ICICI Bank 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

at March 31, 2012. During fiscal 2012 also, we

were able to maintain this momentum despite

the tight systemic liquidity, high interest rates

and the changing competitive landscape. In

addition, we have significantly enhanced our

retail term deposit franchise, substantially

increasing the share of retail deposits in our

total deposit base.

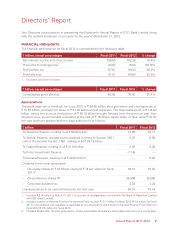

• Our net interest margin has improved from

2.43% in fiscal 2009 to 2.73% in fiscal 2012,

through focused efforts on both the asset

and liability sides of the balance sheet in our

domestic and overseas businesses.

• We have reduced our net non-performing

asset ratio from 2.19% at the peak to 0.62%

at March 31, 2012. The improvement in asset

quality is also evident in the reduction in the

provision charge in our profit & loss account,

which has declined from a peak of 2.29%

of average loans in fiscal 2010 to 0.68%

of average loans in fiscal 2012. Provisions

declined by 31% in fiscal 2012 on a year-on-

year basis.

• With the above improvements, we have grown

our business. After a year of consolidation in

fiscal 2010, we grew our balance sheet at a

robust pace over the last two years. In fiscal

2012, our loans and advances grew by 17%.

• Our return on assets has improved from

0.98% in fiscal 2009 to 1.50% in fiscal 2012,

demonstrating a fundamental positive shift in

our profitability.

• ICICI Bank’s return on equity improved from

7.7% in fiscal 2009 to 11.1% in fiscal 2012.

On a consolidated basis, the return on equity

improved at an even faster pace, from 7.8%

to 13.0% over the same period, reflecting the

robust performance of not only ICICI Bank

but also our subsidiaries operating in various

segments of the financial services sector.

Amidst a rapidly evolving global and domestic

economic environment, we at ICICI Bank have

continued to focus on the strategic path we

outlined three years ago. We had articulated a

clear vision of where we wanted to be, and a

clear path towards getting there. Our goal was

to rebalance our funding mix & grow our retail

deposit base; substantially improve asset quality;

and enhance our profitability. Through this, we

sought to position ourselves to participate in the

growth opportunities in the Indian economy and

its global linkages. I am happy to say that we have

executed this strategy with focus and diligence.

Let me take this opportunity to share just a few

highlights of the progress we have made over

this three year journey.

• We have improved the share of low cost

current and savings accounts in our deposit

base from 28.7% at March 31, 2009 to 43.5%

Letter from the Managing Director & CEO

CHANDA KOCHHAR Managing Director & CEO

4