ICICI Bank 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

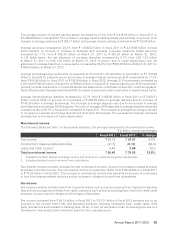

ICICI Prudential Asset Management Company (ICICI AMC)

ICICI AMC is the third largest asset management company in India with average mutual fund assets

under management of ` 687.18 billion for the quarter ended March 31, 2012. ICICI Prudential AMC

achieved a profit after tax of ` 0.88 billion in fiscal 2012 compared to ` 0.72 billion in fiscal 2011.

ICICI Venture Funds Management Company (ICICI Venture)

In fiscal 2012, ICICI Venture continued to focus on investment and advisory opportunities in the Indian

market, including in infrastructure, real estate and special situations. ICICI Venture achieved a profit

after tax of ` 0.68 billion in fiscal 2012 compared to ` 0.74 billion in fiscal 2011.

ICICI Securities (I-Sec)

Market conditions in fiscal 2012 impacted business volumes in corporate finance and broking. I-Sec

continued to focus on strengthening its capabilities across segments and maintained its market

leadership in the corporate finance as well as the retail broking businesses. The company achieved a

profit of ` 0.77 billion in fiscal 2012 compared to ` 1.13 billion in fiscal 2011.

ICICI Securities Primary Dealership (I-Sec PD)

I-Sec PD’s corporate debt placement volumes rose by over 30% with total deals crossing ` 830.00

billion and it continued to maintain its position as the only non-bank entity in the top three in the PRIME

league tables. I-Sec PD was appointed as one of the discretionary fund managers for managing the

funds belonging to the Employees Provident Fund Organisation under the Ministry of Labour for a

period of three years. Despite a challenging market environment, I-Sec PD achieved a profit after tax of

` 0.86 billion in fiscal 2012 compared to ` 0.53 billion in fiscal 2011.

ICICI Bank UK plc (ICICI Bank UK)

ICICI Bank UK’s profit after tax for fiscal 2012 was US$ 25.4 million compared to US$ 36.6 million in

fiscal 2011. At March 31, 2012, ICICI Bank UK plc had total assets of US$ 4.1 billion compared to US$

6.4 billion at March 31, 2011. Its capital position was strong with a capital adequacy ratio of 32.4% at

March 31, 2012 compared to 23.1% at March 31, 2011.

ICICI Bank Canada

ICICI Bank Canada’s profit after tax for fiscal 2012 was CAD 34.4 million compared to CAD 32.4 million

in fiscal 2011. At March 31, 2012, ICICI Bank Canada had total assets of CAD 5.2 billion compared to

CAD 4.5 billion at March 31, 2011. ICICI Bank Canada had a capital adequacy ratio of 31.7% at March

31, 2012 compared to 26.3% at March 31, 2011.

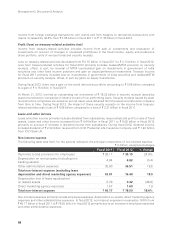

KEY RISKS

We have included statements in this annual report which contain words or phrases such as “will”,

“would”, “aim”, “aimed”, “will likely result”, “is likely”, “are likely”, “believe”, “expect”, “expected to”,

“will continue”, “will achieve”, “anticipate”, “estimate”, “estimating”, “intend”, “plan”, “contemplate”,

“seek to”, “seeking to”, “trying to”, “target”, “propose to”, “future”, “objective”, “goal”, “project”,

“should”, “can”, “could”, “may”, “will pursue” and similar expressions or variations of such expressions,

that may constitute “forward-looking statements”. These forward-looking statements involve a number

of risks, uncertainties and other factors that could cause actual results, opportunities and growth

potential to differ materially from those suggested by the forward-looking statements. These risks and

uncertainties include, but are not limited to, the actual growth in demand for banking and other financial

products and services in the countries where we operate or where a material number of our customers

reside; our ability to successfully implement our strategy, including our retail deposit growth strategy;

our use of the internet and other technology; our rural expansion and ability to meet priority sector

lending requirements; our exploration of merger and acquisition opportunities; our ability to integrate

recent or future mergers or acquisitions into our operations and manage the risks associated with

such acquisitions to achieve our strategic and financial objectives; our ability to manage the increased

complexity of the risks we face following our international expansion; future levels of non-performing

and restructured loans; our growth and expansion in domestic and overseas markets; the adequacy of

Business Overview