ICICI Bank 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RAJIV SABHARWAL

Executive Director

“We will continue to grow our

customer base by focusing

on providing superior

customer experience. The

increase in branch and

ATM touch points will help

us to reach customers in

many more markets. We

will leverage technology for

customer convenience and

for deepening relationships

with existing customers.

The enhancements in the

capabilities of our internet

and mobile channels would

allow customers to do all

transactions as in a branch.

Our rapidly growing rural

footprint will enable us to

offer both credit and savings

products to individual farmers

and small enterprises in

these markets.”

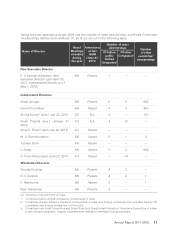

The Government of India has nominated Arvind Kumar, Joint

Secretary, Department of Financial Services, Ministry of Finance,

Government of India, as a Director on the Board of the Bank effective

July 22, 2011, in place of Anup K. Pujari. The Board placed on record

its appreciation of the valuable guidance provided by Anup K. Pujari

to the Bank. In terms of Article 128A of the Articles of Association of

the Bank, Arvind Kumar is not liable to retire by rotation.

In terms of the provisions of the Companies Act, 1956 and the

Articles of Association of the Bank, Homi Khusrokhan, V. Sridar

and N. S. Kannan would retire by rotation at the forthcoming AGM

and are eligible for re-appointment. Homi Khusrokhan, V. Sridar

and N. S. Kannan have offered themselves for re-appointment.

AUDITORS

The auditors, S. R. Batliboi & Co., Chartered Accountants, will retire

at the ensuing AGM. As recommended by the Audit Committee,

the Board has proposed the appointment of S. R. Batliboi & Co.,

Chartered Accountants as statutory auditors for fiscal 2013. Their

appointment has been approved by RBI vide its letter dated April

9, 2012. You are requested to consider their appointment.

PERSONNEL

As required by the provisions of Section 217(2A) of the Companies

Act, 1956, read with Companies (Particulars of Employees)

Rules, 1975, as amended, the names and other particulars of the

employees are set out in the Annexure to the Directors’ Report.

APPOINTMENT OF NOMINEE DIRECTORS ON THE

BOARDS OF ASSISTED COMPANIES

Erstwhile ICICI Limited (ICICI) had a policy of appointing nominee

directors on the boards of certain borrower companies based on

loan covenants, with a view to enable monitoring of the operations

of those companies. Subsequent to the merger of ICICI with

ICICI Bank, the Bank continues to nominate directors on the

boards of assisted companies. Apart from the Bank’s employees,

experienced professionals from various fields are appointed as

nominee directors. At March 31, 2012, ICICI Bank had 15 nominee

directors of whom 13 were employees of the Bank, on the boards

of 25 assisted companies. The Bank has a Nominee Director Cell

for maintaining records of nominee directorships.

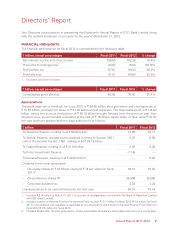

RISK MANAGEMENT FRAMEWORK

The Bank’s risk management strategy is based on a clear

understanding of various risks, disciplined risk assessment

and measurement procedures and continuous monitoring.

The policies and procedures established for this purpose are

continuously benchmarked with international best practices. The

Board of Directors has oversight on all the risks assumed by the

Bank. Specific Committees have been constituted to facilitate

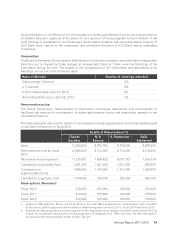

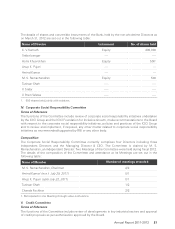

focused oversight of various risks, as follows:

Annual Report 2011-2012 13