ICICI Bank 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212

|

|

64

our total loan portfolio reduced as a result of moderation in systemic retail growth, our conscious strategy

of reducing the unsecured retail loan portfolio, higher level of repayments/prepayments from the existing

secured retail portfolio relative to incremental disbursements and the higher pace of growth in the non-retail

portfolio. In fiscal 2012, we saw an increase in retail lending volumes in secured retail products. In fiscal

2012, our total retail portfolio grew by 7.1% and our secured retail portfolio grew by 9.4%.

Our Credit Risk Management Group monitors all major sectors of the economy and specifically tracks sectors

in which we have loans outstanding. We seek to respond to any economic weakness in an industrial segment

by restricting new exposures to that segment and any growth in an industrial segment by increasing new

exposures to that segment, resulting in active portfolio management.

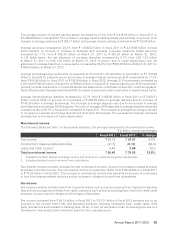

The following tables set forth, at the dates indicated, the composition of our gross advances (net of write-offs).

` in billion, except percentages

March 31, 2011 March 31, 2012

Total

advances

% of total

advances

Total

advances

% of total

advances

Retail finance1` 890.74 39.7% ` 953.93 36.4%

Services – non-finance 173.36 7.7 194.81 7.4

Road, ports, telecom, urban development

and other infrastructure 129.54 5.8 181.96 7.0

Services – finance 161.43 7.2 156.41 6.0

Power 98.11 4.4 141.24 5.4

Iron/steel and iron/steel products 94.88 4.2 122.31 4.7

Mining 41.49 1.9 84.03 3.2

Crude petroleum/refining and

petrochemicals 141.83 6.3 70.76 2.7

Food and beverages 70.63 3.2 67.79 2.6

Construction 36.43 1.6 57.97 2.2

Electronics and engineering 44.72 2.0 56.61 2.2

Wholesale/retail trade 52.00 2.3 50.06 1.9

Metal & products (excl iron & steel) 18.74 0.8 48.19 1.8

Shipping 22.07 1.0 42.39 1.6

Cement 17.25 0.7 39.78 1.5

Chemical and fertilizers 29.24 1.3 34.98 1.3

Other industries2221.69 9.9 317.54 12.1

Total ` 2,244.15 100.0% ` 2,620.76 100.0%

1. Includes home loans, automobile loans, commercial business loans, two wheeler loans, personal loans and

credit cards. Also includes dealer funding portfolio and developer financing portfolio.

2. Other industries primarily include automobiles, drugs and pharmaceuticals, FMCG, gems and jewellery,

manufacturing products excluding metal and textile etc.

Management’s Discussion & Analysis