ICICI Bank 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Business Overview

ECONOMIC OUTLOOK

Our strategy is based on the long-term growth prospects of the Indian economy. India has strong

economic fundamentals in the form of a favourable demographic profile and large investment potential.

This will continue to create opportunities across various customer and product segments. In fiscal 2012,

the economy faced several challenges including high inflation and interest rates and volatile capital

flows and currency markets, due to a combination of global and domestic factors. We believe that while

there may be short-term challenges, the strong underlying fundamentals of the Indian economy would

sustain healthy rates of growth over the medium to long term.

For a discussion of recent economic and regulatory developments, please refer to “Management’s

Discussion & Analysis”.

BUSINESS REVIEW

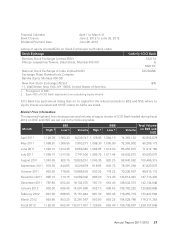

During fiscal 2012, the Bank continued its focus on the 5Cs strategy – Credit growth, CASA mobilisation,

Cost optimisation, Credit quality improvement and Customer centricity. We believe that we have made

substantial progress on all the parameters of this strategy. We have significantly improved our funding

profile, asset quality and profitability and are well-placed to leverage on the growth opportunities in

the economy.

Retail Banking

Fiscal 2012 was characterised by high interest rates and tight liquidity. This led to pressure on demand

deposits in the system. Further, these factors combined with high asset prices resulted in some

moderation in retail loan growth. The year also witnessed de-regulation of interest rates on domestic

savings deposits and non-resident Indian (NRI) deposits.

Customer convenience and high quality service backed by a strong distribution network and innovative

use of technology continued to be the bedrock of our growth strategy. During the year, we expanded

our distribution network by adding 223 branches and 2,902 ATMs, taking the total number of branches

and ATMs to 2,752 and 9,006 respectively.

The Bank has the largest branch network among private sector banks in the country. We continued our

initiatives to offer customised products and services for various customer segments, including through

differentiated sales and service propositions. During the year, we set up over 100 specialised business

banking branches to cater to the growing self-employed and small business segments. Customers

can undertake their trade transactions and obtain business loans at these branches. Healthy growth

in current & savings accounts deposits continued to be our key priority for fiscal 2012. We continued

our focus on residential mortgages, auto loans & commercial business, with credit quality in these

portfolios continuing to be robust. In credit cards, we launched the “Gemstone Collection” of cards

during the year to suit requirements of various customer segments. We also expanded our debit and

prepaid cards portfolio. In addition, we leveraged our distribution infrastructure to increase the cross-

sell of third party products including life insurance and mutual funds.

We continued to take several initiatives in the area of technology to enhance customer convenience

and the overall customer experience. We were among the first banks to introduce account number

portability and also the only bank to enable customers to avail of portability through internet banking

and phone banking. Customers can thus change their servicing branch without changing their

account number and without having to visit the branch. This facility will ensure complete mobility