ICICI Bank 2012 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F121

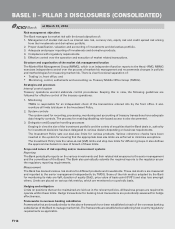

13. RISK MANAGEMENT FRAMEWORK OF ICICI SECURITIES PRIMARY DEALERSHIP LIMITED

The Board of Directors of the Company maintains oversight on the risk management framework of the Company

and approves all major risk management policies and procedures. The Risk Management Committee of the Board is

responsible for analysing and monitoring the risks associated with the different business activities of the Company and

ensuring adherence to the risk and investment limits set by the Board of Directors.

The risk management function in the Company is managed by the Corporate Risk Management Group within the broad

framework of risk policies and guidelines established by the Risk Management Committee.

The risk control framework is through an effective management information system, which tracks the investments as

well as the VaR reports for portfolios. Valuation of instruments is carried out by mid-office as per guidelines issued by

RBI/FIMMDA and other applicable regulatory agencies.

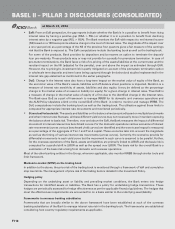

14. RISK MANAGEMENT FRAMEWORK OF ICICI HOME FINANCE COMPANY LIMITED

The Board of Directors of the Company is responsible for the oversight and control of the functioning of the Company

and approves all major policies and procedures of the Company. The Board of Directors has oversight of all the risks

assumed by the company. The Board also functions through various board level and executive committees such as:

a) Audit Committee

b) Management Committee

c) Asset Liability Management Committee

d) Committee of Directors

e) Committee of Executives

f) Product & Processes Approval Committee

g) Banking Operations and Premises Committee

The policies approved by the Board of Directors form the governing framework for overall risk management. The key

policies in this regard are Asset Liability Management Policy, Investment Policy, Anti-Money Laundering Policy, Risk

management Policy, Credit & Recovery Policy, Credit Approval Authorisation Manual and Outsourcing Policy. Business

activities are undertaken within this framework. Independent support groups such as Compliance and Policy & Risk have

been constituted to facilitate independent evaluation, monitoring and reporting of various risks. Additionally, independent

functions such as internal audit & legal are supported by the Internal Audit Department & Corporate Legal Group of ICICI

Bank under the oversight & monitoring of the Audit Committee of the Board of ICICI Home Finance Company. These

support groups function independent of the business groups and represent themselves at the various committees.

The Company’s balance sheet is exposed to liquidity and interest rate risks arising out of borrowing and lending business.

The Asset Liability Management Committee has overall responsibility of monitoring and managing the structural liquidity

and interest rate risk. The Asset Liability Management Committee on a periodic basis (at least once in quarter and more

often if required) reviews the asset liability management position. The company also has in place Liquidity Contingency

Plan that defines the minimum threshold level of liquidity to be maintained. Interest rate risk may arise due to change in

interest rate environment.

15. RISK MANAGEMENT FRAMEWORK OF ICICI PRUDENTIAL LIFE INSURANCE COMPANY LIMITED

The risk governance structure consists of the Board, Board Risk Management Committee (BRMC), Executive Risk

Committee (ERC) and its sub committees. The BRMC comprises non-executive directors. The Board, on recommendation

of BRMC, has approved the following risk policies:

Board Market Risk Policy;

Board Credit Risk Policy;

Board Liquidity Risk Policy;

Board Insurance Risk Policy;

Board Operational Risk Policy;

Board Reinsurance Risk Policy;

Board Underwriting Risk Policy; and

Board Outsourcing Risk Policy.

The risk policies set out the governance structure for risk management in the Company. The ERC, chaired by the Chief

Actuary, is responsible for assisting the Board and the BRMC in their risk management duties and, in particular, is

responsible for the approval of all new products launched by the Company.

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2012