ICICI Bank 2012 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212

|

|

28

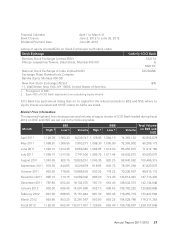

The reported high and low closing prices and volume of ADSs of ICICI Bank traded during fiscal 2012

on the NYSE are given below:

Month High (US$) Low (US$) Number of ADS traded

April 2011 50.67 48.50 27,320,523

May 2011 49.30 44.83 31,197,646

June 2011 49.30 45.32 31,925,960

July 2011 50.00 45.63 25,277,290

August 2011 47.28 35.92 50,386,163

September 2011 39.51 34.00 45,462,116

October 2011 38.88 31.94 54,575,200

November 2011 36.12 27.44 52,420,629

December 2011 30.72 24.43 49,714,662

January 2012 36.21 27.90 60,734,163

February 2012 39.79 36.06 51,370,232

March 2012 38.08 33.77 45,480,772

Fiscal 2012 50.67 24.43 525,865,356

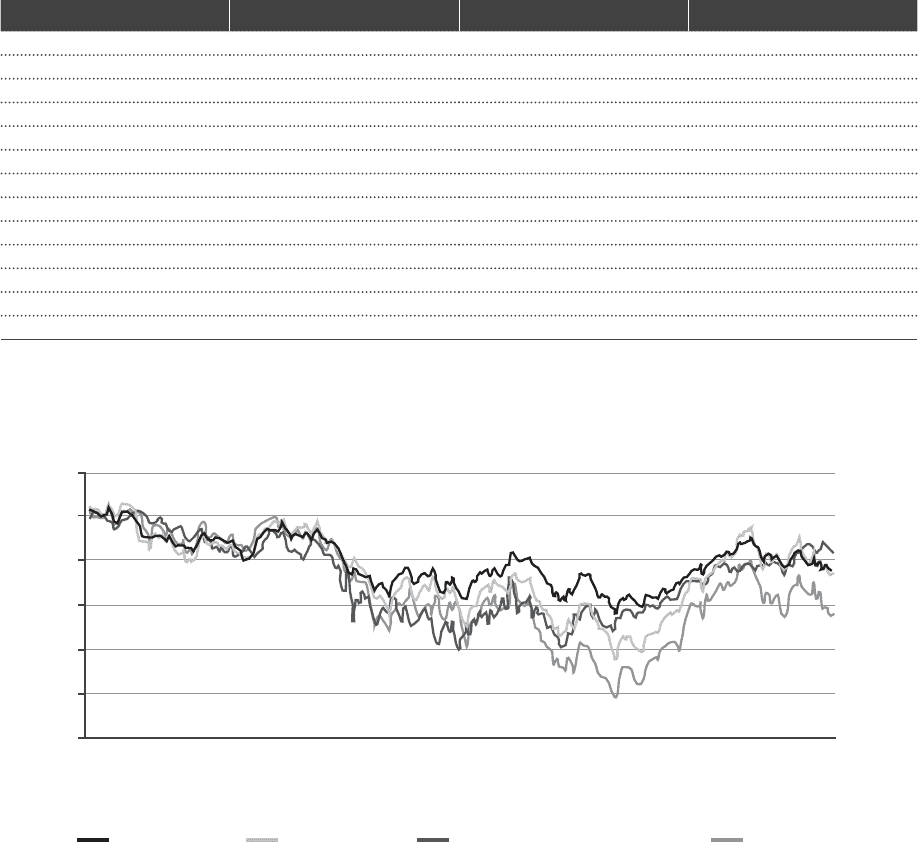

The performance of the ICICI Bank equity share relative to the BSE Sensitive Index (Sensex), BSE Bank

Index (Bankex) and NYSE Financial Index during the period April 1, 2011 to March 31, 2012 is given in

the following chart:

110.00

100.00

90.00

80.00

70.00

60.00

50.00

Sensex Bankex NYSE Financial Index ICICI Bank

Apr 11

May 11

Jun 11

Jul 11

Aug 11

Sep 11

Oct 11

Nov 11

Dec 11

Jan 12

Feb 12

Mar 12

Share Transfer System

ICICI Bank’s investor services are handled by 3i Infotech Limited (3i Infotech). 3i Infotech is a SEBI

registered Category I – Registrar to an Issue & Share Transfer (R&T) Agent. 3i Infotech is a global

information technology company providing technology solutions and in addition to R&T services provides

software products, managed IT Services, application software development & maintenance, payment

solutions, business intelligence, document imaging & digitisation, IT consulting and various transaction

processing services. 3i Infotech’s quality certifications include SEI CMMI Level 5 for software business,

ISO 9001:2000 for BPO (including R&T) and ISO 27001:2005 for infrastructure services.

ICICI Bank’s equity shares are traded mainly in dematerialised form. During the year, 1,385,899 equity

shares involving 6,158 certificates were dematerialised. At March 31, 2012, 99.31% of paid-up equity

share capital (including equity shares represented by ADS constituting 26.85% of the paid-up equity

share capital) are held in dematerialised form.

Directors’ Report