ICICI Bank 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.44

and mitigation of operational risk, developing a common understanding of operational risk and helping

the business and operation groups to improve internal controls, thereby reducing the probability and

potential impact of losses from operational risks. The Bank has also constituted an Operational Risk

Management Committee (ORMC) to oversee the operational risk management in the Bank. The ORM

Policy specifies the composition, roles and responsibilities of the ORMC. While the Policy provides a

broad framework, detailed standard operating procedures for operational risk management processes

have been established. Operational risk management framework in the Bank comprises identification

and assessment of risks and controls, new products and process approval framework, measurement

through incidents and exposure reporting, monitoring through key risk indicators and mitigation through

process and control enhancement and insurance. The Bank has formed an independent Operational

Risk Management Group for design, implementation and enhancement of operational risk management

framework and to support business and operations groups in the operational risk management on an

on-going basis.

We seek to ensure that our capital position supports the risks in our business and our future growth

plans through a robust capital management framework. This includes a comprehensive internal capital

adequacy assessment process conducted annually, which determines the adequate level of capitalisation

necessary to meet regulatory norms and current and future business needs, including under stress

scenarios. We believe we are well-placed to comply with RBI’s guidelines on the implementation of the

Basel III framework in India. We are also working towards migration to the advanced approaches under

the Basel II framework over the medium term, subject to applicable RBI guidelines and approvals.

HUMAN RESOURCES

We continued with our efforts to further strengthen the delivery of our employee value proposition –

“Saath Aapka” - a promise of care, nurturing and opportunity to accomplish professional aspirations.

During the year, we launched two new internal training academies – The Rural & Inclusive Banking

Academy and The Privilege Banking Academy – to support and strengthen the execution of Bank’s

rural and retail banking strategies. The academies focused on equipping new employees with requisite

functional knowledge (covering product features, processes and regulations) and essential customer

service and selling skills before placing them in their respective roles. To facilitate the rural strategy,

we focused on hiring sales professionals familiar with the local language and market. Similarly, the

privilege banking strategy was supported through infusion of trained resources in key markets to

deepen relationship with our customers.

The Bank continued to invest in its industry-academia initiatives to build a talent pool with the required

knowledge and skills for the banking sector. This year, the capacity of our flagship Probationary Officer

programme was enhanced from 1,400 to 2,400 per year. The programme received more than 250,000

applications for 2,400 seats. The Bank also launched two programmes under the aegis of ICICI Business

Leadership Programme, one in partnership with NIIT University and the other with National Institute of

Securities Markets (NISM). These programmes aim to create a talent pool for specialised functions

such as wholesale banking, risk management, treasury and information technology.

The Bank continued to focus on improving service delivery to its customers by placing more experienced

and seasoned staff in leadership positions at the branches. “Skill through Drill”, an innovative video-

based program, was offered to our branch staff to equip them with requisite service skills to deliver the

better service to our customers. All employees in customer service and sales roles were assessed and

certified on threshold functional knowledge.

The Bank continued to provide internal platforms to the employees to engage with senior management,

share views and have an open dialogue on organisation policies and practices. This year, more than

400 such sessions were held with employees where the dialogue was facilitated by senior managers of

the Bank. In addition to engaging with employees and resolving their concerns, the Bank continued to

stand by employees in their hour of need. The industrial relations environment for the Bank remained

cordial and conducive for achieving organisation’s objectives.

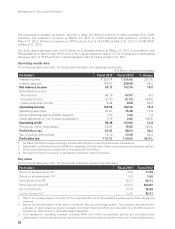

Business Overview