ICICI Bank 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F23

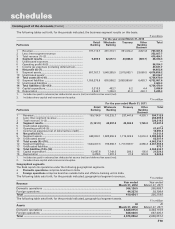

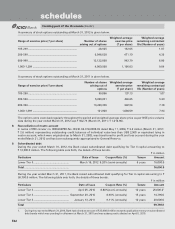

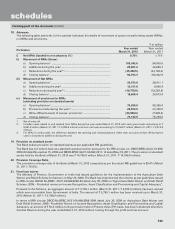

10. Repurchase transactions

The following table sets forth, the details of securities sold and purchased under repo and reverse repo transactions

respectively including transactions under Liquidity Adjustment Facility (LAF).

` in million

Minimum

outstanding

balance

during the

Maximum

outstanding

balance

during the

Daily average

outstanding

balance

during the

Outstanding

balance at

March 31,

2012

Year ended March 31, 2012

Securities sold under Repo and LAF

i) Government Securities ........................................ 1.3 169,551.0 67,461.6 169,551.0

ii) Corporate Debt Securities .................................... — 645.0 5.3 —

Securities purchased under Reverse Repo and LAF

i) Government Securities ........................................ — 36,750.0 1,524.6 2,630.0

ii) Corporate Debt Securities .................................... — — — —

1. Amounts reported are based on face value of securities under repo and reverse repo and LAF.

The following table sets forth, the details of securities sold and purchased under repo and reverse repo.

` in million

Minimum

outstanding

balance

during the

Maximum

outstanding

balance

during the

Daily average

outstanding

balance

during the

Outstanding

balance at

March 31,

2011

Year ended March 31, 2011

Securities sold under Repo

i) Government Securities ....................................... 1.1 214,553.6 41,177.3 1.2

ii) Corporate Debt Securities ................................... — — — —

Securities purchased under Reverse Repo

i) Government Securities ....................................... — 7,817.1 282.2 124.0

ii) Corporate Debt Securities ................................... — 250.0 3.4 —

1. Amounts reported are based on face value of securities under repo and reverse repo.

The transactions with RBI under LAF are accounted for as borrowing and lending transactions from the three months

ended March 31, 2012. If the Bank had continued to account for LAF transactions as “sale and purchase” at March 31,

2012, the investments would have been lower by ` 168,000.0 million and the borrowings would have been lower by

` 168,000.0 million.

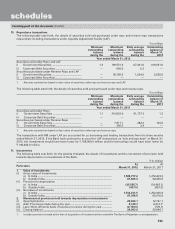

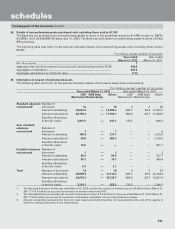

11. Investments

The following table sets forth, for the periods indicated, the details of investments and the movement of provision held

towards depreciation on investments of the Bank.

` in million

Particulars At

March 31, 2012

At

March 31, 2011

1. Value of Investments

(i) Gross value of investments

a) In India .................................................................................................... 1,539,777.2 1,272,423.9

b) Outside India ........................................................................................... 81,826.4 94,499.8

(ii) Provision for depreciation

a) In India .................................................................................................... (25,565.7) (19,483.1)

b) Outside India ........................................................................................... (437.5) (581.0)

(iii) Net value of investments

a) In India .................................................................................................... 1,514,211.5 1,252,940.8

b) Outside India ........................................................................................... 81,388.9 93,918.8

2. Movement of provisions held towards depreciation on investments

(i) Opening balance ........................................................................................... 20,064.1 12,161.1

(ii) Add: Provisions made during the year ........................................................ 8,129.7 8,612.71

(iii) Less: Write-off/(write back) of excess provisions during the year .............. (2,190.6) (709.7)

(iv) Closing balance ............................................................................................. 26,003.2 20,064.1

1. Includes provision created at the time of acquisition of investments from erstwhile The Bank of Rajasthan on amalgamation.

forming part of the Accounts (Contd.)

schedules