ICICI Bank 2012 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

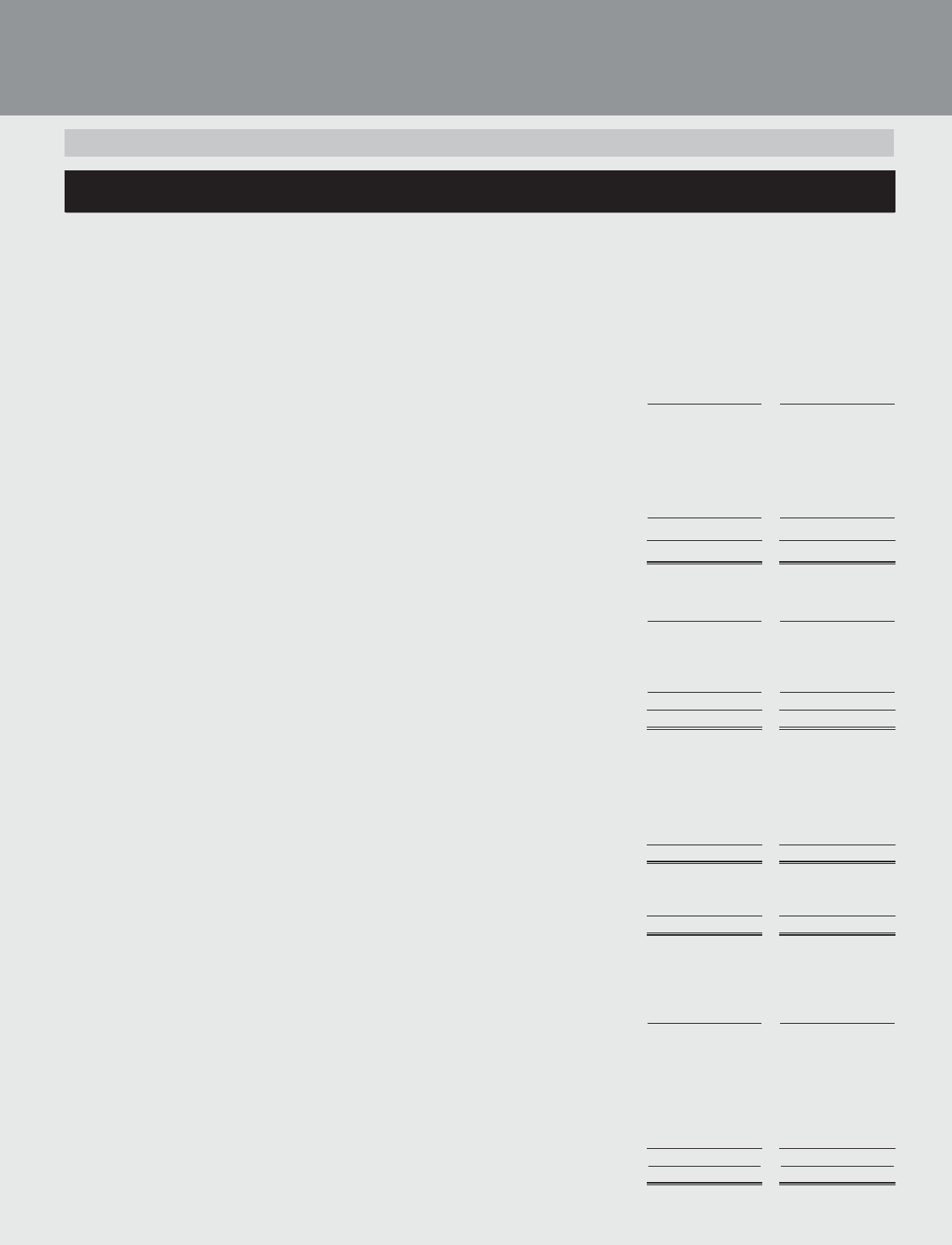

F9

At

31.03.2012

At

31.03.2011

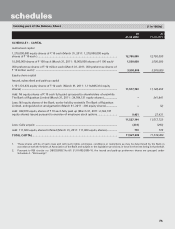

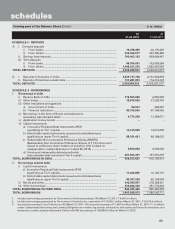

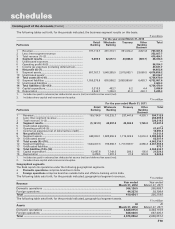

SCHEDULE 8 - INVESTMENTS

I. Investments in India [net of provisions]

i) Government securities ........................................................................................ 869,480,205 641,287,140

