio Ending Education Loan Balances, net December 31, 2015 Private Education Loans FFELP... -

Page 53

...424,735 18% Loans for customers still attending school and who are not yet required to make payments on the loan. Includes loans in deferment or forbearance. December 31, 2012 Private Education Loans FFELP Loans Total Portfolio Private Education Loans December 31, 2011 FFELP Loans Total Portfolio... -

Page 54

...2015 Private Education Loans (Dollars in thousands) FFELP Loans Total Portfolio Beginning balance ...Acquisitions and originations ...Capitalized interest and deferred origination cost premium amortization . . Sales ...Loan consolidation to third-parties ...Repayments and other ...Ending balance... -

Page 55

... 3,347 25% 31 44 - 100% $ 942,568 1,184,073 1,666,547 1,347 25% 31 44 - 100% $ 4,075,948 $ 3,794,535 Interest only, fixed pay and deferred describe the payment option while in school or in grace period. See Item 1. "Business Our Business - Private Education Loans" for further discussion. 53 -

Page 56

...$ - _____ (1) Prior to the Spin-Off, we sold all loans greater than 90 days delinquent to an entity that is now a subsidiary of Navient Corporation, prior to being charged-off. Consequently, many of the pre-Spin-Off, historical credit indicators and period-overperiod trends are not comparable and... -

Page 57

... on the final stages of delinquency. Pre-Spin-Off, these final stages were from 150 days to 212 days delinquent. As a result of changing our corporate charge-off policy and greatly reducing the number of potentially delinquent loans we sell to Navient, the final stages of delinquency and our default... -

Page 58

... have requested extension of grace period generally during employment transition or who have temporarily ceased making full payments due to hardship or other factors, consistent with established loan program servicing policies and procedures. The period of delinquency is based on the number of days... -

Page 59

... 4,249,703 Prior to the Spin-Off, we sold all loans greater than 90 days delinquent to an entity that is now a subsidiary of Navient Corporation, prior to being charged-off. Consequently, many of the pre-Spin-Off, historical credit indicators and period-over-period trends are not comparable and may... -

Page 60

... status. In more limited instances, delinquent customers will also be granted additional forbearance time. Prior to the Spin-Off, the Bank sold Private Education Loans that were delinquent more than 90 days or were granted a hardship forbearance to an entity that is now a subsidiary of Navient... -

Page 61

Monthly Scheduled Payments Due (Dollars in millions) December 31, 2015 0 to 12 13 to 24 25 to 36 37 to 48 More than 48 Not Yet in Repayment Total Loans in-school/grace/deferment ...Loans in forbearance...Loans in repayment - current ...Loans in repayment - delinquent 31-60 days...Loans in ... -

Page 62

...status, which include the ability to extend their repayment term or change their monthly payment. The following table shows the comparison of our Private Education Loan portfolio by product type for the years ended December 31, 2015 and 2014. December 31, 2015 Signature and Other Smart Option Career... -

Page 63

... for all periods presented. Private Education Loan Accrued Interest Receivable Greater Than Allowance for Total Interest 90 Days Uncollectible Receivable Past Due Interest (Dollars in thousands) December 31, 2015...December 31, 2014...December 31, 2013...December 31, 2012...December 31, 2011... -

Page 64

... Resources Funding and Liquidity Risk Management Our primary liquidity needs include our ongoing ability to fund our businesses throughout market cycles, including during periods of financial stress, our ongoing ability to fund originations of Private Education Loans and servicing our Bank deposits... -

Page 65

... deposits were $0.7 million and $0.6 million as of December 31, 2015 and 2014, respectively. For both periods, these were comprised of money market accounts related to our Employee Stock Purchase Plan account. See Notes to Consolidated Financial Statements, Note 14, "Stock-Based Compensation Plans... -

Page 66

...cash balances. Our investment portfolio includes a small portfolio of mortgage-backed securities issued by government agencies and government-sponsored enterprises that are purchased to meet Community Reinvestment Act targets. Additionally, our investing activity is governed by Board-approved limits... -

Page 67

... plans. Our Board of Directors will periodically reconsider these matters. As of January 1, 2015, the Bank was required to comply with U.S. Basel III, which is aimed at increasing both the quantity and quality of regulatory capital and, among other things, establishes Common Equity Tier 1 as a new... -

Page 68

... are charged on these lines of credit is priced at Fed Funds plus a spread at the time of borrowing, and is payable daily. We did not utilize these lines of credit in the years ended December 31, 2015, 2014 and 2013. We established an account at the FRB to meet eligibility requirements for access to... -

Page 69

... period on these unfunded commitments. Contractual Cash Obligations The following table provides a summary of our contractual principal obligations associated with long-term Bank deposits, the ABCP Facility, term funding commitments, loan commitments and lease obligations at December 31, 2015... -

Page 70

... with the Spin-Off, we changed our charge-off policy for Private Education Loans to charging off loans when the loans reach 120 days delinquent. Pre-Spin-Off SLM default aversion strategies were focused on the final stages of delinquency, from 150 days to 212 days. Our default aversion strategies... -

Page 71

... allowance for FFELP Loan losses uses historical experience of customer default, behavior and a two-year loss emergence period to estimate the credit losses incurred in the loan portfolio at the reporting date. We apply the default rate projections, net of applicable Risk Sharing, to each category... -

Page 72

... and servicer of Sallie Mae securitization trusts, we meet the first primary beneficiary criterion because we have the power to direct the activities of the VIE that most significantly impact the VIE's economic performance. In 2015, we executed both secured financings and securitized loan sale... -

Page 73

... deliver on those accountabilities. Enterprise Risk Management Policy and Framework The ERM policy and framework are designed to provide a holistic perspective of risk and control performance across the Company. The policy, which is approved annually by the Board of Directors, outlines the framework... -

Page 74

... Accounting Assumptions and New Product and Services working groups. Disclosure Committee. Our Disclosure Committee assists our Chief Executive Officer and Chief Financial Officer in their review of periodic SEC reporting documents, earnings releases, investor materials and related disclosure... -

