ICICI Bank 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Annual Report 2011-2012 45

INFORMATION TECHNOLOGY

ICICI Bank has been a technology leader in Indian banking for over a decade, taking pioneering steps

to enhance convenience for our customers. We have brought in high levels of functionalities to all our

channels such as internet banking, ATMs, mobile banking and phone banking and at the same time

continued to improve and strengthen internal technology infrastructure, processes and capabilities.

Our information technology strategy has remained focused around increasing customer convenience,

reducing customer complaints and reducing turnaround time.

Against this backdrop, we have, during the course of the year, enhanced offerings for all our retail

customers. These included a range of additional functionalities across our technology channels, including

ATMs, mobile banking and internet banking. For our corporate customers, we reduced the need for

them to visit branches by introducing the online trade platform. The platform will enable customers

to conduct their trade transactions over the internet, track the status of their service requests online

and help us provide better turnaround time. In the area of financial inclusion, we participated in the

online transaction authentication pilot conducted by UIDAI in Hazaribagh, Jharkhand. We successfully

demonstrated transactions like balance enquiries, cash withdrawal, cash deposit and funds transfer as

part of this exercise.

Internally, we also continued with our focus to improve our processes and capabilities. We installed

note-sorting machines in identified branches. These machines can detect fake currency notes and

hence generate clean cash at the branch level itself. We also upgraded our systems to handle high

NEFT transaction volumes.

We continue to invest in innovation and partnering with business teams on ways to leverage technology

to enhance customer convenience, accelerate financial inclusion and deliver a superior experience to

our customers.

KEY SUBSIDIARIES

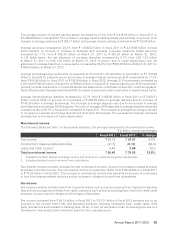

ICICI Prudential Life Insurance Company (ICICI Life)

Fiscal 2012 was the first full year of operations after the regulatory changes in respect of unit linked

insurance products came into effect from September 2010. ICICI Life successfully maintained its

leadership amongst private players in new business premium on retail weighted basis with a market

share of 5.9%. ICICI Life’s total premium for fiscal 2012 was ` 140.22 billion and new business annualised

premium equivalent premium was ` 31.18 billion. ICICI Life’s unaudited new business profit in fiscal

2012 was ` 5.00 billion. The profit after tax for ICICI Life was ` 13.84 billion in fiscal 2012 compared to

` 8.08 billion in fiscal 2011. The total sum assured by ICICI Life increased by 20% from ` 1,737.64 billion

at March 31, 2011 to ` 2,082.99 billion at March 31, 2012.

ICICI Lombard General Insurance Company (ICICI General)

ICICI General maintained its leadership in the private sector with an overall market share of 9.4% in

fiscal 2012. ICICI General’s gross written premium grew by 22% from ` 44.08 billion in fiscal 2011 to

` 53.58 billion during fiscal 2012.

Insurance Regulatory and Development Authority, vide its order dated March 22, 2012, has specified

the ultimate loss ratios for general insurance companies in respect of the third party motor pool, a

multilateral reinsurance arrangement covering third party risk of commercial vehicles. The loss ratios

range from 159% to 213% between fiscal 2008 to fiscal 2011 and 145% for fiscal 2012 (after considering

price increase of 68.5% effective April 25, 2011). This had an impact on the entire general insurance

industry. The additional impact of the above on ICICI General was ` 6.85 billion. As a result of the

negative impact, ICICI General recorded a loss of ` 4.16 billion in fiscal 2012 compared to a loss of

` 0.80 billion in fiscal 2011.