ICICI Bank 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F39

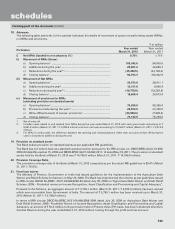

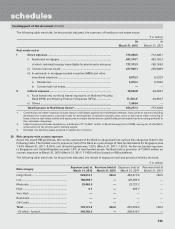

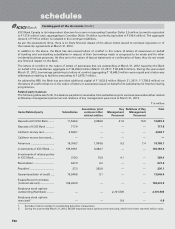

Experience adjustment

` in million

Particulars

Year ended

March 31,

2012

Year ended

March 31,

2011

Year ended

March 31,

2010

Year ended

March 31,

2009

Year ended

March 31,

2008

Plan assets ............................................................... 9,379.5 8,467.4 1,839.9 2,145.3 1,490.1

Defined benefit obligations ..................................... 9,602.7 8,842.9 1,748.7 1,932.2 1,678.1

Amount not recognised as an asset

(limit in para 59(b) ................................................... —— 7.7 51.2 —

Surplus/(deficit) ....................................................... (223.2) (375.5) 83.5 161.9 (188.0)

Experience adjustment on plan assets ................... 51.7 69.1 (130.7) 144.8 (117.9)

Experience adjustment on plan liabilities ............... 2,692.3 689.7 196.9 6.6 (121.9)

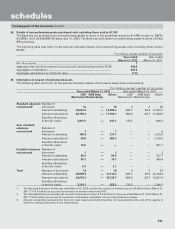

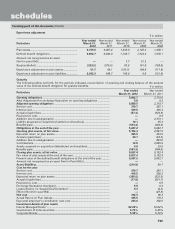

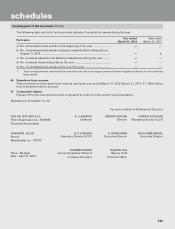

Gratuity

The following tables set forth, for the periods indicated, reconciliation of opening and closing balance of the present

value of the defined benefit obligation for gratuity benefits. ` in million

Particulars Year ended

March 31, 2012

Year ended

March 31, 2011

Opening obligations ........................................................................................... 5,082.7 2,310.5

Add: Adjustment for exchange fluctuation on opening obligations ................ 5.8 0.2

Adjusted opening obligations ........................................................................... 5,088.5 2,310.7

Service cost ......................................................................................................... 379.7 297.1

Interest cost ......................................................................................................... 419.5 326.3

Actuarial (gain)/loss ............................................................................................. (57.4) (324.9)

Past service cost .................................................................................................. —9.9

Addition due to amalgamation ........................................................................... —2,773.1

Liability assumed on acquisition/(settled on divestiture) .................................. 10.1 35.3

Benefits paid ........................................................................................................ (593.2) (344.8)

Obligations at the end of the year .................................................................... 5,247.2 5,082.7

Opening plan assets, at fair value ..................................................................... 5,182.4 2,507.5

Expected return on plan assets .......................................................................... 395.5 233.5

Actuarial gain/(loss) ............................................................................................. 20.1 (63.2)

Addition due to amalgamation ........................................................................... —803.0

Contributions ....................................................................................................... 12.8 2,006.9

Assets acquired on acquisition/(distributed on divestiture) .............................. 9.8 39.5

Benefits paid ........................................................................................................ (593.2) (344.8)

Closing plan assets, at fair value ....................................................................... 5,027.4 5,182.4

Fair value of plan assets at the end of the year ................................................. 5,027.4 5,182.4

Present value of the defined benefit obligations at the end of the year ........... 5,247.2 5,082.7

Amount not recognised as an asset (limit in Para 59(b)) ................................... ——

Asset/(liability).................................................................................................... (219.8) 99.7

Cost for the year

Service cost ......................................................................................................... 379.7 297.1

Interest cost ......................................................................................................... 419.5 326.3

Expected return on plan assets .......................................................................... (395.5) (233.5)

Actuarial (gain)/loss ............................................................................................. (77.5) (261.7)

Past service cost .................................................................................................. —9.9

Exchange fluctuation loss/(gain) ......................................................................... 5.8 0.2

Losses/(Gains) on “Acquisition/Divestiture” ....................................................... 0.3 (4.2)

Effect of the limit in para 59(b)

.................................................................................. —(47.9)

Net cost ............................................................................................................... 332.3 86.2

Actual Return on Plan Assets.............................................................................. 415.5 170.3

Expected employer’s contribution next year ..................................................... 253.6 382.0

Investment details of plan assets

Insurer Managed Funds1 ..................................................................................... 82.65% 79.84%

Government of India securities ........................................................................... 4.74% 6.45%

Corporate Bonds ................................................................................................. 5.98% 5.39%

forming part of the Accounts (Contd.)

schedules