Page 75

... Board of Directors periodically reviews and approves the investment and asset and liability management policies and contingency funding plan developed and administered by ALCO. The Risk Committee of our Board of Directors as well as our Chief Financial Officer report to the full Board of Directors... -

Page 76

... closely the mismatch between the maturity of assets and liabilities; our ongoing ability to fund originations of Private Education Loans; and servicing our indebtedness and bank deposits. Key objectives associated with our funding liquidity needs relate to our ability to access the capital markets... -

Page 77

...' businesses prior to the Spin-Off, other than certain specifically identified liabilities relating to the conduct of our consumer banking business. Nonetheless, given the prior usage of the Sallie Mae and SLM names by entities now owned by Navient, we and our subsidiaries may from time to time be... -

Page 78

...Education Loans, as well as servicing history information with respect to Private Education Loans previously serviced by Navient and access to certain promissory notes in Navient's possession. The loan servicing and administration agreement has a fixed term with a renewal option in favor of the Bank... -

Page 79

... right to obtain from Navient certain post-Spin-Off performance data relating to Private Education Loans owned or serviced by Navient to support and facilitate ongoing underwriting, originations, forecasting, performance and reserve analyses. The tax sharing agreement governs the respective rights... -

Page 80

... debt versus floating rate assets. As part of its suite of financial products, the Bank offers fixed-rate Private Education Loans. As with other Private Education Loans, the term to maturity is lengthy, and the customer has the option to repay the loan faster than the promissory note requires. Asset... -

Page 81

... liquid retail deposits and the obligation to return cash collateral held related to derivatives exposures. Assets include receivables and other assets (including premiums and reserves). Funding includes unswapped time deposits, liquid MMDA's swapped to fixed rates and stockholders' equity. (3) 79 -

Page 82

... lives of our earning assets and liabilities at December 31, 2015. Weighted Average (Averages in Years) Life 6.18 0.47 5.11 Earning assets Education loans ...Cash and investments ...Total earning assets ...Deposits Short-term deposits ...Long-term deposits ...Total deposits...Borrowings Short-term... -

Page 83

... to our management, including our principal executive officer and principal financial officer as appropriate, to allow timely decisions regarding required disclosure. Management's Report on Internal Control over Financial Reporting Our management is responsible for establishing and maintaining... -

Page 84

... and Management and Related Stockholder Matters The information contained in the 2016 Proxy Statement, including information appearing in the sections titled "Equity Compensation Plan Information," "Ownership of Common Stock" and "Ownership of Common Stock by Directors and Executive Officers" in... -

Page 85

... or incorporated by reference as part of this Annual Report on Form 10-K. We will furnish at cost a copy of any exhibit filed with or incorporated by reference into this Annual Report on Form 10K. Oral or written requests for copies of any exhibits should be directed to the Corporate Secretary. 83 -

Page 86

... Director Restricted Stock Agreement 2015 (incorporated by reference to Exhibit 10.1 of the Company's Quarterly Report on Form 10-Q filed on July 22, 2015). SLM Corporation Executive Severance Plan for Senior Officers, including amendments as of June 25, 2015. SLM Corporation Change in Control... -

Page 87

... SLM Corporation Directors Equity Plan Non-Employee Director Stock Option Agreement - 2009 (incorporated by reference to Exhibit 10.6 of the Company's Quarterly Report on Form 10-Q filed on November 5, 2009). Form of SLM Corporation 2009-2012 Incentive Plan Stock Option Agreement, Net Settled, Time... -

Page 88

... Servicing and Administration Agreement between Sallie Mae Bank and Navient Solutions, Inc., dated as of April 30, 2014 (incorporated by reference to Exhibit 10.4 of the Company's Current Report on Form 8-K filed on May 2, 2014). Computation of Ratio of Earnings to Fixed Charges and Preferred Stock... -

Page 89

... duly authorized. Dated: February 26, 2016 SLM CORPORATION By: /S/ RAYMOND J. QUINLAN Raymond J. Quinlan Executive Chairman and Chief Executive Officer Pursuant to the requirement of the Securities Exchange Act of 1934, as amended, this report has been signed below by the following persons on... -

Page 90

/S/ JED H. PITCHER Jed H. Pitcher Director February 26, 2016 /S/ FRANK C. PULEO Frank C. Puleo Director February 26, 2016 /S/ VIVIAN C. SCHNECK-LAST Vivian C. Schneck-Last /S/ WILLIAM N. SHIEBLER William N. Shiebler Director February 26, 2016 Director February 26, 2016 /S/ ROBERT S. STRONG ... -

Page 91

......Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets ...Consolidated Statements of Income ...Consolidated Statements of Comprehensive Income...Consolidated Statements of Changes in Equity ...Consolidated Statements of Cash Flows ...Notes to Consolidated Financial... -

Page 92

... generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), SLM Corporation's internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control... -

Page 93

... of Independent Registered Public Accounting Firm The Board of Directors and Stockholders SLM Corporation: We have audited SLM Corporation's (the Company) internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control - Integrated Framework (2013... -

Page 94

... shares authorized: 430.7 million and 424.8 million shares, issued, respectively. . Additional paid-in capital ...Accumulated other comprehensive loss (net of tax benefit $9,949 and $7,186, respectively) ...Retained earnings ...Total SLM Corporation's stockholders' equity before treasury stock... -

Page 95

... to SLM Corporation ...Preferred stock dividends...Net income attributable to SLM Corporation common stock ...Basic earnings per common share attributable to SLM Corporation...Average common shares outstanding...Diluted earnings per common share attributable to SLM Corporation . Average common... -

Page 96

... adjustments for (gain) on sale of available-for-sale securities included in other income ...Total unrealized (losses) gains on investments ...Unrealized losses on cash flow hedges ...Total unrealized (losses) gains ...Income tax benefit ...Other comprehensive loss, net of tax benefit... -

