ICICI Bank 2012 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F62

At

31.03.2012

At

31.03.2011

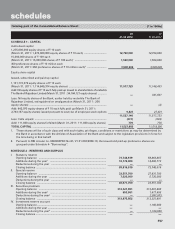

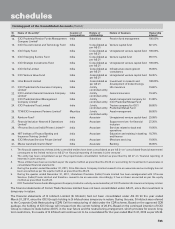

SCHEDULE 10 - FIXED ASSETS

I. Premises

At cost at March 31 of preceding year .......................................................... 45,902,791 28,681,193

Additions during the year1 ............................................................................. 1,656,184 18,438,137

Deductions during the year ........................................................................... (591,807) (1,216,539)

Depreciation to date ...................................................................................... (9,383,551) (8,156,035)

Net block ........................................................................................................ 37,583,617 37,746,756

II. Other fixed assets (including furniture and fixtures)

At cost at March 31 of preceding year .......................................................... 41,441,024 36,232,085

Additions during the year1 ............................................................................. 4,441,598 6,665,154

Deductions during the year ........................................................................... (746,961) (1,456,215)

Depreciation to date ...................................................................................... (30,793,785) (26,862,655)

Net block ........................................................................................................ 14,341,876 14,578,369

III. Assets given on Lease

At cost at March 31 of preceding year .......................................................... 17,510,087 17,760,500

Additions during the year .............................................................................. — —

Deductions during the year ........................................................................... (543) (250,413)

Depreciation to date, accumulated lease adjustment and provisions ........ (15,115,215) (14,939,735)

Net block ......................................................................................................... 2,394,329 2,570,352

TOTAL FIXED ASSETS ........................................................................................... 54,319,822 54,895,477

1. Includes assets acquired from erstwhile The Bank of Rajasthan Limited.

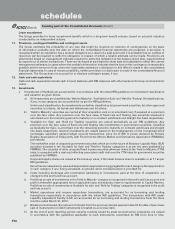

SCHEDULE 11 - OTHER ASSETS

I. Inter-office adjustments (net debit) .............................................................. — 207,829

II. Interest accrued ............................................................................................ 53,644,915 49,240,460

III. Tax paid in advance/tax deducted at source (net) ...................................... 38,176,875 37,124,889

IV. Stationery and stamps ................................................................................. 10,308 109,751

V. Non-banking assets acquired in satisfaction of claims1 ............................. 600,575 887,459

VI. Advance for capital assets ........................................................................... 1,494,098 1,418,588

VII. Deposits ........................................................................................................ 12,144,123 13,776,546

VIII. Deferred tax asset (net) ................................................................................ 28,033,693 29,936,668

IX. Others2 .......................................................................................................... 122,031,732 99,507,443

TOTAL OTHER ASSETS ......................................................................................... 256,136,319 232,209,633

1. Includes certain non-banking assets acquired in satisfaction of claims which are in the process of being transferred in the Bank’s name.

2. Includes goodwill on consolidation amounting to ` 1,432.3 million (March 31, 2011: ` 1,464.8 million).

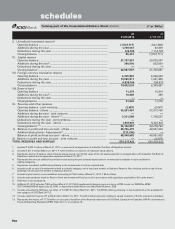

SCHEDULE 12 - CONTINGENT LIABILITIES

I. Claims against the Group not acknowledged as debts ................................ 34,360,751 21,093,514

II. Liability for partly paid investments .............................................................. 128,050 128,050

III. Liability on account of outstanding forward exchange contracts1 ............... 3,672,103,795 2,550,667,789

IV. Guarantees given on behalf of constituents .................................................

a) In India ....................................................................................................... 721,472,153 647,524,739

b) Outside India .............................................................................................. 243,307,639 182,021,705

V. Acceptances, endorsements and other obligations ..................................... 569,297,814 393,972,235

VI. Currency swaps1 ............................................................................................. 629,205,403 567,720,233

VII. Interest rate swaps, currency options and interest rate futures1 ................. 4,441,277,345 5,800,967,594

VIII. Other items for which the Group is contingently liable 2.............................. 64,438,333 61,900,784

TOTAL CONTINGENT LIABILITIES ........................................................................ 10,375,591,283 10,225,996,643

1. Represents notional amount.

2. Includes an amount of ` 8,307.0 million (March 31, 2011: ` 1,653.8 million) pertaining to government securities settled after the balance sheet

date, which are accounted as per settlement date method pursuant to RBI guidelines issued during the year ended March 31, 2011.

forming part of the Consolidated Balance Sheet (Contd.) (` in ‘000s)

schedules