ICICI Bank 2012 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.I. Philosophy of Corporate Governance

ICICI Bank’s corporate governance philosophy encompasses not only regulatory and legal requirements,

such as the terms of listing agreements with stock exchanges, but also several voluntary practices aimed

at a high level of business ethics, effective supervision and enhancement of value for all stakeholders.

The corporate governance framework adopted by the Bank already encompasses a significant portion

of the recommendations contained in the ‘Corporate Governance Voluntary Guidelines 2009’ issued by

the Ministry of Corporate Affairs, Government of India.

Whistle Blower Policy

ICICI Bank has formulated a Whistle Blower Policy. In terms of this policy, employees of ICICI Bank and

its subsidiaries are free to raise issues, if any, on breach of any law, statute or regulation by the Bank

and on the accounting policies and procedures adopted for any area or item and report them to the

Audit Committee through specified channels. This mechanism has been communicated and posted on

the Bank’s intranet.

ICICI Bank Code of Conduct for Prevention of Insider Trading

In accordance with the requirements of the Securities and Exchange Board of India (SEBI) (Prohibition

of Insider Trading) Regulations, 1992, ICICI Bank has instituted a comprehensive code of conduct for

prevention of insider trading.

Group Code of Business Conduct and Ethics

The Board of Directors has approved a Group Code of Business Conduct and Ethics for Directors and

employees of the ICICI Group. The Code aims at ensuring consistent standards of conduct and ethical

business practices across the constituents of the ICICI Group. This Code is also available on the website

of the Bank (www.icicibank.com). Pursuant to Clause 49 of the Listing Agreement, a confirmation from

the Managing Director & CEO regarding compliance with the Code by all the Directors and senior

management is given on page 34 of the Annual Report.

CEO/CFO Certification

In terms of Clause 49 of the Listing Agreement, the certification by the Managing Director & CEO and

Executive Director & CFO on the financial statements and internal controls relating to financial reporting

has been obtained.

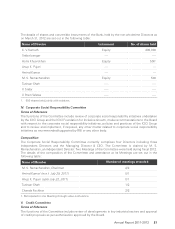

Board of Directors

ICICI Bank has a broad-based Board of Directors, constituted in compliance with the Banking Regulation

Act, 1949, the Companies Act, 1956 and listing agreements entered into with stock exchanges, and in

accordance with good corporate governance practices. The Board functions either as a full Board or

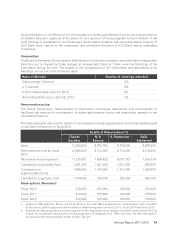

through various committees constituted to oversee specific operational areas. The Board has constituted

ten committees, namely, Audit Committee, Board Governance, Remuneration & Nomination Committee,

Corporate Social Responsibility Committee, Credit Committee, Customer Service Committee, Fraud

Monitoring Committee, Information Technology Strategy Committee, Risk Committee, Share Transfer

& Shareholders’/Investors’ Grievance Committee and Committee of Executive Directors. These

Board Committees other than the Committee of Executive Directors currently consist of majority of

independent Directors and most of the Committees are chaired by independent Directors.

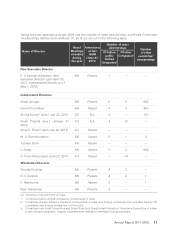

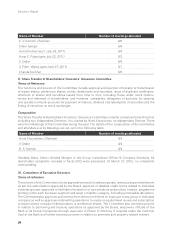

At March 31, 2012, the Board of Directors consisted of 12 members. There were six Meetings of

the Board during fiscal 2012 - on April 28, July 29, September 15-16 and October 31 in 2011 and

January 31 and February 9-10 in 2012. The names of the Directors, their attendance at Board Meetings

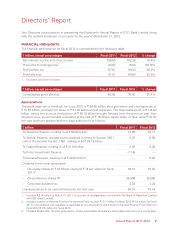

Directors’ Report

16