Page 97

SLM CORPORATION CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (In thousands) Navient's Subsidiary Investment Balance at December 31, 2012...Net income (loss) ...Other comprehensive loss, net of tax ...Total comprehensive income (loss) ...Net transfers to affiliate ...Balance at December 31, 2013...$... -

Page 98

... Shares Preferred Stock Shares Balance at December 31, 2013 . Additional Paid-In Capital Navient's Subsidiary Investment Accumulated Other Comprehensive Income (Loss) Total SLM Corporation Equity Noncontrolling interest Issued Treasury Outstanding Preferred Stock Common Stock Retained Earnings... -

Page 99

... Paid-In Capital Retained Earnings Treasury Stock Total SLM Corporation Equity Balance at December 31, 2014 ...Net income ...Other comprehensive loss, net of tax ...Total comprehensive income ...Separation adjustments related to the Spin-Off of Navient Corporation ...Cash dividends: Preferred... -

Page 100

... Net income ...Adjustments to reconcile net income to net cash (used in) provided by operating activities: Provisions for credit losses...Deferred tax (benefit) provision ...Amortization of brokered deposit placement fee ...Amortization of ABCP upfront fee...Amortization of deferred loan origination... -

Page 101

......Fees paid - ABCP facility...Net decrease in deposits with entity that is a subsidiary of Navient ...Special cash contribution from Navient ...Net capital contributions from entity that is a subsidiary of Navient...Excess tax benefit from the exercise of stock-based awards ...Preferred stock... -

Page 102

...rewards on everyday purchases to help families save for college. On April 30, 2014, we completed our plan to legally separate into two distinct publicly traded entities: an education loan management, servicing and asset recovery business, named Navient Corporation ("Navient"); and a consumer banking... -

Page 103

... general corporate overhead expenses allocated to the Company. The timing and steps necessary to complete the Spin-Off and comply with the Securities and Exchange Commission ("SEC") reporting requirements, including the replacement of pre-Spin-Off SLM with our current publicly traded registrant... -

Page 104

... otherwise noted) 2. Significant Accounting Policies (Continued) Investments Investments consisted of only mortgage-backed securities in 2015 and 2014. We record our investment purchases and sales on a trade date basis. The amortized cost of debt securities is adjusted for amortization of premiums... -

Page 105

... adjustments may be needed to those historical default rates. We may also take certain other qualitative factors into consideration when calculating the allowance for loan losses. These qualitative factors include, but are not limited to, changes in the economic environment, changes in lending... -

Page 106

...hardship forbearance or more than six months of administrative forbearance; or (4) have a borrower or cosigner who has filed for bankruptcy. At December 31, 2015, we held approximately $89 million of Split Loans. Pre-Spin-Off SLM charged off loans when they were 212 days delinquent. As such, default... -

Page 107

...The allowance for FFELP Loan losses uses historical experience of customer default behavior and a two-year loss emergence period to estimate the credit losses incurred in the loan portfolio at the reporting date. We apply the default rate projections, net of applicable Risk Sharing, to each category... -

Page 108

...trust for the benefit of the members until distributed in accordance with the Upromise member's request and/or the terms of the Upromise service agreement. Upromise, which acts as the trustee for the trust, has deposited a majority of the cash with the Bank pursuant to a money market deposit account... -

Page 109

... of the loan. We also pay to the U.S. Department of Education ("ED") an annual 105 basis point consolidation loan rebate fee on FFELP consolidation loans, which is netted against loan interest income. Additionally, interest earned on education loans reflects potential non-payment adjustments in... -

Page 110

... with Navient Corporation," for further discussion regarding loan purchase agreements. Other Income Our Upromise subsidiary has a number of programs that encourage consumers to save for the cost of college education. We have established a consumer savings network, which is designed to promote... -

Page 111

... we agree to repurchase the related loans from the trust. We did not record a servicing asset or servicing liability related to our securitization transactions because we determined the servicing fees we receive are at market rate. Derivative Accounting We account for our derivatives, consisting of... -

Page 112

...million of deferred taxes payable (installment payments due quarterly through 2018) in connection with gains recognized by pre-Spin-Off SLM on debt repurchases in prior years. As part of the tax sharing agreement between us and Navient, Navient has agreed to fully pay us for these deferred taxes due... -

Page 113

... when determining a controlling financial interest. The standard is effective January 1, 2016, with early adoption permitted during an interim period in fiscal year 2015. In the third quarter of 2015, we elected to early adopt the new accounting guidance retrospectively to July 1, 2015. The early... -

Page 114

... 31, 2015 and 2014, we had no outstanding cash equivalents. In 2010, the FRB introduced the Term Deposit Facility to facilitate the conduct of monetary policy by providing a tool that may be used to manage the aggregate quantity of reserve balances held by depository institutions. Under this program... -

Page 115

...2015, there were 35 of 74 separate mortgage-backed securities with unrealized losses in our investment portfolio. Fourteen of the 35 securities in a net loss position were issued under Ginnie Mae programs that carry a full faith and credit guarantee from the U.S. Government. The remaining securities... -

Page 116

... loans and customers' resources. Private Education Loans bear the full credit risk of the customer. We manage this risk through risk-performance underwriting strategies and qualified cosigners. Private Education Loans generally carry a variable rate indexed to LIBOR. As of December 31, 2015... -

Page 117

... and the customer is returned to a current repayment status. In more limited instances, delinquent customers will also be granted additional forbearance time. We also have an interest rate reduction program to assist customers in repaying their Private Education Loans through reduced payments, while... -

Page 118

...be managed using one or more of these collection tools to an entity that is now a subsidiary of Navient. See Note 16, "Arrangements with Navient Corporation." The period of delinquency for loans is based on the number of days scheduled payments are contractually past due. As of December 31, 2015 and... -

Page 119

...Metrics Allowance for Loan Losses Year Ended December 31, 2015 FFELP Loans Private Education Loans Total Allowance for Loan Losses Beginning balance...Total provision ...Net charge-offs: Charge-offs ...Recoveries ...Net charge-offs ...Loan sales Allowance: Ending balance: individually evaluated for... -

