PNC Bank 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In the end, we believe our capital position, together with our earnings potential, gives us the

flexibility to comply with new regulatory capital requirements when finalized while still returning

capital to our shareholders.

The progress we made and our results in 2010 contributed to a 15 percent increase in PNC’s

share price. Taking a longer view, we ranked third among our peers in total shareholder return

on a five-year basis. For the same period, we outperformed the overall stock market index, the

S&P 500 index, the S&P 500 bank index and our peer group average.*

Serving the Needs of Consumers and Small Business The combination of Retail

Banking, Residential Mortgage Banking and our Asset Management Group accounted for

nearly half of our 2010 revenue. We offer a broad array of products and services for individual

consumers, small businesses, colleges and universities, and institutional clients.

Retail Banking PNC has more than 5.4 million consumer and small

business checking relationships, which we see as a cornerstone product

in our client acquisition strategy. We increased these relationships by

75,000 and grew average transaction deposits by more than $3 billion

in 2010.

While we attract the majority of our new customers through our 2,500

branches, 38 percent of our total account acquisition in 2010 came

through alternative channels. These channels play an important role in

our client acquisition success.

For example, through our University Banking program, we currently have relationships with

more than 200 colleges and universities, an increase of nearly 75 percent from 2009. This

program gives us the opportunity to market PNC’s retail products to more than 300,000

incoming freshmen and approximately 1.9 million students overall. Once we have these

customers in the door, our wide branch network and innovative products provide us with

long-term retention opportunities.

In my tenure at PNC, few changes have been as notable as the decline of paper checks.

Customers have been moving away from checks and toward electronic payments at an

accelerating pace. At the same time, we are seeing tremendous growth in mobile banking.

At PNC, we recognize that changes in customer preferences along with financial reform will

affect Retail Banking. We know that many of our peers have announced increased fees and the

elimination of free checking, which we believe will result in significant market disruption.

O

* PNC’s 2010 peer group consists of BB&T Corporation, Bank of America Corporation, Capital One Financial, Inc., Comerica Inc., Fifth Third

Bancorp, JPMorgan Chase, KeyCorp, M&T Bank, Regions Financial Corporation, SunTrust Banks, Inc., U.S. Bancorp, and Wells Fargo & Co.

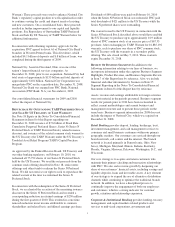

Checking Relationships

Thousands

2,402

5,390

2008 2009 2010

5,465