ICICI Bank 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2011-2012 53

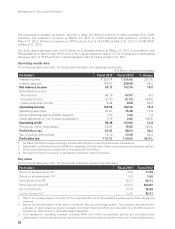

Net interest income and spread analysis

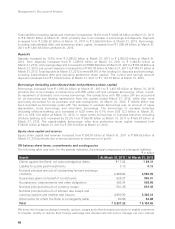

The following table sets forth, for the periods indicated, the net interest income and spread analysis.

` in billion, except percentages

Fiscal 2011 Fiscal 2012 % change

Interest income ` 259.74 ` 335.42 29.1%

Interest expense 169.57 228.08 34.5

Net interest income 90.17 107.34 19.0

Average interest-earning assets13,418.59 3,932.59 15.0

Average interest-bearing liabilities1` 3,168.26 ` 3,603.51 13.7%

Net interest margin 2.64% 2.73% —

Average yield 7.60% 8.53% —

Average cost of funds 5.35% 6.33% —

Interest spread 2.25% 2.20% —

1. The average balances are the averages of daily balances, except averages of foreign branches which are

calculated on monthly basis till October 31, 2010 and on a fortnightly basis thereafter.

2. All amounts have been rounded off to the nearest ` 10.0 million.

Net interest income increased by 19.0% from ` 90.17 billion in fiscal 2011 to ` 107.34 billion in fiscal 2012

reflecting an increase in net interest margin from 2.64% in fiscal 2011 to 2.73% in fiscal 2012 and a 15.0%

increase in the average volume of interest-earning assets.

The yield on interest-earning assets increased from 7.60% in fiscal 2011 to 8.53% in fiscal 2012 and cost of

funds increased from 5.35% in fiscal 2011 to 6.33% in fiscal 2012. Net interest margin increased from 2.64%

in fiscal 2011 to 2.73% in fiscal 2012. The higher increase in average interest-earning assets compared to

increase in average interest-bearing liabilities led to an increase in net interest margin. Net interest margin of

overseas branches improved from 0.88% for fiscal 2011 to 1.23% for fiscal 2012 primarily due to increase in

yield on overseas advances.

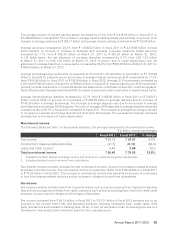

The following table sets forth, for the periods indicated, the trend in yield, cost, spread and margin.

Fiscal 2011 Fiscal 2012

Yield on interest-earning assets 7.60% 8.53%

- On advances 8.53 9.55

- On investments 6.39 7.24

- On SLR investments 6.29 7.34

- On other investments 6.55 7.10

- On other interest-earning assets 6.46 6.21

Cost of interest-bearing liabilities 5.35 6.33

- Cost of deposits 4.92 6.12

- Current and savings account (CASA) deposits 2.46 2.87

- Term deposits 6.51 8.21

- Cost of borrowings 6.14 6.71

Interest spread 2.25 2.20

Net interest margin 2.64% 2.73%

Yield on interest-earning assets increased from 7.60% in fiscal 2011 to 8.53% in fiscal 2012 primarily due to

the following factors:

Yield on average advances increased from 8.53% in fiscal 2011 to 9.55% in fiscal 2012 primarily due to

increase in yield on domestic and overseas corporate loans which increased as a result of incremental

disbursements at higher lending rates and reflecting the rising interest rate environment. Further, the yield

on advances was also higher on account of increase in ICICI Bank‘s Base Rate from 8.75% at March 31, 2011

to 10.00% at March 31, 2012.