Page 120

...5,149,215 (3) Prior to the Spin-Off, we sold all loans greater than 90 days delinquent to an entity that is now a subsidiary of Navient Corporation, prior to being charged-off. Consequently, many of the pre-Spin-Off, historical credit indicators and period-over-period trends are not comparable and... -

Page 121

...,317 (3) ... Prior to the Spin-Off, we sold all loans greater than 90 days delinquent to an entity that is now a subsidiary of Navient Corporation, prior to being charged-off. Consequently, many of the pre-Spin-Off, historical credit indicators and period-over-period trends are not comparable and... -

Page 122

... to their forbearance status. Prior to the Spin-Off, we did not have TDR loans because the loans generally were sold to a now unrelated affiliate in the same month that the terms were restructured. Subsequent to May 1, 2014, we have individually assessed $307.2 million of Private Education Loans as... -

Page 123

... with established loan program servicing policies and procedures. Loans in repayment include loans on which borrowers are making interest only and fixed payments as well as loans that have entered full principal and interest repayment status. The period of delinquency is based on the number of days... -

Page 124

... reductions in interest rates) that became TDRs in the periods presented. Additionally, for the periods presented, the table summarizes charge-offs occurring in the TDR portfolio, as well as TDRs for which a payment default occurred in the relevant period presented and within 12 months of the loan... -

Page 125

... loan status and loan seasoning. The FICO scores are assessed at origination and periodically refreshed/updated through the loan's term. The following table highlights the gross principal balance of our Private Education Loan portfolio stratified by key credit quality indicators. December 31, 2015... -

Page 126

... have requested extension of grace period generally during employment transition or who have temporarily ceased making full payments due to hardship or other factors, consistent with established loan program servicing policies and procedures. The period of delinquency is based on the number of days... -

Page 127

... the amount of accrued interest on our 90 days past due portfolio for all periods presented. Private Education Loan Accrued Interest Receivable Total Interest Receivable Greater Than 90 Days Past Due Allowance for Uncollectible Interest December 31, 2015...December 31, 2014... $ $ 542,919 445,710... -

Page 128

... non-maturity savings and money market deposits, brokered and retail CDs, as discussed further below, and brokered MMDAs. In addition, we gather what we consider to be core deposits from various sources. These deposit products are serviced by third-party providers. Placement fees associated with the... -

Page 129

... Non-interest bearing deposits were $0.7 million and $0.6 million as of December 31, 2015 and 2014, respectively. For both periods, these were comprised of money market accounts related to our Employee Stock Purchase Plan account. See Note 14, "Stock-Based Compensation Plans and Arrangements" for... -

Page 130

..., 2015 Short-Term Long-Term Total Secured borrowings: Private Education Loan term securitizations ABCP Facility ...Total ...$ $ - 500,175 500,175 $ $ 579,101 - 579,101 $ $ 579,101 500,175 1,079,276 Short-term Borrowings Asset-Backed Commercial Paper Funding Facility On December 19, 2014, we closed... -

Page 131

... Balance Weighted Average Interest Rate Short-term borrowings: ABCP Facility ...Maximum outstanding at any month end...$ $ 500,175 710,005 0.84% $ 135,064 3.10% Long-term Borrowings On July 30, 2015, we executed our SMB Private Education Loan Trust 2015-B term ABS transaction, which was accounted... -

Page 132

... are accounted for as secured borrowings. We consolidate the following financing VIEs as of December 31, 2015: December 31, 2015 Debt Outstanding Short-Term Long-Term Total Carrying Amount of Assets Securing Debt Outstanding Loans Restricted Cash Other Assets(1) Total Secured borrowings: Private... -

Page 133

... settlement date. We continue to service the loans in the trust. In the fourth quarter of 2015, we recorded a pre-tax gain of $58.0 million on the sale, net of closing adjustments and transaction costs, a 7.8 percent premium. On July 30, 2015, we executed a $714.0 million Private Education Loan term... -

Page 134

... changes in cash flows due to changes in interest rates or total changes in cash flow. Amounts reported in accumulated other comprehensive income related to derivatives will be reclassified to interest expense as interest payments are made on our variable rate deposits. During the next twelve months... -

Page 135

... Consolidated Balance Sheet Cash Flow Hedges December 31, 2015 Hedged Risk Exposure December 31, 2014 Fair Value Hedges December 31, 2015 December 31, 2014 Trading December 31, 2015 December 31, 2014 Total December 31, 2015 December 31, 2014 Fair Values(1) Derivative Assets:(2) Interest rate... -

Page 136

... ...Total ...Cash Flow Hedges Interest rate swaps: Hedge ineffectiveness losses recorded in earnings ...Realized losses recorded in interest expense ...Total ...Trading Interest rate swaps: Interest reclassification...Change in fair value of future interest payments recorded in earnings ...Total... -

Page 137

... on the consolidated balance sheets. Cash collateral pledged related to derivative exposure between the Company and its derivatives counterparties was $54.8 million and $72.5 million at December 31, 2015 and 2014, respectively. Collateral pledged is recorded in "Other interest-earning assets" on the... -

Page 138

... repurchases and issuances associated with these programs. Years Ended December 31, (Shares and per share amounts in actuals) Shares repurchased related to employee stock-based compensation plans(1) ...Average purchase price per share ...Common shares issued(2) ...(1) 2015 2014 2013 $ 3,008... -

Page 139

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (Dollars in thousands, unless otherwise noted) 12. Stockholders' Equity (Continued) Separation Adjustments Related to the Spin-Off of Navient During 2015, we finalized the balances received as part of the Spin-Off transaction for... -

Page 140

... balance sheets include certain assets and liabilities that have historically been held at pre-Spin-Off SLM but which are specifically identifiable or otherwise allocable to the Company. The cash and cash equivalents held by pre-SpinOff SLM at the corporate level were not allocated to the Bank... -

Page 141

...Preferred stock dividends ...Net income attributable to SLM Corporation common stock ...Denominator: Weighted average shares used to compute basic EPS ...Effect of dilutive securities: Dilutive effect of stock options, restricted stock, restricted stock units and Employee Stock Purchase Plan ("ESPP... -

