ICICI Bank 2012 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F107

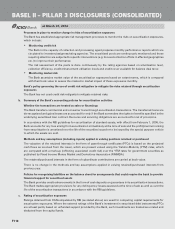

Collateral management

Overview

The Bank defines collateral as the assets or rights provided to the Bank by the borrower or a third party in order

to secure a credit facility. The Bank would have the rights of secured creditor in respect of the assets/contracts

offered as security for the obligations of the borrower/obligor. The Bank ensures that the underlying documentation

for the collateral provides the bank appropriate rights over the collateral or other forms of credit enhancement

including the right to liquidate, retain or take legal possession of it in a timely manner in the event of default by

the counterparty. The Bank also endeavours to keep the assets provided as security to the Bank under adequate

insurance during the tenor of the Bank’s exposure. The collateral value is monitored periodically.

Collateral valuation

As stipulated by the RBI guidelines, the Bank uses the comprehensive approach for collateral valuation. Under this

approach, the Bank reduces its credit exposure to counterparty when calculating its capital requirements to the

extent of risk mitigation provided by the eligible collateral as specified in the Basel II guidelines.

The Bank adjusts the value of any collateral received to adjust for possible future fluctuations in the value of the

collateral in line with the requirements specified by RBI guidelines. These adjustments, also referred to as ‘haircuts’,

to produce volatility-adjusted amounts for collateral, are reduced from the exposure to compute the capital charge

based on the applicable risk weights.

Types of collateral taken by the Bank

The Bank determines the appropriate collateral for each facility based on the type of product and risk profile of

the counterparty. In case of corporate and small and medium enterprises financing, fixed assets are generally

taken as security for long tenor loans and current assets for working capital finance. For project finance, security

of the assets of the borrower and assignment of the underlying project contracts is generally taken. In addition, in

some cases, additional security such as pledge of shares, cash collateral, charge on receivables with an escrow

arrangement and guarantees is also taken.

For retail products, the security to be taken is defined in the product policy for the respective products. Housing

loans and automobile loans are secured by the security of the property/automobile being financed. The valuation

of the properties is carried out by an empanelled valuer at the time of sanctioning the loan.

The Bank also offers products which are primarily based on collateral such as shares, specified securities,

warehoused commodities and gold jewellery. These products are offered in line with the approved product policies,

which include types of collateral, valuation and margining.

The Bank extends unsecured facilities to clients for certain products such as derivatives, credit cards and personal

loans. The limits with respect to unsecured facilities have been approved by the Board of Directors.

The decision on the type and quantum of collateral for each transaction is taken by the credit approving authority

as per the credit approval authorisation approved by the Board of Directors. For facilities provided as per approved

product policies (retail products, loan against shares etc.), collateral is taken in line with the policy.

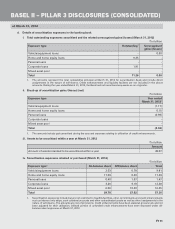

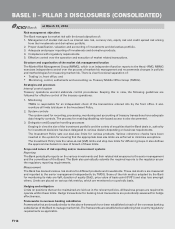

Credit risk mitigation techniques

The RBI guidelines on Basel II allow the following credit risk mitigants to be recognised for regulatory capital

purposes:

Eligible financial collateral, which include cash (deposited with the Bank), gold (including bullion and jewellery,

subject to collateralised jewellery being benchmarked to 99.99% purity), securities issued by Central and State

Governments, Kisan Vikas Patra, National Savings Certificates, life insurance policies with a declared surrender

value issued by an insurance company, which is regulated by the insurance sector regulator, certain debt

securities, mutual fund units where daily net asset value is available in public domain and the mutual fund is

limited to investing in the instruments listed above.

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2012