ICICI Bank 2012 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

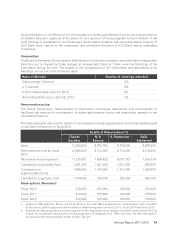

O The Risk Committee of the Board reviews risk management policies of the Bank in relation to

various risks. The Risk Committee reviews various risk policies pertaining to credit, market, liquidity,

operational and outsourcing risks, review of the Bank’s stress testing framework and group risk

management framework. The Committee reviews the risk profile of the Bank through periodic

review of the key risk indicators and risk profile templates and annual review of the Internal

Capital Adequacy Assessment Process (ICAAP). The Committee also reviews the risk profile of

its overseas banking subsidiaries annually. The Risk Committee reviews the Bank’s compliance

with risk management guidelines stipulated by the Reserve Bank of India and of the status of

implementation of the advanced approaches under the Basel framework. The Risk Committee also

reviews the stress-testing framework as part of the ICAAP. The stress-testing framework included

a wide range of Bank-specific and market (systemic) scenarios. Linkage of macroeconomic factors

to stress test scenarios was documented as a part of ICAAP. The ICAAP exercise covers the

domestic and overseas operations of the Bank, the banking subsidiaries and the material non-

banking subsidiaries. The Risk Committee also reviews the Liquidity Contingency Plan (LCP) for the

Bank and the threshold limits. During the year the Bank has also finalised the approach towards

Enterprise Risk Management framework.

O Apart from sanctioning credit proposals, the Credit Committee of the Board reviews developments

in key industrial sectors and the Bank’s exposure to these sectors as well as to large borrower

accounts. The Credit Committee also reviews the non-performing loans, accounts under watch,

overdues and incremental sanctions.

O The Audit Committee of the Board provides direction to and monitors the quality of the internal

audit function and also monitors compliance with inspection and audit reports of Reserve Bank of

India and statutory auditors.

O The Asset Liability Management Committee is responsible for managing liquidity and interest rate

risk and reviewing asset-liability position of the Bank.

A summary of reviews conducted by these Committees are reported to the Board on a regular basis.

Policies approved from time to time by the Board of Directors/Committees of the Board form the

governing framework for each type of risk. The business activities are undertaken within this policy

framework. Independent groups and sub-groups have been constituted across the Bank to facilitate

independent evaluation, monitoring and reporting of various risks. These groups function independently

of the business groups/sub-groups.

The Bank has dedicated groups, namely, the Risk Management Group, Compliance Group, Corporate

Legal Group, Internal Audit Group and the Financial Crime Prevention & Reputation Risk Management

Group, with a mandate to identify, assess and monitor all of the Bank’s principal risks in accordance with

well-defined policies and procedures. Risk Management Group is further organised into the Credit Risk

Management Group, Market Risk Management Group and Operational Risk Management Group. These

groups are completely independent of all business operations and coordinate with representatives

of the business units to implement ICICI Bank’s risk management policies and methodologies. The

internal audit and compliance groups are responsible to the Audit Committee of the Board.

CORPORATE GOVERNANCE

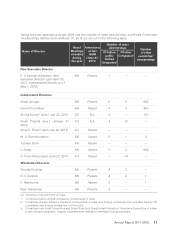

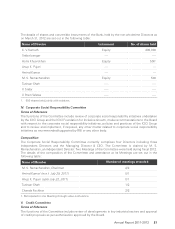

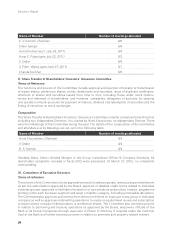

The corporate governance framework at ICICI Bank is based on an effective independent Board, the

separation of the Board’s supervisory role from the executive management and the constitution of Board

Committees, generally comprising a majority of independent Directors and chaired by independent

Directors, to oversee critical areas.

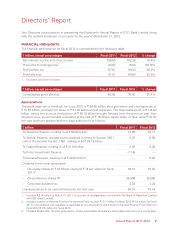

Directors’ Report

14