ICICI Bank 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F20

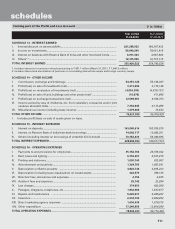

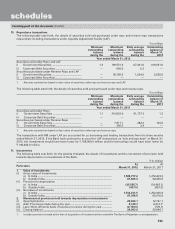

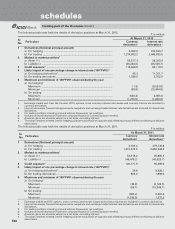

The following table sets forth, for the periods indicated, capital expenditure and depreciation thereon for the geographical

segments.

` in million

Capital expenditure incurred during Depreciation provided during

Year ended

March 31, 2012 Year ended

March 31, 2011

Year ended

March 31, 2012

Year ended

March 31, 2011

Domestic operations ........................ 3,616.0 21,484.5 5,211.8 5,590.1

Foreign operations ........................... 72.8 44.7 33.5 34.3

Total .................................................. 3,688.8 21,529.2 5,245.3 5,624.4

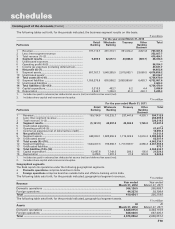

5. Maturity pattern

xIn compiling the information of maturity pattern, certain estimates and assumptions have been made by the management.

xAssets and liabilities in foreign currency exclude off-balance sheet assets and liabilities.

The following table sets forth, the maturity pattern of assets and liabilities of the Bank at March 31, 2012.

` in million

Maturity buckets

Loans &

Advances 2

Investment

securities2

Deposits2Borrowings2,3 Total foreign

currency

assets

Total foreign

currency

liabilities

Day 11 ................................................. 7,738.5 35,284.9 19,792.9 — 30,222.0 2,688.8

2 to 7 days1 ........................................ 13,041.4 217,729.6 44,612.6 174,543.1 69,821.6 9,310.3

8 to 14 days1 ...................................... 13,191.0 49,505.7 54,744.2 2,543.6 10,671.6 7,216.8

15 to 28 days ..................................... 39,001.7 95,723.5 97,134.4 26,841.4 21,209.7 25,492.3

29 days to 3 months .......................... 142,209.3 77,392.4 273,131.8 80,937.6 67,038.9 114,905.9

3 to 6 months ..................................... 188,828.5 87,627.9 288,254.6 141,606.5 73,969.8 129,864.6

6 months to 1 year ............................ 336,379.4 149,466.7 452,112.8 223,622.4 95,326.5 241,781.4

1 to 3 years ........................................ 1,043,883.5 245,244.2 690,126.6 173,520.5 172,330.3 197,466.2

3 to 5 years ........................................ 388,469.1 152,923.0 228,550.3 197,146.0 147,925.4 140,532.7

Above 5 years .................................... 364,534.2 484,702.5 406,539.4 380,888.0 254,969.4 151,621.8

Total ................................................... 2,537,276.6 1,595,600.4 2,554,999.6 1,401,649.1 943,485.2 1,020,880.8

1. The aforesaid disclosure is in accordance with the revised maturity buckets as per the RBI circular no. DBOD.BP.BC.22/21.04.018/2009-10

dated July 1, 2009.

2. Includes foreign currency balances.

3. Includes borrowings in the nature of subordinated debts and preference shares as per RBI guidelines vide circular no. DBOD.BP.BC no.

81/21.01.002/2009-10.

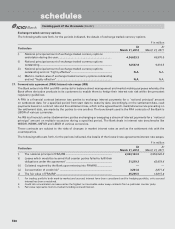

The following table sets forth the maturity pattern of assets and liabilities of the Bank at March 31, 2011.

` in million

Maturity buckets

Loans &

Advances2

Investment

securities2

Deposits2Borrowings2,3 Total foreign

currency

assets

Total foreign

currency

liabilities

Day 11 ................................................. 9,280.7 49,614.9 45,279.5 913.1 57,011.6 35,628.8

2 to 7 days1 ........................................ 12,637.9 18,462.6 63,935.7 3,028.3 27,144.3 6,388.6

8 to 14 days1 ...................................... 14,881.9 24,073.6 54,938.5 7,270.2 11,484.9 8,654.3

15 to 28 days ..................................... 26,058.4 92,754.3 64,625.1 23,284.7 13,578.6 16,578.0

29 days to 3 months .......................... 149,170.8 96,887.8 212,721.9 92,328.3 58,021.5 78,777.9

3 to 6 months ..................................... 190,491.4 76,649.1 178,717.0 108,229.9 29,419.1 114,994.8

6 months to 1 year ............................ 260,740.5 120,666.5 374,534.2 138,828.8 53,188.7 153,395.3

1 to 3 years ........................................ 889,201.1 359,736.2 1,177,196.9 229,022.1 214,539.8 202,968.1

3 to 5 years ........................................ 342,603.1 106,907.7 33,946.6 110,920.2 131,949.7 80,851.3

Above 5 years .................................... 268,593.1 401,106.8 50,125.7 381,717.2 170,112.0 138,821.6

Total .................................................. 2,163,659.0 1,346,859.6 2,256,021.1 1,095,542.8 766,450.2 837,058.7

1. The aforesaid disclosure is in accordance with the revised maturity buckets as per the RBI circular no. DBOD.

BP.BC.22/21.04.018/2009-10 dated July 1, 2009.

2. Includes foreign currency balances.

3. Includes borrowings in the nature of subordinated debts and preference shares as per RBI guidelines vide circular no. DBOD.

BP.BC no. 81/21.01.002/2009-10.

forming part of the Accounts (Contd.)

schedules