Page 142

... by Sallie Mae officers and employees prior to the Spin-Off. In general, holders of awards granted prior to 2014 received both Sallie Mae and Navient equity awards, and holders of awards granted in 2014 received solely equity awards of their post-Spin-Off employer. Stock options, restricted stock... -

Page 143

...the stock price at the grant date. The following table summarizes stock option activity for the year ended December 31, 2015. (Dollars in thousands, except per share data) Number of Options Weighted Average Exercise Price per Share Weighted Average Remaining Contractual Term Aggregate Intrinsic... -

Page 144

... ("PSUs") are equity awards granted to employees that entitle the holder to shares of our common stock when the award vests. RSUs may be time-vested over three years or vested at grant but subject to transfer restrictions, while PSUs vest based on corporate earnings-related performance targets over... -

Page 145

... average period of 1.9 years. (2) Employee Stock Purchase Plan In the third quarter of 2014, we resumed offering the opportunity for employees to enroll in our ESPP. Employees may purchase shares of our common stock at the end of a 12-month offering period at a price equal to the share price... -

Page 146

... participants purchased 47,176 shares of our common stock. 15. Fair Value Measurements We use estimates of fair value in applying various accounting standards for our financial statements. We categorize our fair value estimates based on a hierarchal framework associated with three levels of price... -

Page 147

... instruments ...Total earning assets...Interest-bearing liabilities Money-market and savings accounts Certificates of deposit...Short-term borrowings ...Long-term borrowings ...Accrued interest payable ...Derivative instruments ...Total interest-bearing liabilities ...Excess of net asset fair value... -

Page 148

... cash flows using stated terms of the assets and internally developed assumptions to determine aggregate portfolio yield, net present value and average life. The significant assumptions used to determine fair value are prepayment speeds, default rates, cost of funds and required return on equity... -

Page 149

...' businesses prior to the Spin-Off, other than certain specifically identified liabilities relating to the conduct of our consumer banking business. Nonetheless, given the prior usage of the Sallie Mae and SLM names by entities now owned by Navient, we and our subsidiaries may from time to time be... -

Page 150

... action related to the servicing, operations and collections activities of pre-Spin-Off SLM and its subsidiaries with respect to Private Education Loans and FFELP Loans that were assets of the Bank or Navient at the time of the Spin-Off; provided that written notice is provided to Navient prior... -

Page 151

... well as servicing history information with respect to Private Education Loans previously serviced by Navient and access to certain promissory notes in Navient's possession. The loan servicing and administration agreement has a fixed term with a renewal option in favor of the Bank. The data sharing... -

Page 152

... of Utah and its deposits are insured by the FDIC. The Bank's ability to pay dividends is subject to the laws of Utah and the regulations of the FDIC. Generally, under Utah's industrial bank laws and regulations as well as FDIC regulations, the Bank may pay dividends from its net profits without... -

Page 153

... relating to customer complaints, fees and charges assessed in connection with the servicing of student loans and related collection practices of pre-Spin-Off SLM by entities now subsidiaries of Navient during a time period prior to the SpinOff. Two state attorney generals have provided the Bank... -

Page 154

... demands from state attorneys general, legislative committees, and administrative agencies. These requests may be for informational or regulatory purposes and may relate to our business practices, the industries in which we operate, or other companies with whom we conduct business. Our practice has... -

Page 155

...31, 2015 2014 2013 Statutory rate ...State tax, net of federal benefit ...Impact of state rate change on net deferred tax liabilities, net of federal benefit...State, valuation allowance adjustments on net operating losses ...Unrecognized tax benefits, U.S. federal and state, net of federal benefit... -

Page 156

... Loan reserves ...Stock-based compensation plans ...Deferred revenue...Operating loss and credit carryovers...Unrealized losses...Accrued expenses not currently deductible ...Unrecorded tax benefits ...Other ...Total deferred tax assets ...Deferred tax liabilities: Gains on repurchased debt ...Fixed... -

Page 157

...the effective tax rate. As a part of the Spin-Off, the Company recorded a liability related to uncertain tax positions for which it is indemnified by Navient. See Note 2, "Significant Accounting Policies - Income Taxes," for additional details. Tax related interest expense is reported as a component... -

Page 158

... save, plan and pay for college. We primarily originate, service and/or collect loans made to students and their families to finance the cost of their education. We provide funding, delivery and servicing support for education loans in the United States through our Private Education Loan programs... -

Page 159

... company's investments in its subsidiaries under the equity method. Parent Only Condensed Balance Sheets December 31, 2015 2014 Assets Cash and cash equivalents...Total investments in subsidiaries (primarily Sallie Mae Bank) ...Tax indemnification receivable ...Due from subsidiaries, net...Other... -

Page 160

... before income tax expense (benefit) and equity in net income from subsidiaries ...Income tax (benefit) expense ...Equity in net income from subsidiaries (primarily Sallie Mae Bank) ...Net income ...Preferred stock dividends ...Net income attributable to common stock ...$ $ 6,414 - 6,414 (239) 36... -

Page 161

... ...Total adjustments ...Net cash used in operating activities ...Cash flows from investing activities: Net cash provided by (used in) investing activities ...Cash flows from financing activities: Special cash contribution from Navient...Excess tax benefit from exercise of stock-based awards... -

Page 162

... intangible asset impairment and amortization expense ...Restructuring and other reorganization expenses ...Income tax expense ...Net income attributable to SLM Corporation ...Preferred stock dividends...Net income attributable to SLM Corporation common stock ...Basic earnings per common share... -

Page 163

... interest . . Net income attributable to SLM Corporation ...Preferred stock dividends...Net income attributable to SLM Corporation common stock ...Basic earnings per common share attributable to SLM Corporation ...Diluted earnings per common share attributable to SLM Corporation ... F-73 -

