ICICI Bank 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.68

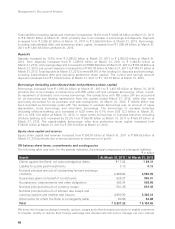

Segment information

RBI in its guidelines on “segmental reporting” has stipulated specified business segments and their

definitions, for the purposes of public disclosures on business information for banks in India.

The standalone segmental report for the year ended March 31, 2012, based on the segments identified and

defined by RBI, has been presented as follows:

Retail Banking includes exposures of the Bank, which satisfy the four qualifying criteria of ‘regulatory retail

portfolio’ as stipulated by the RBI guidelines on Basel II framework.

Wholesale Banking includes all advances to trusts, partnership firms, companies and statutory bodies, by

the Bank which are not included in the Retail Banking segment, as per the RBI guidelines for the Bank.

Treasury includes the entire investment portfolio of the Bank.

Other Banking includes hire purchase and leasing operations and other items not attributable to any

particular business segment of the Bank.

Framework for transfer pricing

All liabilities are transfer priced to a central treasury unit, which pools all funds and lends to the business

units at appropriate rates based on the relevant maturity of assets being funded after adjusting for regulatory

reserve requirement and directed lending requirements.

Retail banking segment

The profit before tax of the retail banking segment was ` 5.50 billion in fiscal 2012 compared to a loss of

` 5.14 billion in fiscal 2011, primarily due to decline in provisions for loan losses in the unsecured retail

portfolio and increase in net interest income.

Net interest income increased by 14.9% from ` 33.20 billion in fiscal 2011 to ` 38.15 billion in fiscal 2012

primarily due to increase in average CASA deposits of the retail banking segment, offset, in part, by increased

cost of savings account deposits effective May 3, 2011.

Non-interest income increased by 21.7% from ` 21.16 billion in fiscal 2011 to ` 25.76 billion in fiscal 2012,

primarily due to higher level of foreign exchange and third party referral fees and fees from the credit card

portfolio.

Provisions decreased by 86.4% from ` 13.81 billion in fiscal 2011 to ` 1.88 billion fiscal 2012, primarily due

to decline in provisions for loan losses in the unsecured retail portfolio. The credit losses in the retail asset

portfolio continued to be lower on account of sharp reduction in accretion to retail non-performing loans

since fiscal 2011.

Wholesale banking segment

Profit before tax of the wholesale banking segment increased from ` 49.00 billion in fiscal 2011 to

` 62.07 billion in fiscal 2012 primarily due to increase in net interest income offset, in part, by increase in

provisions.

Net interest income increased by 46.4% from ` 33.72 billion in fiscal 2011 to ` 49.37 billion in fiscal 2012

primarily driven by loan growth in the wholesale banking segment. Non-interest income increased by 2.9%

from ` 39.85 billion in fiscal 2011 to ` 41.01 billion for fiscal 2012, primarily due to the continued traction

in granular fee income streams like foreign exchange and transaction banking related fees from corporate

clients, offset, in part, by moderation in lending linked fee income. Provisions were higher primarily due to

the impact of restructuring of loans during the year and RBI’s increased provisioning requirements on non-

performing assets.

Treasury banking segment

Profit before tax of the treasury segment decreased from ` 22.01 billion in fiscal 2011 to ` 20.81 billion in

fiscal 2012 primarily due to increase in provisions against investments, offset, in part, by increase in non-

Management’s Discussion & Analysis