ICICI Bank 2012 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F70

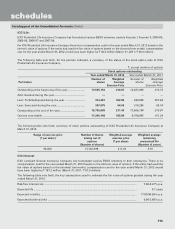

Leave encashment

The Group provides for leave encashment benefit, which is a long-term benefit scheme, based on actuarial valuation

conducted by an independent actuary.

11. Provisions, contingent liabilities and contingent assets

The Group estimates the probability of any loss that might be incurred on outcome of contingencies on the basis

of information available upto the date on which the consolidated financial statements are prepared. A provision is

recognised when an enterprise has a present obligation as a result of a past event and it is probable that an outflow of

resources will be required to settle the obligation, in respect of which a reliable estimate can be made. Provisions are

determined based on management estimate required to settle the obligation at the balance sheet date, supplemented

by experience of similar transactions. These are reviewed at each balance sheet date and adjusted to reflect the current

management estimates. In cases where the available information indicates that the loss on the contingency is reasonably

possible but the amount of loss cannot be reasonably estimated, a disclosure to this effect is made in the consolidated

financial statements. In case of remote possibility, neither provision nor disclosure is made in the consolidated financial

statements. The Group does not account for or disclose contingent assets, if any.

12. Cash and cash equivalents

Cash and cash equivalents include cash in hand, balances with RBI, balances with other banks and money at call and short

notice.

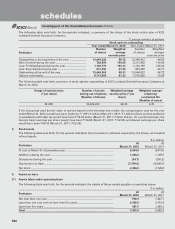

13. Investments

i) Investments of the Bank are accounted for in accordance with the extant RBI guidelines on investment classification

and valuation as given below.

a) All investments are classified into ‘Held to Maturity’, ‘Available for Sale’ and ‘Held for Trading’. Reclassifications,

if any, in any category are accounted for as per the RBI guidelines.

Under each classification, the investments are further classified as (a) government securities, (b) other approved

securities, (c) shares, (d) bonds and debentures and (e) others.

b) ‘Held to Maturity’ securities are carried at their acquisition cost or at amortised cost, if acquired at a premium

over the face value. Any premium over the face value of fixed rate and floating rate securities acquired is

amortised over the remaining period to maturity on a constant yield basis and straight line basis respectively.

c) ‘Available for Sale’ and ‘Held for Trading’ securities are valued periodically as per RBI guidelines. Any

premium over the face value of fixed rate and floating rate investments in government securities, classified

as ‘Available for Sale’, is amortised over the remaining period to maturity on constant yield basis and straight

line basis respectively. Quoted investments are valued based on the trades/quotes on the recognised stock

exchanges, subsidiary general ledger account transactions, price list of RBI or prices declared by Primary

Dealers Association of India jointly with Fixed Income Money Market and Derivatives Association (FIMMDA),

periodically.

The market/fair value of unquoted government securities which are in the nature of Statutory Liquidity Ratio (SLR)

securities included in the ‘Available for Sale’ and ‘Held for Trading’ categories is as per the rates published by

FIMMDA. The valuation of other unquoted fixed income securities wherever linked to the Yield-to-Maturity (YTM)

rates, is computed with a mark-up (reflecting associated credit risk) over the YTM rates for government securities

published by FIMMDA.

Unquoted equity shares are valued at the break-up value, if the latest balance sheet is available or at ` 1 as per

RBI guidelines.

Securities are valued scrip-wise and depreciation/appreciation is aggregated for each category. Net appreciation

in each category, if any, being unrealised, is ignored, while net depreciation is provided for.

d) Costs including brokerage and commission pertaining to investments, paid at the time of acquisition, are

charged to the profit and loss account.

e)

Profit/loss on sale of investments in the ‘Held to Maturity’ category is recognised in the profit and loss account and

profit is thereafter appropriated (net of applicable taxes and statutory reserve requirements) to Capital Reserve.

Profit/loss on sale of investments in ‘Available for sale’ and ‘Held for Trading’ categories is recognised in the profit

and loss account.

f) Market repurchase and reverse repurchase transactions, are accounted for as borrowing and lending

transactions respectively in accordance with the extant RBI guidelines. The transactions with RBI under

Liquidity Adjustment Facility (LAF) are accounted for as borrowing and lending transactions from the three

months ended March 31, 2012.

g) Broken period interest (the amount of interest from the previous interest payment date till the date of purchase/

sale of instruments) on debt instruments is treated as a revenue item.

h) At the end of each reporting period, security receipts issued by asset reconstruction companies are valued

in accordance with the guidelines applicable to such instruments, prescribed by RBI from time to time.

forming part of the Consolidated Accounts (Contd.)

schedules