ICICI Bank 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

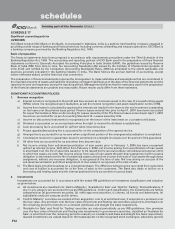

F18

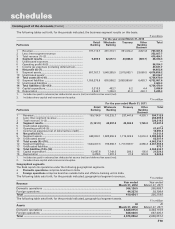

RBI has also stipulated that banks shall maintain capital at higher of the minimum capital required as per Basel II or 80%

of the minimum capital requirement under Basel I. At March 31, 2012, the prudential floor at 80% of the minimum capital

requirement under Basel I was ` 332,499.0 million and was lower than the minimum capital requirement of ` 358,727.2

million under Basel II. Hence, the Bank has maintained capital adequacy at March 31, 2012 as per the Basel II norms.

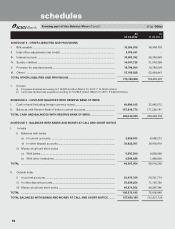

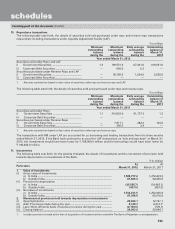

The following table sets forth, for the dates indicated, computation of capital adequacy.

` in million

As per Basel I framework As per Basel II framework

At

March 31, 2012

At

March 31, 2011

At

March 31, 2012

At

March 31, 2011

Tier I capital .............................................................. 512,158.7 463,987.9 505,182.8 449,749.1

Lower Tier I ............................................................... 30,254.9 28,116.1 30,254.9 28,116.1

Tier II capital ............................................................. 238,563.6 231,007.0 232,946.4 217,501.5

Upper Tier II .............................................................. 143,889.5 138,248.5 143,889.5 138,248.5

Lower Tier II subordinated debt ............................ 155,206.3 155,836.3 155,206.3 155,836.3

Total capital ............................................................... 750,722.3 694,994.9 738,129.2 667,250.6

Total risk weighted assets ....................................... 4,618,042.1 3,942,191.1 3,985,857.8 3,414,979.5

CRAR (%) .................................................................. 16.26% 17.63% 18.52% 19.54%

CRAR – Tier I capital (%) .......................................... 11.09% 11.77% 12.68% 13.17%

CRAR – Tier II capital (%) ....................................... 5.17% 5.86% 5.84% 6.37%

Amount raised by issue of Innovative Perpetual

Debt Instruments (IPDI) during the year .............. ————

Amount raised by issue of upper Tier II

Instruments during the year .................................. ————

Amount of subordinated debt raised as Tier II

capital during the year ........................................... 16,000.0 59,790.0116,000.0 59,790.01

1. Includes an issuance of ` 25,000.0 million, wherein the funds were received in March 2010 but were not considered

for Tier II capital pending allotment.

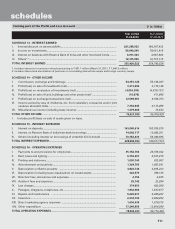

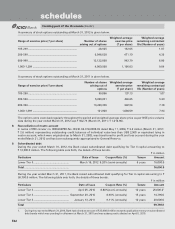

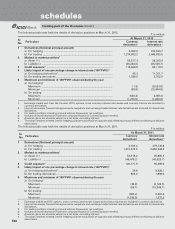

4. Information about business and geographical segments

Business Segments

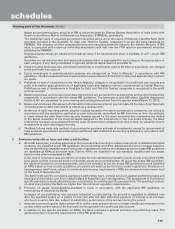

Pursuant to the guidelines issued by RBI on Accounting Standard 17 – (Segment Reporting) - Enhancement of Disclosures

dated April 18, 2007, effective from year ended March 31, 2008, the following business segments have been reported.

xRetail Banking includes exposures which satisfy the four criteria of orientation, product, granularity and low value

of individual exposures for retail exposures laid down in Basel Committee on Banking Supervision document

“International Convergence of Capital Measurement and Capital Standards: A Revised Framework”.

xWholesale Banking includes all advances to trusts, partnership firms, companies and statutory bodies, which are

not included under Retail Banking.

xTreasury includes the entire investment portfolio of the Bank.

xOther Banking includes hire purchase and leasing operations and other items not attributable to any particular

business segment.

Income, expenses, assets and liabilities are either specifically identified with individual segments or are allocated to

segments on a systematic basis.

All liabilities are transfer priced to a central treasury unit, which pools all funds and lends to the business units at appropriate

rates based on the relevant maturity of assets being funded after adjusting for regulatory reserve requirements.

The transfer pricing mechanism of the Bank is periodically reviewed. The segment results are determined based on the

transfer pricing mechanism prevailing for the respective reporting periods.

forming part of the Accounts (Contd.)

schedules