Page 164

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) (Dollars in thousands, unless otherwise noted...approximately 3 month LIBOR plus 1.00 percent on outstandings. The amended ABCP Facility extends the revolving period, during which we may borrow, repay and reborrow funds, until ... -

Page 165

Exhibit 10.6 SLM CORPORATION Executive Severance Plan for Senior Officers (Including Amendments as of June 25, 2015) -

Page 166

... of Plan. The name of this plan is the SLM Corporation Executive Severance Plan for Senior Officers ("Plan"). The purpose of the Plan is to provide compensation and benefits to certain senior level officers of SLM Corporation (the "Corporation") and Sallie Mae, Inc. upon employment termination... -

Page 167

..., long-term disability payments, payments from a nonqualified deferred compensation plan maintained by the Corporation, or amounts paid on account of the exercise of stock options or on account of the award or vesting of restricted or performance stock or other stock-based compensation. 2.03 "Board... -

Page 168

... (provided that variability in the value of stock-based compensation or in the compensation provided under the SLM Corporation Incentive Plan or a successor plan will not be deemed to cause a material reduction in compensation); or (c) a relocation of the Eligible Officer's primary work location to... -

Page 169

... Officer's Average Bonus times a multiplier plus a cash payment equal to the Eligible Officer's target annual bonus amount for the year in which the Termination Date occurs, such target bonus amount to be prorated for the full number of months in the final year that the Eligible Officer was employed... -

Page 170

... insurance plans generally available to the senior management of the Corporation, as such plans may be in effect from time to time on the terms generally applied to actively employed senior management of the Corporation, including any Eligible Officer cost-sharing provision. An Eligible Officer... -

Page 171

... Resources Officer, Chief Administrative Officer, and General Counsel (the "Committee"); provided, however, that nothing herein shall limit the authority of the Nominations, Governance and Compensation Committee of the Corporation's Board of Directors with respect to its right to review and approve... -

Page 172

... may submit comments, records, documents, or other information supporting the appeal, regardless of whether such information was considered in the prior benefits decision. Upon request and free of charge, the individual will be provided reasonable access to and copies of all documents, records and... -

Page 173

...person or institution referred to in (b) above, and the release will be a valid and complete discharge for the payment. 6.04 Notice of Address. Each Eligible Officer entitled to benefits under the Plan must file with the Corporation, in writing, his post office address and each change of post office... -

Page 174

..., amend the Plan (which amendment shall be effective upon its adoption or at such other time designated by the Board of Directors) at any time prior to a Termination Event as may be necessary to avoid the imposition of the additional tax under Section 409A(a)(1)(B) of the Code; provided, however... -

Page 175

6.10 Withholding Taxes. All payments made under this Plan will be subject to reduction to reflect taxes required to be withheld by law. 6.11 No Assignment. The rights of an Eligible Officer to payments or benefits under this Plan shall not be made subject to option or assignment, either by voluntary... -

Page 176

...A Example of calculation of "Average Bonus" Portion of Severance Payment under the Plan (Based on a 24-month look back) 1. Assumptions/Given: • Annual salary = $250,000 • Bonus (MIP) Target = 70% of annual rate ($175,000) • Current Corp MIP Score = 40% (score for the most recent quarter-end in... -

Page 177

...of calculation of "Average Bonus" Portion of Severance Payment under the Plan - with less than 2 years of service (Example assumes 18 months of employment from January 1, 2008, through June 30, 2009) 1. Assumptions/Given: • Annual salary = $250,000 • Bonus (MIP) Target = 70% of annual rate ($175... -

Page 178

8. Annualize 24 month prorated total by dividing by 2: • $100,000 ÷ 2 = $50,000 • Round = $50,000 -

Page 179

... the __ month period of [Date through Date]. (d) Benefit Programs: I waive future coverage and benefits under all SLM disability programs, but this Agreement and Release does not affect my eligibility for other SLM medical, dental, life insurance, retirement, and benefit plans. Whether I sign this... -

Page 180

..., and all related companies, and all of its former and current officers, employees, directors, and employee benefit programs (and the trustees, administrators, fiduciaries, and insurers of such programs) of any of them (collectively "Released Parties") from all actions, charges, claims, demands... -

Page 181

... the Age Discrimination in Employment (ADEA) after I have signed this Agreement and Release; or (c) prohibit or restrict me from: (i) making any disclosure of information required by law; (ii) filing a charge, initiating, making disclosures, testifying in, providing information to, or assisting in... -

Page 182

... or control to them. (b) Other than previously disclosed to SLM's General Counsel, Deputy General Counsel, or SLM's Board of Directors, I hereby represent and warrant that I have not reported any illegal or potentially illegal conduct or activities to any supervisor, manager, department head, human... -

Page 183

...have properly reported all hours that I have worked and I have been paid all wages, overtime, commissions, compensation, benefits, and other amounts that SLM or any Released Party should have paid me in the past, other than with respect to any benefit plan terminations or distributions authorized as... -

Page 184

... to work consistent with my experience, training, and education. To enable SLM to monitor compliance with the obligations imposed by this Agreement and Release, I further agree to inform in writing Sallie Mae's Senior Vice President, Human Resources of the identity of my subsequent employer (s) and... -

Page 185

... receive seventy percent (70%) of the cash Plan Benefits described in Section (1) above. Revocation of claims can be made by delivering a written notice of revocation to Senior Vice President, Administration, Sallie Mae, Inc., 300 Continental Drive, Newark, DE 19713. (9) I acknowledge that I have... -

Page 186

.... You have up to forty-five (45) calendar days to consider this Agreement and Release. By signing this Agreement and Release, you will be waiving any claims whether known or unknown. _____ Name _____ Date _____ Name Senior Vice President, Chief Human Resources Officer SLM Corporation _____ Date -

Page 187

Exhibit 10.7 SLM CORPORATION Change in Control Severance Plan for Senior Officers (Including Amendments as of June 25, 2015) -

Page 188

... stock-based compensation. 2.02"Board of Directors" means the Board of Directors of SLM Corporation. 2.03"Bonus" means the greater of: (a) the average of the annual bonuses earned under the SLM Corporation Incentive Plan or any successor plan for the two (2) year period prior to a Change in Control... -