ii) Other approved securities ................................................................................... 4,250 325,363

iii) Shares (includes equity and preference shares) ............................................... 22,922,636 28,134,073

iv) Debentures and bonds ....................................................................................... 195,135,236 161,462,866

v) Subsidiaries and/or joint ventures1 ..................................................................... 64,796,927 64,796,927

vi) Others (commercial paper, mutual fund units, pass through certificates,

security receipts, certificate of deposits, RIDF and other related

investments etc.) ............................................................................................... 361,872,334 356,934,417

TOTAL INVESTMENTS IN INDIA ...................................................................................... 1,514,211,588 1,252,940,786

II. Investments outside India [net of provisions]

i) Government securities ........................................................................................ 4,399,569 8,862,278

ii) Subsidiaries and/or joint ventures abroad

(includes equity and preference shares) ............................................................ 66,864,257 66,026,356

iii) Others ................................................................................................................... 10,125,016 19,030,210

TOTAL INVESTMENTS OUTSIDE INDIA .......................................................................... 81,388,842 93,918,844

TOTAL INVESTMENTS ...................................................................................................... 1,595,600,430 1,346,859,630

A. Investments in India

Gross value of investments ....................................................................................... 1,539,777,243 1,272,423,922

Less: Aggregate of provision/depreciation ............................................................... 25,565,655 19,483,136

Net investments.......................................................................................................... 1,514,211,588 1,252,940,786

B. Investments outside India

Gross value of investments ....................................................................................... 81,826,347 94,499,793

Less: Aggregate of provision/depreciation ............................................................... 437,505 580,949

Net investments.......................................................................................................... 81,388,842 93,918,844

TOTAL INVESTMENTS ...................................................................................................... 1,595,600,430 1,346,859,630

1. Includes application money amounting to ` 50.7 million (March 31, 2011: ` 50.7 million).

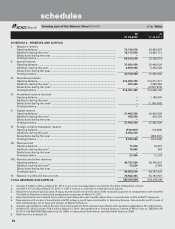

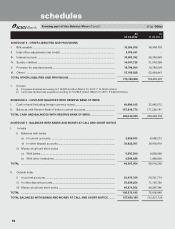

SCHEDULE 9 - ADVANCES [net of provisions]

A. i) Bills purchased and discounted .......................................................................... 48,693,815 58,480,555

ii) Cash credits, overdrafts and loans repayable on demand ................................ 317,745,152 302,123,773

iii) Term loans ............................................................................................................ 2,019,802,749 1,690,225,268

iv) Securitisation, finance lease and hire purchase receivables ............................ 151,034,863 112,829,418

TOTAL ADVANCES ............................................................................................................ 2,537,276,579 2,163,659,014

B. i) Secured by tangible assets (includes advances against book debts) ............... 2,138,141,465 1,679,661,354

ii) Covered by bank/government guarantees ......................................................... 13,869,020 27,057,409

iii) Unsecured ............................................................................................................ 385,266,094 456,940,251

TOTAL ADVANCES ............................................................................................................ 2,537,276,579 2,163,659,014

C. I. Advances in India

i) Priority sector ................................................................................................ 592,856,433 534,015,609

ii) Public sector .................................................................................................. 11,968,345 13,788,639

iii) Banks ............................................................................................................. 154,618 1,810,607

iv) Others ............................................................................................................ 1,238,268,015 1,063,077,445

TOTAL ADVANCES IN INDIA ............................................................................................ 1,843,247,411 1,612,692,300

II. Advances outside India

i) Due from banks ............................................................................................ 22,280,480 37,410,346

ii) Due from others

a) Bills purchased and discounted ............................................................. 5,098,400 4,572,713

b) Syndicated and term loans ..................................................................... 647,151,172 494,699,999

c) Others ...................................................................................................... 19,499,116 14,283,656

TOTAL ADVANCES OUTSIDE INDIA ................................................................................ 694,029,168 550,966,714

TOTAL ADVANCES ............................................................................................................ 2,537,276,579 2,163,659,014

(` in ‘000s)

forming part of the Balance Sheet (Contd.)

schedules