ICICI Bank 2012 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F102

ii) if the interest due and charged during a quarter is not serviced fully within 90 days from the end of the quarter;

iii) the account remains ‘out of order’ in respect of an overdraft/cash credit facility. An account is treated as ‘out of

order’ if:

a. the outstanding balance remains continuously in excess of the sanctioned limit/drawing power for 90 days; or

b. where the outstanding balance in the principal operating account is less than the sanctioned limit/drawing

power, but there are no credits continuously for 90 days as on the date of the balance sheet; or

c. credits in the account are not enough to cover the interest debited during the accounting period; or

d. drawings have been permitted in the account for a continuous period of 90 days based on drawing power

computed on the basis of stock statements that are more than three months old even though the unit may be

working or the borrower’s financial position is satisfactory; or

e. the regular/ad hoc credit limits have not been reviewed/renewed within 180 days from the due date/date of ad

hoc sanction.

iv) a bill purchased/discounted by the Bank remains overdue for a period of more than 90 days;

v) interest and/or installment of principal in respect of an agricultural loan remains overdue for two crop seasons for

short duration crops and one crop season for long duration crops;

vi) In respect of a securitisation transaction undertaken in terms of the RBI guidelines on securitisation, the amount of

liquidity facility remains outstanding for more than 90 days;

vii) In respect of derivative transactions, if the overdue receivables representing positive mark-to-market value of a

derivative contract, remain unpaid for a period of 90 days from the specified due date for payment.

Irrespective of payment performance, the Bank identifies a borrower account as an NPA even if it does not meet any of

the above mentioned criteria, where:

loans availed by a borrower are repeatedly restructured unless otherwise permitted by regulations;

loans availed by a borrower are classified as fraud;

project does not commence commercial operations within the timelines permitted under the RBI guidelines in

respect of the loans extended to a borrower for the purpose of implementing a project; and

any security in nature of debenture/bonds/equity shares issued by a borrower and held by the Bank is classified as

non-performing investment.

Further, non performing investments are identified as per extant regulations.

Further, NPAs are classified into sub-standard, doubtful and loss assets based on the criteria stipulated by RBI. A sub-

standard asset is one, which has remained a NPA for a period less than or equal to 12 months. An asset is classified as

doubtful if it has remained in the sub-standard category for more than 12 months. A loss asset is one where loss has been

identified by the Bank or internal or external auditors or during RBI inspection but the amount has not been written off fully.

Restructured assets

As per RBI guidelines, a fully secured standard loan can be restructured by rescheduling principal repayments and/

or the interest element, but must be separately disclosed as a restructured loan in the year of restructuring. Similar

guidelines apply to restructuring of substandard and doubtful loans.

A sub-standard/doubtful asset, which has been restructured, will be upgraded to the standard category only after a

satisfactory performance by the borrower over a period of time. The RBI has specified the period to be one year from

date when the instalment/interest falls due as per the restructuring scheme.

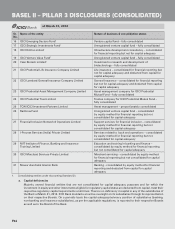

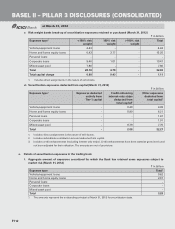

a. Credit risk exposures (March 31, 2012)

Credit risk exposures (excluding specific risk on available-for-sale and held-for-trading portfolio) include all credit

exposures as per RBI guidelines on exposure norms and investments in the held-to-maturity category. Domestic

sovereign exposures that are risk-weighted at zero percent and exposures to regulatory capital instruments of

subsidiaries that are deducted from the capital funds have been excluded.

` in billion

Category Credit exposure

Fund-based facilities 4,311.26

Non-fund based facilities 3,019.83

Total17,331.09

1. Includes all entities considered for Basel II capital adequacy computation.

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2012