ICICI Bank 2012 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F90

schedules

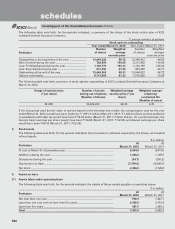

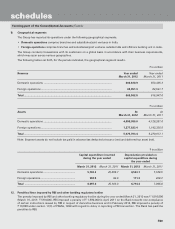

13. Small and Micro Industries

Under the Micro, Small and Medium Enterprises Development Act, 2006 which came into force from October 2, 2006,

certain disclosures are required to be made relating to enterprises covered under the Act. During the year ended March 31,

2012, the amount paid after the due date to vendors registered under the MSMED Act, 2006 was ` 7.1 million (March 31,

2011: ` 17.9 million). An amount of ` 0.1 million (March 31, 2011: ` 0.7 million) has been charged to profit & loss account

towards accrual of interest on these delayed payments.

14. Reconciliation of nostro account

In terms of RBI circular no. DBOD.BP.BC.No. 133/21.04.018/2008-09 dated May 11, 2009, ` 3.2 million (March 31, 2011:

` 2.6 million) representing outstanding credit balances of individual value less than US$ 2,500 or equivalent lying in nostro

account, which were originated up to March 31, 2002, was transferred to profit and loss account during the year ended

March 31, 2012 and has been subsequently appropriated to General Reserve.

15. Repurchase transactions

The Bank has started accounting for LAF transactions as borrowing and lending during the year ended March 31, 2012. If

the Bank had continued to account for LAF transactions as “sale and repurchase” at March 31, 2012, the investments would

have been lower by ` 168,000.0 million and the borrowings would have been lower by ` 168,000.0 million.

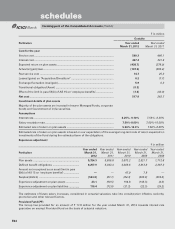

16. Contribution to Motor Third Party Insurance Pool by ICICI Lombard General Insurance Company Limited (ICICI

General)

In accordance with IRDA guidelines, ICICI General, together with all other general insurance companies participated in the

Indian Motor Third Party Insurance Pool (‘the Pool’), administered by the General Insurance Corporation of India (‘GIC’)

from April 1, 2007. The Pool covers reinsurance of third party risks of commercial vehicles.

ICICI General ceded 100.0% of the third party premium collected to the Pool and recorded its share of results in the

Pool based of unaudited statement received from the Pool for the period from March 2011 up to February 2012 and on

management’s estimate for March 2012. In accordance with regulations, the Pool had followed a policy of providing for

Unexpired Risk Reserve at a minimum of 50.0% of the Pooled business. Accordingly company has carried forward 50.0%

of current year premiums from the Pool as Unexpired Risk Reserve.

IRDA through its orders dated December 23, 2011, January 3, 2012 and March 22, 2012 has directed the dismantling of the

Pool on a clean cut basis and advised recognition of the Pool liabilities as per the loss ratios estimated by GAD UK (‘GAD

Estimates’) for underwriting years commencing from the year ended March 31, 2008 to year ended March 31, 2012, with

the option to recognise the same over a three year period. ICICI General has decided to recognise the additional liabilities

of the Pool in the current year and accordingly, the Bank’s consolidated net profit after tax for the year ended March 31,

2012 includes impact of additional Pool losses of ` 5,030.3 million in line with the Bank’s shareholding in ICICI General.

During the year ended March 31, 2011, IRDA had carried out independent assessment of the provision required and

through its order dated March 12, 2011 directed all general insurance companies to make a provision of not less than

153.00% for each of the four years from the inception of the Pool (i.e. from 2007-08). Due to this, an additional provision of

` 2,720.0 million had been created by ICICI General in the year ended March 31, 2011. Accordingly, the Bank’s consolidated

net profit after tax for the year ended March 31, 2011 included impact of additional losses on account of the Pool of

` 2,000.6 million.

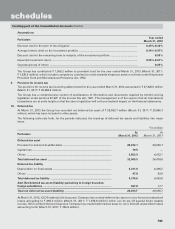

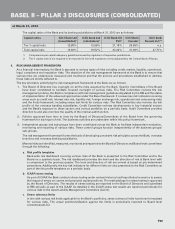

17. Transition from Canadian GAAP to IFRS by ICICI Bank Canada

Pursuant to the decision of Canadian Accounting Standards Board, ICICI Bank Canada has adopted International Financial

Reporting Standards (IFRS) for preparation of its financial statements for periods beginning on or after January 1, 2011.

Accordingly, its financial statements included in the consolidated financial statements were prepared in accordance with

Canadian Generally Accepted Accounting Principles for previous periods and have been prepared as per IFRS with effect

from April 1, 2011. The impact of

`

717.8 million on first time adoption of IFRS has been adjusted and shown in Schedule

2- Reserves and Surplus under balance in profit and loss account-others in the financials for the year ended March 31, 2012.

forming part of the Consolidated Accounts (Contd.)