ICICI Bank 2012 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F101

In respect of retail advances, the Bank’s credit officers evaluate credit proposals on the basis of the operating notes

approved by the COED and the risk assessment criteria defined by RMG.

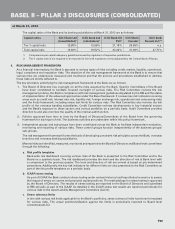

Credit approval authorisation structure

The Board of Directors has delegated the approving authority to committees such as the Credit Committee (comprising a

majority of independent Directors), the COED (comprising whole time Directors), the Committee of Senior Management

(comprising Whole Time Directors and Group Executives/Presidents), the Committee of Executives, the Regional

Committee, Small and Medium Enterprise and Corporate Agriculture Forums (SMEAG forums) and Retail Credit Forums

(RCF forums) (comprising of designated executives), and also to individual executives (under joint delegation). SMEAG

forums, RCF forums and individual executives (under joint delegation) can approve proposals under program norms

(Programs approved by the COED). The above authorities can approve financial assistance within certain individual and

group exposure limits set by the Board of Directors. The authorisation is based on the level of risk and the quantum of

exposure, to ensure that the transactions with higher exposure and level of risk are put up to correspondingly higher

forum/committee for approval.

In respect of retail loans, all exposures are approved under operating notes or programs approved by the COED. This

involves a cluster-based approach for a particular product or for homogeneous group of individuals/business entities

that comply with certain laid down parameterised norms. The norms vary across product segments/customer profile,

but typically include factors such as the borrower’s income, the loan-to-value ratio and demographic parameters. The

individual credit proposals are evaluated and approved by executives on the basis of the product policies.

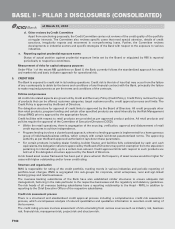

Credit risk monitoring process

For effective monitoring of credit facilities, a post-approval authorisation structure has been laid down. For corporate,

small enterprises and rural and agriculture linked banking business, Credit Middle Office Group verifies adherence to

the terms of the approval prior to commitment and disbursement of credit facilities.

The Bank has established centralised operations to manage operational risk in the various back office processes of

the Bank’s retail loan business except for a few operations, which are decentralised to improve turnaround time for

customers. The fraud prevention and control group manages fraud-related risks through fraud prevention and through

recovery of fraud losses. The fraud control group evaluates various external agencies involved in the retail finance

operations, including direct marketing associates, external verification associates and collection agencies.

The Bank has a collections unit structured along various product lines and geographical locations, to manage delinquency

levels. The collections unit operates under the guidelines of a standardised recovery process.

The segregation of responsibilities and oversight by groups external to the business groups ensure adequate checks

and balances.

Reporting and measurement

Credit exposure for the Bank is measured and monitored using a centralised exposure management system. The

analysis of the composition of the portfolio is presented to the Risk Committee on a quarterly basis.

The Bank complies with the norms on exposure stipulated by RBI for both single borrower as well as borrower group at

the consolidated level. Limits have been set as a percentage of the Bank’s consolidated capital funds and are regularly

monitored. The utilisation against specified limits is reported to the COED and Credit Committee on a periodic basis.

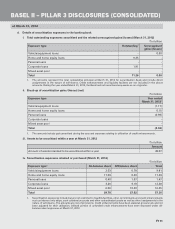

Credit concentration risk

Credit concentration risk arises mainly on account of concentration of exposures under various categories including

industry, products, geography, sensitive sectors, underlying collateral nature and single/group borrower exposures.

Limits have been stipulated on single borrower, borrower group, industry and longer tenure exposure to a borrower

group. Exposure to top 10 borrowers and borrower groups, exposure to capital market segment and unsecured

exposures for the ICICI Group (consolidated) are reported to the senior management committees on a quarterly basis.

Limits on countries and bank counterparties have also been stipulated.

Definition and classification of non-performing assets (NPAs)

The Bank classifies its advances (loans and credit substitutes in the nature of an advance) into performing and non-

performing loans in accordance with the extant RBI guidelines.

An NPA is defined as a loan or an advance where:

i) interest and/or installment of principal remain overdue for more than 90 days in respect of a term loan. Any amount

due to the bank under any credit facility is ‘overdue’ if it is not paid on the due date fixed by the Bank;

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

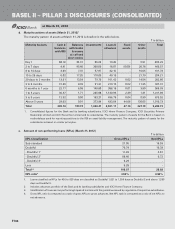

at March 31, 2012