ICICI Bank 2012 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F78

forming part of the Consolidated Accounts (Contd.)

schedules

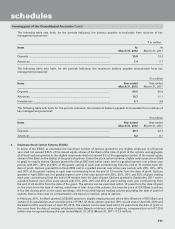

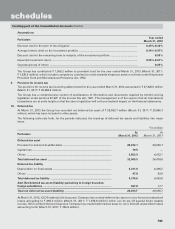

If ICICI Bank had used the fair value of options based on binomial tree model, compensation cost in the year ended

March 31, 2012 would have been higher by ` 1,816.1 million. The key assumptions used to estimate the fair value of

options granted during the year ended March 31, 2012 are given below.

Risk-free interest rate .......................................................................................................................... 7.99-9.07% p.a.

Expected life ........................................................................................................................................ 6.35-6.98 years

Expected volatility ............................................................................................................................... 47.53-49.20% p.a.

Expected dividend yield ..................................................................................................................... 1.26-1.60% p.a.

The weighted average fair value of options granted during the year ended March 31, 2012 is ` 592.52 per option

(March 31, 2011: ` 535.87).

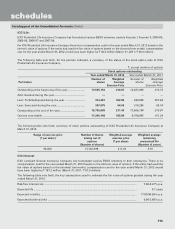

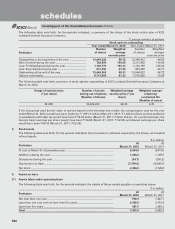

A summary of the status of the Bank’s stock option plan is given below.

` except number of options

Stock options outstanding

Year ended March 31, 2012 Year ended March 31, 2011

Particulars

Number of

options

Weighted

Average

Exercise Price

Number of

options

Weighted

Average

Exercise Price

Outstanding at the beginning of the year ....................... 20,529,387 779.72 18,763,460 689.50

Add: Granted during the year ......................................... 4,060,600 1,104.82 5,514,600 972.00

Less: Lapsed during the year, net of re-issuance .......... 448,372 798.77 1,005,536 871.95

Less: Exercised during the year ...................................... 942,070 510.94 2,743,137 517.21

Outstanding at the end of the year ................................. 23,199,545 846.94 20,529,387 779.72

Options exercisable ......................................................... 12,019,655 745.26 10,197,137 682.72

In terms of the Scheme, 23,199,545 options (March 31, 2011: 20,529,387 options) granted to eligible employees were

outstanding at March 31, 2012.

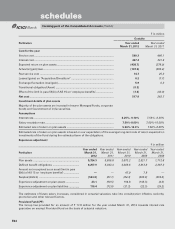

A summary of stock options outstanding at March 31, 2012 is given below.

Range of exercise price

(` per share)

Number of shares

arising out of

options

Weighted average

exercise price

(` per share)

Weighted average

remaining

contractual life

(Number of years)

105-299 28,925 132.05 1.07

300-599 6,048,620 471.10 4.35

600-999 13,122,000 942.79 6.80

1,000-1,399 4,000,000 1,106.03 9.04

A summary of stock options outstanding at March 31, 2011 is given below.

Range of exercise price

(` per share)

Number of shares

arising out of

options

Weighted average

exercise price

(` per share)

Weighted average

remaining

contractual life

(Number of years)

105-299 95,086 137.13 1.07

300-599 6,906,951 466.85 5.30

600-999 13,426,350 942.54 7.78

1,000-1,399 101,000 1,084.59 7.94

The options were exercised regularly throughout the period and weighted average share price as per NSE price volume

data during the year ended March 31, 2012 was ` 922.76 (March 31, 2011: ` 1,014.96).