ICICI Bank 2012 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F119

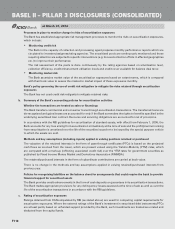

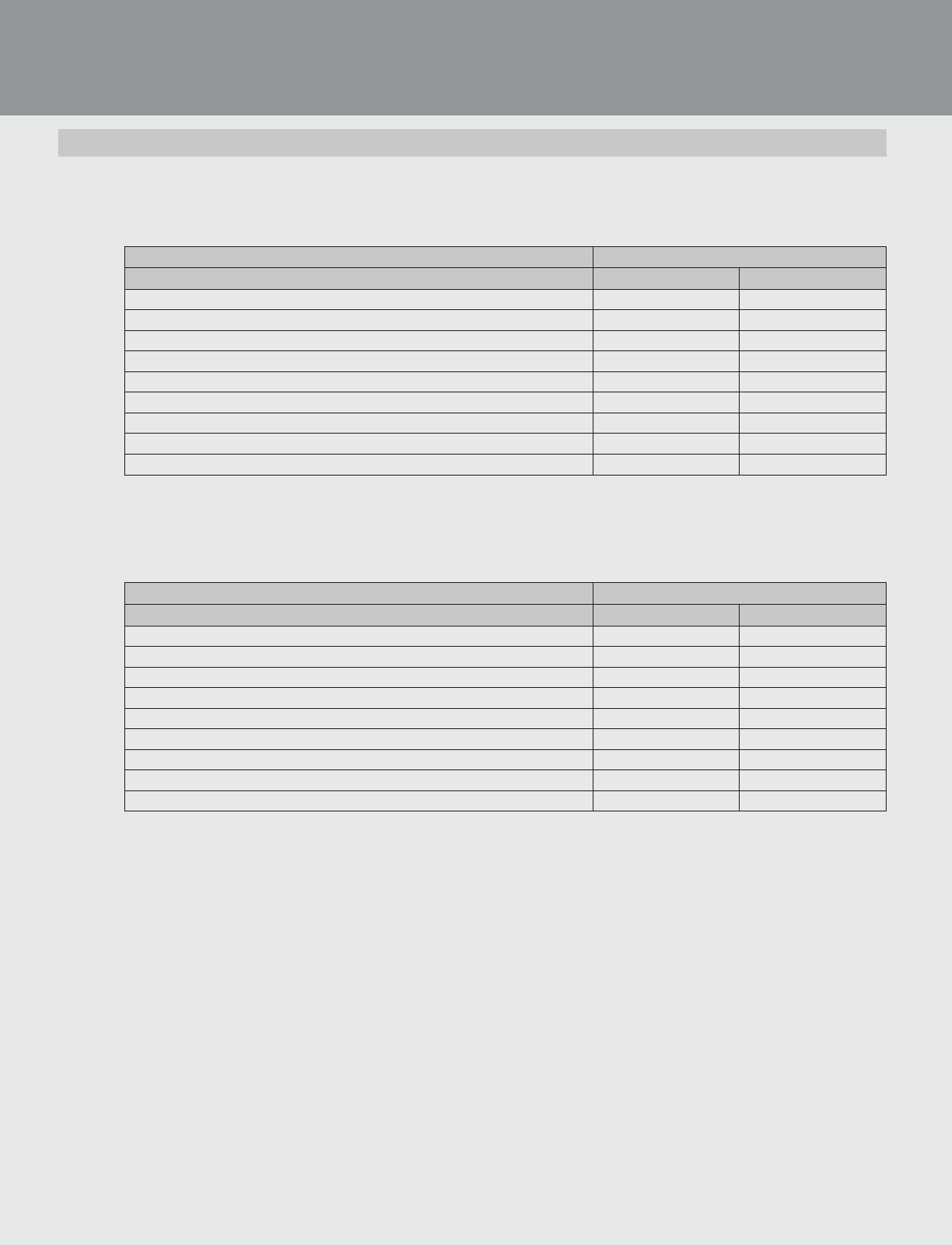

b. Level of interest rate risk

The following table sets forth one possible prediction of the impact on the net interest income of changes in interest

rates on interest sensitive positions for the year ending March 31, 2012, assuming a parallel shift in the yield curve:

` in million

Change in interest rates1

Currency -100 basis points +100 basis points

INR (2,072.4) 2,072.4

USD (433.0) 433.0

JPY (85.2) 85.2

GBP (193.9) 193.9

EURO (72.6) 72.6

CHF 8.1 (8.1)

CAD (205.2) 205.2

Others (157.4) 157.4

Total (3,211.6) 3,211.6

1. Consolidated figures for ICICI Bank and its banking subsidiaries, ICICI Home Finance Company, ICICI Securities Primary

Dealership Limited and ICICI Securities and its subsidiaries.

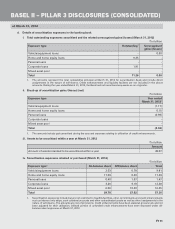

The following table sets forth one possible prediction of the impact on economic value of equity of changes in

interest rates on interest sensitive positions at March 31, 2012, assuming a parallel shift in the yield curve:

` in million

Change in interest rates1,2

Currency -100 basis points +100 basis points

INR 23,001.2 (23,001.2)

USD 2,290.0 (2,290.0)

JPY (324.0) 324.0

GBP (245.8) 245.8

EURO (426.0) 426.0

CHF 4.1 (4.1)

CAD 748.9 (748.9)

Others 315.2 (315.2)

Total 25,363.6 (25,363.6)

1. For INR, coupon and yield of Indian government securities and for other currencies, coupon and yield of currency-wise

Libor/swap rates have been assumed across all time buckets that are closest to the mid point of the time buckets.

2. Consolidated figures for ICICI Bank and its banking subsidiaries, ICICI Home Finance Company, ICICI Securities Primary

Dealership Limited, ICICI Securities and its subsidiaries.

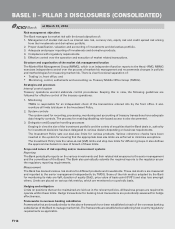

12. LIQUIDITY RISK

Liquidity risk is the risk of inability to meet financial commitments as they fall due, through available cash flows or

through sale of assets at fair market value. It is the current and prospective risk to the Bank’s earnings and equity arising

out of inability to meet the obligations as and when they become due. It includes both, the risk of unexpected increases

in the cost of funding an asset portfolio at appropriate maturities as well as the risk of being unable to liquidate a position

in a timely manner at a reasonable price.

The goal of liquidity risk management is to be able, even under adverse conditions, to meet all liability repayments on

time and to fund all investment opportunities by raising sufficient funds either by increasing liabilities or by converting

assets into cash expeditiously and at reasonable cost.

Organisational set-up

The Bank manages liquidity risk in accordance with its ALM Policy. This policy is framed as per the extant regulatory

guidelines and is approved by the Board of Directors. The ALM Policy is reviewed periodically to incorporate changes

as required by regulatory stipulation or to realign with changes in the economic landscape. The ALCO of the Bank

formulates and reviews strategies and provides guidance for management of liquidity risk within the framework laid out

in the ALM Policy. The Risk Committee of the Board has oversight on the ALCO.

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2012