ICICI Bank 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2011-2012 57

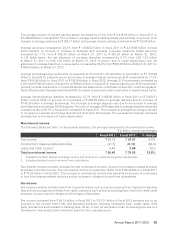

Payments to and provisions for employees

Employee expenses increased by 24.8% from ` 28.17 billion in fiscal 2011 to ` 35.15 billion in fiscal 2012.

Employee expenses increased primarily due to annual increase in salaries and performance bonus and

increase in the employee base, including sales executives, employees on fixed term contracts and interns.

The average number of employees increased by around 18% in fiscal 2012 compared to fiscal 2011 (at

March 31, 2011: 56,969 employees and at March 31, 2012: 58,276 employees).

Depreciation

Depreciation on owned property decreased marginally from ` 4.84 billion in fiscal 2011 to ` 4.82 billion in

fiscal 2012. Depreciation on leased assets decreased from ` 0.79 billion in fiscal 2011 to ` 0.42 billion in fiscal

2012 primarily due to a reduction in leased assets.

Other administrative expenses

Other administrative expenses primarily include rent, taxes and lighting, advertisement and publicity, repairs

and maintenance and other expenditure. Other administrative expenses increased by 18.5% from ` 30.80

billion in fiscal 2011 to ` 36.51 billion in fiscal 2012. The increase in other administrative expenses was

primarily due to increase in our branch and ATM network. The number of branches and extension counters

(excluding foreign branches and offshore banking units) increased from 2,529 at March 31, 2011 to 2,752 at

March 31, 2012. We also increased our ATM network from 6,104 ATMs at March 31, 2011 to 9,006 ATMs at

March 31, 2012. The increase in other administrative expenses was offset, in part, by a decrease in collection

expenses and advertisement expenses.

Direct marketing agency expenses

Direct marketing agency expenses increased marginally from ` 1.57 billion in fiscal 2011 to ` 1.60 billion in

fiscal 2012. We use marketing agents, called direct marketing agents or associates, for sourcing our retail

assets. We include commissions paid to these direct marketing agents in non-interest expense. In line with

the RBI guidelines, these commissions are expensed upfront and not amortised over the life of the loan.

Provisions and contingencies (excluding provisions for tax)

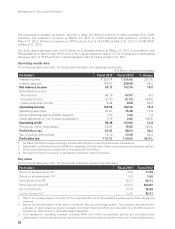

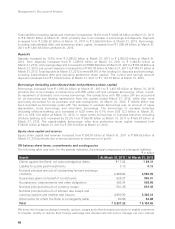

The following tables set forth, for the periods indicated, the components of provisions and contingencies.

` in billion, except percentages

Fiscal 2011 Fiscal 2012 % change

Provision for investments (including credit substitutes) (net) ` 2.04 ` 4.13 102.5%

Provision for non-performing and other assets119.77 9.93 (49.8)

Provision for standard assets — ——

Others 1.06 1.77 67.0

Total provisions and contingencies (excluding

provisions for tax) ` 22.87 ` 15.83 (30.8)%

1. Includes restructuring related provision.

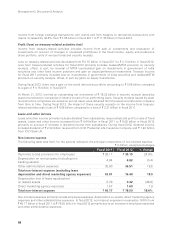

Provisions are made by us on standard, sub-standard and doubtful assets at rates prescribed by RBI. Loss

assets and unsecured portions of doubtful assets are provided/written off as required by extant RBI guidelines.

Subject to the minimum provisioning levels prescribed by RBI, provisions on retail non-performing loans are

made at the borrower level in accordance with our retail assets provisioning policy. The specific provisions

on retail loans held by us are higher than the minimum regulatory requirement.

During fiscal 2012, RBI revised rates of provisioning for non-performing assets and restructured advances.

Accordingly, we made an additional provision of 5% to 10% on our non-performing advances. During fiscal

2012, RBI also revised rates of provisioning for standard restructured advances from 0.25%-1% (depending

upon the category of advance) to 2%.

Provisions and contingencies (excluding provisions for tax) decreased by 30.8% from ` 22.87 billion in fiscal

2011 to ` 15.83 billion in fiscal 2012 primarily due to a reduction in provisions for retail non-performing loans.

The reduction in provision against retail non-performing loans was primarily due to a sharp reduction in

accretion to retail non-performing loans since fiscal 2011.