ICICI Bank 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F41

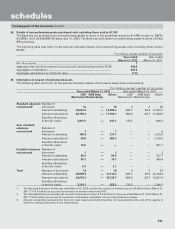

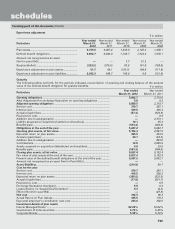

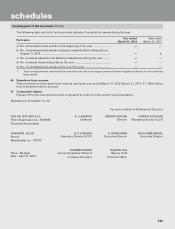

38. Provisions and contingencies

The following table sets forth, for the periods indicated, the break-up of provisions and contingencies included in profit

and loss account.

` in million

Year ended

March 31, 2012

Year ended

March 31, 2011

Provisions for depreciation of investments ....................................................... 4,132.0 2,038.2

Provision towards non-performing and other assets ........................................ 9,931.8 19,769.1

Provision towards standard assets ..................................................................... ——

Provision towards income tax ............................................................................ 21,874.2 21,381.1

Deferred tax adjustment ..................................................................................... 1,446.5 (5,317.8)

Provision towards wealth tax .............................................................................. 61.0 30.0

Other provisions and contingencies................................................................... 1,766.6 1,061.1

Total provisions and contingencies ................................................................... 39,212.1 38,961.7

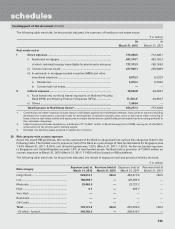

39. Provision for income tax

The provision for income tax (including deferred tax) for the year ended March 31, 2012 amounted to ` 23,320.7 million

(March 31, 2011: ` 16,063.3 million).

The Bank has a comprehensive system of maintenance of information and documents required by transfer pricing

legislation under section 92-92F of the Income Tax Act, 1961. The Bank is of the opinion that all international transactions

are at arm’s length so that the above legislation will not have material impact on the financial statements.

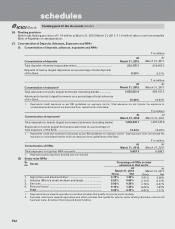

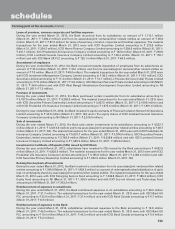

40. Deferred tax

At March 31, 2012, the Bank has recorded net deferred tax asset of ` 25,453.2 million (March 31, 2011: ` 26,900.3 million),

which has been included in other assets.

The following table sets forth, for the periods indicated, the break-up of deferred tax assets and liabilities into major items.

` in million

At

March 31, 2012

At

March 31, 2011

Deferred tax asset

Provision for bad and doubtful debts .................................................................. 27,348.8 28,944.3

Capital loss ............................................................................................................ 79.5 —

Others ................................................................................................................... 2,299.3 2,398.8

Total deferred tax asset ....................................................................................... 29,727.6 31,343.1

Deferred tax liability ............................................................................................

Depreciation on fixed assets ................................................................................ 4,275.1 4,444.1

Total deferred tax liability ................................................................................... 4,275.1 4,444.1

Deferred tax asset/(liability) pertaining to foreign branches .............................. 0.7 1.3

Total net deferred tax asset/ (liability) ............................................................... 25,453.2 26,900.3

During the year ended March 31, 2012, Bank has created deferred tax asset on carry forward capital losses, as based on its

firm plans it is virtually certain that sufficient future taxable capital gains will be available against which the loss can be set off.

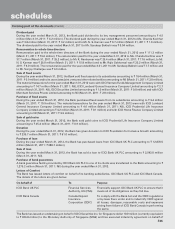

41. Dividend distribution tax

For the purpose of computation of dividend distribution tax on the proposed dividend, the Bank has reduced the dividend

received from its Indian subsidiaries, which are not the subsidiaries of any other company, on which dividend distribution

tax has been paid by the subsidiaries as per the provisions of Section 115-O of the Income Tax Act, 1961.

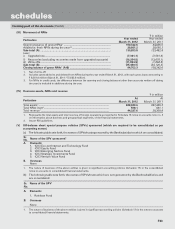

42. Related Party Transactions

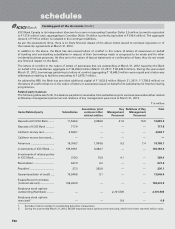

The Bank has transactions with its related parties comprising subsidiaries, associates/joint ventures/other related entities,

key management personnel and relatives of key management personnel.

Subsidiaries

ICICI Bank UK PLC, ICICI Bank Canada, ICICI Bank Eurasia Limited Liability Company, ICICI Prudential Life Insurance

Company Limited1, ICICI Lombard General Insurance Company Limited1, ICICI Prudential Asset Management Company

Limited1, ICICI Securities Limited, ICICI Securities Primary Dealership Limited, ICICI Home Finance Company Limited,

forming part of the Accounts (Contd.)

schedules