ICICI Bank 2012 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F97

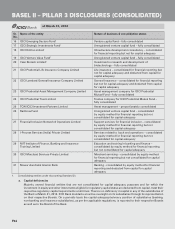

3. CAPITAL ADEQUACY

a. Capital management

Objective

The Bank actively manages its capital to meet regulatory norms and current and future business needs considering

the risks in its businesses, expectation of rating agencies, shareholders and investors, and the available options of

raising capital.

Organisational set-up

The capital management framework of the Bank is administered by the Finance Group and the Risk Management

Group (RMG) under the supervision of the Board and the Risk Committee.

Regulatory capital

The Bank is subject to the capital adequacy norms stipulated by the RBI guidelines on Basel II. The RBI guidelines

on Basel II require the Bank to maintain a minimum ratio of total capital to risk weighted assets of 9.0%, with a

minimum Tier-1 capital adequacy ratio of 6.0%. The total capital adequacy ratio of the Bank at a standalone level at

March 31, 2012 as per the RBI guidelines on Basel II is 18.52% with a Tier-1 capital adequacy ratio of 12.68%. The

total capital adequacy ratio of the ICICI Group (consolidated) at March 31, 2012 as per the RBI guidelines on Basel

II is 19.60% with a Tier-1 capital adequacy ratio of 12.80%.

Under Pillar 1 of the RBI guidelines on Basel II, the Bank follows the standardised approach for credit and market

risk and basic indicator approach for operational risk.

Internal assessment of capital

The Bank’s capital management framework includes a comprehensive internal capital adequacy assessment

process (ICAAP) conducted annually and which determines the adequate level of capitalisation for the Bank to meet

regulatory norms and current and future business needs, including under stress scenarios. The ICAAP is formulated

at both standalone bank level and the consolidated group level. The ICAAP encompasses capital planning for a four

year time horizon, identification and measurement of material risks and the relationship between risk and capital.

The Bank’s capital management framework is complemented by its risk management framework (detailed in the

following sections), which includes a comprehensive assessment of material risks.

Stress testing which is a key aspect of the ICAAP and the risk management framework provides an insight on

the impact of extreme but plausible scenarios on the Bank’s risk profile and capital position. Based on the Board

approved stress testing framework, the Bank conducts stress tests on its various portfolios and assesses the

impact on its capital ratios and the adequacy of capital buffers for current and future periods. The Bank periodically

assesses and refines its stress tests in an effort to ensure that the stress scenarios capture material risks as well as

reflect possible extreme market moves that could arise as a result of market conditions.

The business and capital plans and the stress testing results of the group entities are integrated into the ICAAP.

Based on the ICAAP, the Bank determines its capital needs and the optimum level of capital by considering the

following in an integrated manner:

Bank’s strategic focus, business plan and growth objectives;

regulatory capital requirements as per the RBI guidelines;

assessment of material risks and impact of stress testing;

perception of credit rating agencies, shareholders and investors;

future strategy with regard to investments or divestments in subsidiaries; and

evaluation of options to raise capital from domestic and overseas markets, as permitted by RBI from time to time.

The Bank formulates its internal capital level targets based on the ICAAP and endeavours to maintain its capital

adequacy level in accordance with the targeted levels at all times.

Monitoring and reporting

The Board of Directors of ICICI Bank maintains an active oversight over the Bank’s capital adequacy levels. On a

quarterly basis an analysis of the capital adequacy position and the risk weighted assets and an assessment of the

various aspects of Basel II on capital and risk management as stipulated by RBI, are reported to the Board. Further,

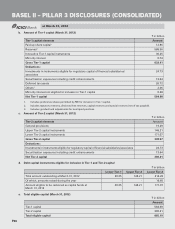

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2012