ICICI Bank 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

Income from foreign exchange transactions with clients and from margins on derivatives transactions with

clients increased by 42.8% from ` 7.95 billion in fiscal 2011 to ` 11.35 billion in fiscal 2012.

Profit/(loss) on treasury-related activities (net)

Income from treasury-related activities includes income from sale of investments and revaluation of

investments on account of changes in unrealised profit/(loss) in the fixed income, equity and preference

share portfolio, units of venture funds and security receipts.

Loss on treasury-related activities decreased from ` 2.15 billion in fiscal 2011 to ` 0.13 billion in fiscal 2012.

Loss from treasury-related activities for fiscal 2012 primarily includes realised/MTM provision on security

receipts, offset, in part, by reversal of MTM loss/realised gain on investments in government of India

securities and other fixed income positions and gain on equity/preference investments. Treasury income

for fiscal 2011 primarily included loss on investments in government of India securities and realised/MTM

provision on security receipts, offset, in part, by gains on equity investments.

During fiscal 2012, there was a gain on the credit derivatives portfolio amounting to ` 0.56 billion compared

to a gain of ` 0.15 billion in fiscal 2011.

At March 31, 2012, we had an outstanding net investment of ` 18.32 billion in security receipts issued by

asset reconstruction companies in relation to sale of non-performing loans. Security receipts issued by asset

reconstruction companies are valued as per net asset value obtained from the asset reconstruction company

from time to time. During fiscal 2012, the impact of these security receipts on the income from treasury-

related activities was a loss of ` 4.08 billion compared to a loss of ` 2.31 billion in fiscal 2011.

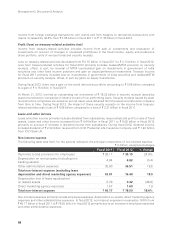

Lease and other income

Lease and other income primarily includes dividend from subsidiaries, lease rentals and profit on sale of fixed

assets. Lease and other income increased from ` 4.44 billion in fiscal 2011 to ` 8.08 billion in fiscal 2012

primarily on account of increase in dividend income from subsidiaries. During fiscal 2012, dividend income

included dividend of ` 2.32 billion received from ICICI Prudential Life Insurance Company and ` 1.22 billion

from ICICI Bank UK.

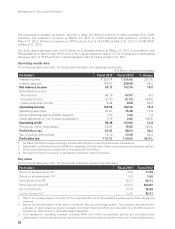

Non-interest expense

The following table sets forth, for the periods indicated, the principal components of non-interest expense.

` in billion, except percentages

Fiscal 2011 Fiscal 2012 % change

Payments to and provisions for employees ` 28.17 ` 35.15 24.8%

Depreciation on own property (including non

banking assets) 4.84 4.82 (0.4)

Other administrative expenses 30.80 36.51 18.5

Total non-interest expense (excluding lease

depreciation and direct marketing agency expenses) 63.81 76.48 19.9

Depreciation (net of lease equalisation)

on leased assets 0.79 0.42 (46.8)

Direct marketing agency expenses 1.57 1.60 1.9

Total non-interest expense ` 66.17 ` 78.50 18.6%

Non-interest expenses primarily include employee expenses, depreciation on assets, direct marketing agency

expenses and other administrative expenses. In fiscal 2012, non-interest expenses increased by 18.6% from

` 66.17 billion in fiscal 2011 to ` 78.50 billion in fiscal 2012 primarily due to an increase in employee expenses

and other administrative expenses.

Management’s Discussion & Analysis