Page 189

... a dissolution of the Corporation or the filing of a petition for relief under the United States Bankruptcy Code; or (e) such other events as the Board of Directors or a Committee of the Board of Directors from time to time may specify. 2.05"Cash Acceleration Change in Control" means the occurrence... -

Page 190

...'s employment by the Corporation for any reason other than "For Cause" or on account of death or disability, as defined in the Corporation's long-term disability policy in effect at the time of termination ("Disability"). ARTICLE 3 ELIGIBILITY AND BENEFITS 3.01Eligible Officers. Officers of SLM... -

Page 191

...medical and dental insurance benefits if within the first twenty-four (24) month period after the occurrence of a Cash Acceleration Change in Control, either: (i) the Eligible Officer gives written notice of his Termination of Employment for Good Reason, provided that if such notice is on account of... -

Page 192

... cushion amount to take into account that the final value of the benefits delivered to the Executive Officer could be determined at a later point in time. Each Eligible Officer shall cooperate fully with the Company to determine the benefits applicable under this Section. (b)Determination by... -

Page 193

... Resources Officer, Chief Administrative Officer, and General Counsel (the "Committee"); provided, however, that nothing herein shall limit the authority of the Nominations, Governance and Compensation Committee of the Corporation's Board of Directors with respect to its right to review and approve... -

Page 194

... or by written instrument signed by the majority. ARTICLE 5 CLAIM FOR BENEFITS UNDER THIS PLAN 5.01Claims for Benefits under this Plan. A condition precedent to receipt of severance benefits is the execution of an unaltered release of claims in form and substance prescribed by the Corporation. If an... -

Page 195

... of the Corporation's business and/ or assets shall be obligated under this Plan in the same manner and to the same extent as the Corporation would be required to perform it in the absence of a succession. (b) This Plan and all rights of the Eligible Officer hereunder shall inure to the benefit of... -

Page 196

... may, in its sole discretion, amend the Plan (which amendment shall be effective upon its adoption or at such other time designated by the Board of Directors) at any time prior to an Equity Acceleration Change in Control and/or Cash Acceleration Change in Control as may be necessary to avoid the... -

Page 197

... between the parties. 6.10Withholding Taxes. All payments made under this Plan shall be subject to reduction to reflect taxes required to be withheld by law. 6.11No Assignment. The rights of an Eligible Officer to payments or benefits under this Plan shall not be made subject to option or assignment... -

Page 198

...for the __ month period of [Date through Date]. (d)Benefit Programs: I waive future coverage and benefits under all SLM disability programs, but this Agreement and Release does not affect my eligibility for other SLM medical, dental, life insurance, retirement, and benefit plans. Whether I sign this... -

Page 199

..., and all related companies, and all of its former and current officers, employees, directors, and employee benefit programs (and the trustees, administrators, fiduciaries, and insurers of such programs) of any of them (collectively "Released Parties") from all actions, charges, claims, demands... -

Page 200

... the Age Discrimination in Employment (ADEA) after I have signed this Agreement and Release; or (c)prohibit or restrict me from: (i) making any disclosure of information required by law; (ii) filing a charge, initiating, making disclosures, testifying in, providing information to, or assisting in... -

Page 201

... to SLM's General Counsel, Deputy General Counsel, or SLM's Board of Directors, I hereby represent and warrant that I have not reported any illegal or potentially illegal conduct or activities to any supervisor, manager, department head, human resources representative, director, officer, agent... -

Page 202

... of my employment engaged in the same business conducted by SLM at the time of my termination. In further consideration of the Plan Benefits described above in this Agreement and Release, I agree that for [INSERT NUMBER OF MONTHS OF BASE PAY SEVERANCE IDENTIFIED IN PLAN SECTION 3.02] months after my... -

Page 203

... to work consistent with my experience, training, and education. To enable SLM to monitor compliance with the obligations imposed by this Agreement and Release, I further agree to inform in writing Sallie Mae's Senior Vice President, Human Resources of the identity of my subsequent employer (s) and... -

Page 204

...receive seventy percent (70%) of the cash Plan Benefits described in Section (1) above. Revocation of claims can be made by delivering a written notice of revocation to Senior Vice President, Administration, Sallie Mae, Inc., 300 Continental Drive, Newark, DE 19713. (9)I acknowledge that I have read... -

Page 205

.... You have up to forty-five (45) calendar days to consider this Agreement and Release. By signing this Agreement and Release, you will be waiving any claims whether known or unknown. _____ Name _____ Date _____ Name Senior Vice President, Chief Human Resources Officer SLM Corporation _____ Date -

Page 206

... PURPOSE The Sallie Mae Supplemental 401(k) Savings Plan (the "Supplemental Savings Plan") provides retirement benefits to certain officers and key employees of the Corporation (defined below) who are eligible to participate in a tax-qualified 401(k) savings plan sponsored by SLM Corporation or any... -

Page 207

... by Code Section 401(a)(17) and further, who are designated by the CEO or senior human resources officer of the Corporation, will be eligible to participate in the Supplemental Savings Plan ("Eligible Employees"). 4.2. Eligible Employees will be so advised and an account will be established in... -

Page 208

... SLM Corporation, New BLC Corporation, a Delaware corporation ("SLM BankCo"), and Navient Corporation, each Supplemental Savings Plan Account with amounts deemed invested in SLM Corporation common stock will be credited with one share of Navient Corporation common stock and one share of SLM BankCo... -

Page 209

... Terminates Employment. An election to change the time and manner of payment of amounts credited to a Participant's Supplemental Savings Plan Account and earnings credited to such amounts: 1) must delay distribution of such amounts for at least 5 years beyond the original distribution date... -

Page 210

... to defer receipt of payment under this Supplemental Savings Plan once such payment is due. Additionally, except as provided in Section 7.4 above, no amounts credited to a Supplemental Savings Plan Account will be subject to withdrawal while the Participant is employed by the Corporation. Amounts... -

