ICICI Bank 2012 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F108

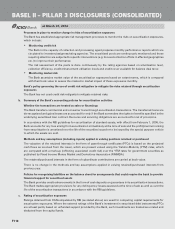

On-balance sheet netting, which is confined to loans/advances and deposits, where banks have legally

enforceable netting arrangements, involving specific lien with proof of documentation.

Guarantees, where these are direct, explicit, irrevocable and unconditional. Further, the eligible guarantors

would comprise:

- Sovereigns, sovereign entities stipulated in the RBI guidelines on Basel II, bank and primary dealers with a

lower risk weight than the counterparty; and

- Other entities, which are rated AA(-) or better.

The Bank reckons the permitted credit risk mitigants for obtaining capital relief only when the credit risk mitigant

fulfills the conditions stipulated for eligibility and legal certainty by RBI in its guidelines on Basel II.

Concentrations within credit risk mitigation

The RBI guidelines, among its conditions for eligible credit risk mitigants, require that there should not be a material

positive correlation between the credit quality of the counterparty and the value of the collateral being considered.

RMG conducts the assessment of the aspect of material positive correlation on cases referred to it and accordingly

evaluates the eligibility of the credit risk mitigant for obtaining capital relief. Currently, the Bank does not have any

concentration risk within credit risk mitigation.

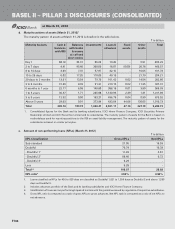

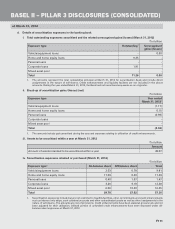

b. Portfolio covered by eligible financial collateral (March 31, 2012)

` in billion

Amount1

Exposures fully covered by eligible financial collateral, after application of haircut 99.27

Exposures fully covered by eligible corporate guarantees 15.25

1. Includes all entities considered for Basel II capital adequacy computation.

The processes for capital computation and credit risk mitigation based on Basel II guidelines are consistent across

subsidiaries of the Bank.

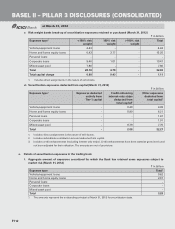

8. SECURITISATION

a. Securitisation objectives, roles played by the Bank and the risks

Objectives

The Bank’s primary objective of securitisation activities is to increase the efficiency of capital and enhance the

return on capital employed by diversifying sources of funding.

Roles played by the Bank

In securitisation transactions backed by assets either originated by the Bank or third parties, the Bank plays the

following major roles:

Underwriter: allowing un-subscribed portions of securitised debt issuances, if any to devolve on the Bank,

with the intent of selling at a later stage.

Investor/trader/market-maker: acquiring investment grade securitised debt instruments backed by financial

assets originated by third parties for purposes of investment/trading/market-making with the aim of developing

an active secondary market in securitised debt.

Structurer: structuring appropriately in a form and manner suitably tailored to meet investor requirements,

while being compliant with extant regulations.

Provider of liquidity facilities: addressing temporary mismatches on account of the timing differences

between the receipt of cash flows from the underlying performing assets and the fulfillment of obligations to

the beneficiaries.

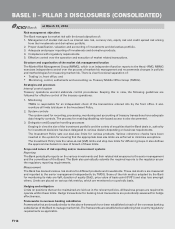

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2012