ICICI Bank 2012 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F105

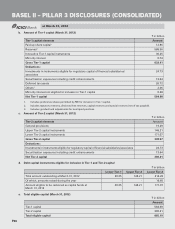

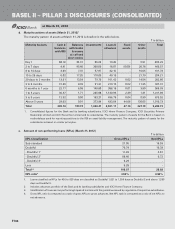

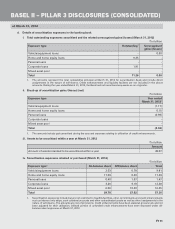

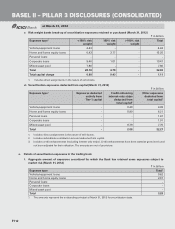

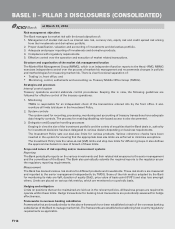

f. Movement of NPLs

` in billion

Gross NPL Net NPL

Opening balance at April 1, 2011 109.57 30.53

Additions during the year1 35.65 18.31

Reductions/write-offs during the year1 (39.15) (21.92)

Closing balance at March 31, 20122 106.07 26.92

1. The difference between the opening and closing balances (other than accounts written off during the year) of NPLs in

credit cards is included in additions during the year.

2. Includes advances portfolio of the Bank and its banking subsidiaries and ICICI Home Finance Company.

g. Movement of provisions for NPLs

` in billion

Amount

Opening balance at April 1, 2011 79.04

Provisions made during the year1 22.08

Write-offs during the year (11.57)

Write-back of excess provisions during the year (10.39)

Closing balance at March 31, 20122 79.16

1. The difference between the opening and closing balances (other than accounts written off during the year) of provisions

on credit cards is included in provisions made during the year.

2 Includes advances portfolio of the Bank and its banking subsidiaries and ICICI Home Finance Company.

h. Amount of non-performing investments (NPIs) in securities, other than government and other approved securities

` in billion

Amount1

Gross NPIs at March 31, 2012 6.19

Total provisions held on NPIs 4.68

Net NPIs at March 31, 2012 1.51

1. Includes NPIs of the Bank and its banking subsidiaries.

i. Movement of provisions for depreciation on investments1

` in billion

Amount

Opening balance at April 1, 2011 28.22

Provision/depreciation (net) made during the year 2.93

(Write-off)/(write back) of excess provision during the year (2.90)

Closing balance at March 31, 2012228.25

1. After considering movement in appreciation on investments.

2. Includes all entities considered for Basel II capital adequacy computation.

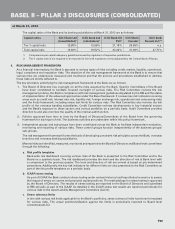

6. CREDIT RISK: PORTFOLIOS SUBJECT TO THE STANDARDISED APPROACH

a. External ratings

The Bank uses the standardised approach to measure the capital requirements for credit risk. As per the standardised

approach, regulatory capital requirements for credit risk on corporate exposures is measured based on external

credit ratings assigned by External Credit Assessment Institutions (ECAI) specified by RBI in its guidelines on Basel

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2012