Page 211

... from the general assets of the Corporation, and no special or separate fund will be established or other segregation of assets made to assure such payments. Nothing contained in the Supplemental Savings Plan will create a trust of any kind. In the event that any Participant or other person acquires... -

Page 212

... Neither the establishment of the Supplemental Savings Plan, any modifications thereof, nor the payment of any amounts under the Supplemental Savings Plan will be construed as giving to any employee or other person any legal or equitable right against the Corporation, the Board of Directors of the... -

Page 213

...and the release of such other person or institution will be a valid and complete discharge for the payment. 14.2. Notice of Address. Each person entitled to benefits under the Plan must file with the Administrator, in writing, his mailing address and each change of mailing address. Any communication... -

Page 214

...as of April 28, 2014, by and among SLM Corporation, New BLC Corporation ("SLM BankCo"), and Navient Corporation. The Predecessor Plan, originally known as the SLM Holding Corporation and USA Education, Inc. Deferred Compensation Plan for Key Employees, first became effective January 1, 1998, and was... -

Page 215

... the terms of this Plan. Code. "Code" means the Internal Revenue Code of 1986, as amended from time to time. Committee. "Committee" means the SLM Corporation Retirement Committee, or such other committee whose members may be appointed by and serving at the pleasure of the management-level Enterprise... -

Page 216

... from time to time pursuant to which deemed earnings are credited to the Participant's Distribution Option Account. Eligible Employee. "Eligible Employee" means an Employee who is a member of the group of selected management and/or highly compensated Employees of the Company and who is designated by... -

Page 217

...SLM Corporation Deferred Compensation Plan for Key Employees, as established effective May 1, 2014, and as thereafter amended from time to time. Plan Year. "Plan Year" means the 12-month period beginning on each January 1 and ending on the following December 31. Post-Distribution Navient Share Price... -

Page 218

.... "Service" also includes employment with an Affiliate if an Employee transfers directly between the Company and the Affiliate. Specified Employee. "Specified Employee" means a person identified in accordance with procedures adopted by the Committee that reflect the requirements of Code Section... -

Page 219

...opportunity to defer Salary to be earned in the following Plan Year. Any Eligible Employee may enroll in the Plan, effective as of the first day of a Plan Year, by filing a complete and fully executed Enrollment Agreement with the Company's Human Resources Department or a Plan administrator selected... -

Page 220

... Options. The Committee may establish minimum or maximum amounts that may be deferred under this Section and may change such standards from time to time. Any such limits shall be communicated by the Company to the Eligible Employees prior to the commencement of a Plan Year. Once a Participant files... -

Page 221

...performance of such Earnings Crediting Option, and shall equal the total return of such Earnings Crediting Option, net of asset based charges, including, without limitation, money management fees, fund expenses and mortality and expense risk insurance contract charges. The Company reserves the right... -

Page 222

...12 months before the original distribution date; and 3) will not be effective until 12 months after the Participant makes the new election. Once a Participant Terminates Employment, he may change his election with respect to the timing and manner of payment of his Retirement Distribution Account but... -

Page 223

... derived and is acceptable to the Company's Human Resources Department or a Plan administrator selected by the Company; except that amounts deemed to be allocated to SLM Corporation stock as an Earnings Crediting Option shall be made in a lump sum in SLM Corporation stock as provided in Section 12... -

Page 224

... Valuation Date immediately preceding Plan Year divided by (ii) the number of installments remaining. With respect to Grandfathered Funds, a Participant may accelerate the distribution of his Retirement Distribution Account balance upon the occurrence of a Change in Control. With respect to amounts... -

Page 225

... to his Retirement. With regard to amounts deferred into an In-Service Distribution Account constituting Grandfathered Funds, such lump sum will be distributed in Sallie Mae common stock no later than 60 days following termination of Service for Participants who are Executive Officers for purposes... -

Page 226

... the number of annual installments remaining to be paid pursuant to the election of the Participant. Section 9.3. Survivor Benefits Under the In-Service Distribution Option. A Participant may elect on the Enrollment Agreement the time and manner of payment of his In-Service Distribution Account in... -

Page 227

...that the Committee, upon written request of a Participant, determines, in its sole discretion, that the Participant has suffered an unforeseeable financial emergency, the Company shall pay to the Participant from the vested portion of his Distribution Option Account, as soon as practicable following... -

Page 228

... the Plan less than two years. Amounts in excess of Grandfathered Funds that are deferred into a Participant's Distribution Option Account and earnings credited to such amounts may not be withdrawn under Article 11. Section 11.2. Acceleration of Periodic Distributions. Upon the Participant's written... -

Page 229

... credited to such amounts, any portion of an Insider's Distribution Option Account deemed to be invested in Sallie Mae common stock shall be distributed in a lump sum in the form of Sallie Mae common stock at least 6 months following Termination of Employment. Section 12.2. Designated Key Employees... -

Page 230

...of Code Section 409A and any guidance issued thereunder) with respect to Grandfathered Funds. Section 13.2. Claims Procedure. (a) Claim A person who believes that he is being denied a benefit to which he is entitled under the Plan (hereinafter referred to as a "Claimant") may file a written request... -

Page 231

...to which the Participant may be entitled under any other arrangement established by the Company for the benefit of its employees. Section 13.5. No Limitation on Company Actions. Nothing contained in the Plan shall be construed to prevent the Company from taking any action which is deemed by it to be... -

Page 232

... individual tax liabilities relating to any such benefits. Section 13.10. Unfunded Status of Plan. The Plan is intended to constitute an "unfunded" plan of deferred compensation for Participants. Benefits payable hereunder shall be payable out of the general assets of the Company, and no segregation... -

Page 233

... on the postmark on the receipt for registration or certification. IN WITNESS WHEREOF, SLM Corporation has caused this Plan to be duly executed in its name and on its behalf as of the _____ day of , 2015. SLM Corporation By Bonnie Beasley Senior Vice President and Chief Human Resources Officer 20 -

Page 234