PNC Bank 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our response differs. We are seeking to increase customers and deepen our relationships

with them. As a result, we are offering new, integrated payment products that connect

checking, credit, debit and rewards, and that leverage our highly successful Virtual Wallet

bank account offering.

This approach reflects our extensive research, indicating customers want choice, transparency

and value from their bank. We believe this is consistent with our brand promise to customers

and employees and is aligned to our shareholders’ expectations.

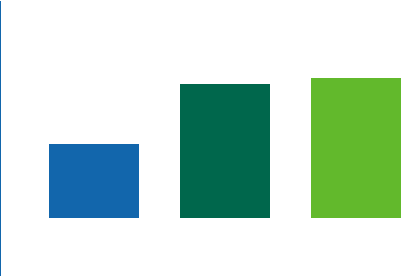

Asset Management Group Our Asset Management Group had an

outstanding 2010, with full year earnings up 34 percent compared with

2009. Asset flows improved through the year, picking up speed in the

second half. This sales momentum combined with a year-end lift in equity

markets helped us reach $212 billion in assets under administration by

year end. Assets under management totaled $108 billion.

Despite extreme market volatility in the last two years, Asset Management has consistently

grown sales and acquired new clients. Referrals from other PNC business units, including

Retail Banking and Corporate & Institutional Banking, enabled us to end 2010 with one of the

strongest prospect pipelines we have ever had. In fact, total sales and referrals from PNC

businesses increased 60 percent in comparison with 2009 and now make up 30 percent of

overall sales. We believe these in-house referrals to be among the best in the industry, and we

think we can do even better by spreading the practice to more PNC units.

A strong pipeline gives us the confidence to invest aggressively in Asset Management.

Last year, we hired approximately 500 employees, placing many of them in higher-potential

markets such as Chicago, Florida, Milwaukee and Washington, D.C. We are not finished.

Over the next two years, we expect to add 400 more employees in this business.

We are investing in technology as well as people. Later this year, we will introduce a new tool

specifically designed to give our high-net-worth clients a consolidated view of their assets in

much the same way Virtual Wallet provides retail customers with a high-definition view of their

money. This tool, called Wealth Insight, will provide our Asset Management customers with

more information about their assets, and we believe it will give us a competitive advantage in

the marketplace.

Residential Mortgage Banking Two years ago, PNC made the decision to return to the national

residential mortgage business as it is a key consumer-banking product. We believe this strategy

provides us with opportunities to deepen customer relationships while maintaining our focus on

moderate risk.

Assets Under Management

Billions

$57

$103

2008 2009 2010

$108