ICICI Bank 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Annual Report 2011-2012 63

The capital management framework is complemented by the risk management framework, which includes a

comprehensive assessment of all material risks. Stress testing, which is a key aspect of the capital assessment

process and the risk management framework, provides an insight into the impact of extreme but plausible

scenarios on the risk profile and capital position. Based on our Board-approved stress testing framework, we

conduct stress tests on our various portfolios and assess the impact on our capital ratios and the adequacy of

our capital buffers for current and future periods. We periodically assess and refine our stress tests in an effort

to ensure that the stress scenarios capture material risks as well as reflect possible extreme market moves that

could arise as a result of market conditions. Internal capital adequacy assessment process at the consolidated

level integrates the business and capital plans and the stress testing results of the group entities.

Based on the internal capital adequacy assessment process, we determine our capital needs and the

optimum level of capital by considering the following in an integrated manner:

strategic focus, business plan and growth objectives;

regulatory capital requirements as per RBI guidelines;

assessment of material risks and impact of stress testing;

perception of credit rating agencies, shareholders and investors;

future strategy with regard to investments or divestments in subsidiaries; and

evaluation of options to raise capital from domestic and overseas markets, as permitted by RBI from time

to time.

We formulate our internal capital level targets based on the internal capital adequacy assessment process

and endeavour to maintain the capital adequacy level in accordance with the targeted levels at all times.

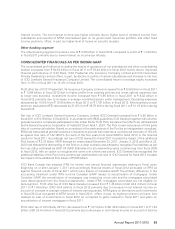

Basel III

In order to strengthen the resilience of the banking sector to potential future shocks, together with ensuring

adequate liquidity in the banking system, the Basel Committee on Banking Supervision (BCBS) issued the

Basel III proposals on December 17, 2009. Following a consultation phase on these proposals, the final

set of Basel III rules were issued on December 16, 2010. The Basel III rules on capital consist of measures

on improving the quality, consistency and transparency of capital, enhancing risk coverage, introducing a

supplementary leverage ratio, reducing pro-cyclicality and promoting countercyclical buffers, and addressing

systemic risk and interconnectedness. The Basel III rules on liquidity consist of a measure of short-term

liquidity coverage ratio aimed at building liquidity buffers to meet stress situations, and a measure of long-

term net stable funding ratio aimed at promoting longer term structural funding. BCBS has stipulated a

phased implementation of the Basel III framework between January 1, 2013 and January 1, 2019.

On May 2, 2012, RBI issued the final guidelines on the Basel III capital regulations. We continue to monitor

developments on the Basel III framework and believe that our current robust capital adequacy position,

adequate headroom currently available to raise hybrid/debt capital and demonstrated track record of access

to domestic and overseas markets for capital raising will enable us to adapt to the Basel III framework. RBI

issued the draft guidelines on Basel III liquidity standards on February 21, 2012 and solicited feedback from

the industry on these guidelines. The final guidelines on Basel III liquidity standards are awaited from RBI.

ASSET QUALITY AND COMPOSITION

Loan concentration

We follow a policy of portfolio diversification and evaluate our total financing in a particular sector in light

of our forecasts of growth and profitability for that sector. Between 2003 and 2006, the banking system as

a whole saw significant expansion of retail credit, with retail loans contributing for a major part of overall

systemic credit growth. In line with this, we experienced rapid growth in our retail loan portfolio and an

increase in the proportion of retail loans in our total loans. From fiscal 2008, the share of retail loans in