ICICI Bank 2012 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F95

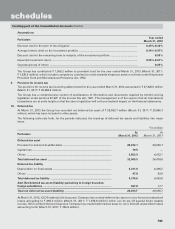

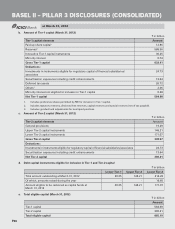

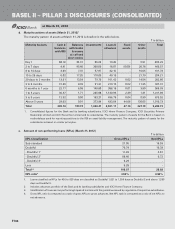

b. Bank’s interest in insurance entities

The book value of the Bank’s total interest in its insurance subsidiaries at March 31, 2012, which is deducted from

capital for capital adequacy under Basel II is detailed in the following table.

` in billion

Name of the entity Country of

incorporation

Ownership

interest

Book value of

investment

ICICI Prudential Life Insurance Company Limited India 73.86% 35.93

ICICI Lombard General Insurance Company Limited India 73.44% 13.48

The quantitative impact on regulatory capital of using risk weighted investments method versus using the

deduction method at March 31, 2012 is set out in the following table.

` in billion

Method Quantitative impact

Deduction method 49.41

Capital at 9% based on risk weighted assets 4.45

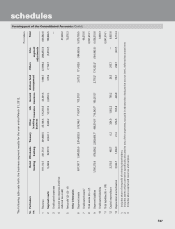

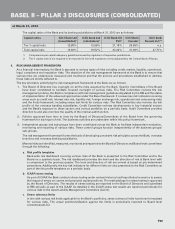

2. CAPITAL STRUCTURE

a. Summary information on main terms and conditions/features of capital instruments

As per the RBI capital adequacy norms, ICICI Bank’s regulatory capital is classified into Tier-1 capital and Tier-2

capital.

Tier-1 capital includes paid-up equity capital, statutory reserves, other disclosed free reserves, capital reserves

and innovative perpetual debt instruments (Tier-1 bonds) eligible for inclusion in Tier-1 capital that comply with

requirement specified by RBI.

Tier-2 capital includes revaluation reserves (if any), general provision and loss reserve, investment reserve, upper

Tier-2 instruments (upper Tier-2 bonds) and subordinate debt instruments (lower Tier-2 bonds) eligible for inclusion

in Tier-2 capital.

ICICI Bank and its subsidiaries have issued debt instruments that form a part of Tier-1 and Tier-2 capital. The terms

and conditions that are applicable for these instruments comply with the stipulated regulatory requirements and

where required an independent legal opinion has been obtained for inclusion of these instruments in capital.

Tier-1 bonds are non-cumulative and perpetual in nature with a call option after 10 years. Interest on Tier-1 bonds

is payable either annually or semi-annually. These Tier-1 bonds have a step-up clause on interest payment ranging

up to 100 basis points.

The upper Tier-2 bonds are cumulative and have an original maturity of 15 years with call option after 10 years.

The interest on upper Tier-2 bonds is payable either annually or semi-annually. Some of the upper Tier-2 debt

instruments have a step-up clause on interest payment ranging up to 100 basis points.

The lower Tier-2 bonds (subordinated debt) are cumulative and have an original maturity between 5 to 15 years.

The interest on lower Tier-2 capital instruments is payable quarterly, semi-annually or annually.

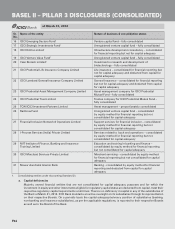

RBI through its circular dated January 20, 2011 stipulated that henceforth capital instruments issued with step-

up option will not be eligible for inclusion in the capital funds. Capital issuances with step-up option prior to the

release of the above-mentioned circular would continue to remain eligible for inclusion in regulatory capital. The

Bank is in compliance with this stipulation and the existing Tier-1 and Tier-2 capital instruments with step-up option

have all been issued prior to January 20, 2011.

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2012